E&P | NGI All News Access | Permian Basin

Resolute Chips Away at Debt With $42M Midland Basin Sale

Resolute Energy Corp. (REN) has agreed to sell noncore assets in the Midland Basin in West Texas to a private party for $42 million and use the proceeds to pay down debt. The Midland is a sub-basin of the Permian Basin.

The deal is expected to close around May 1 with an effective date of March 1, the Denver-based producer said. Assets being sold consist of operated and non-operated properties, primarily in Howard County, TX.

“This transaction represents the first step in our previously announced plan to pursue noncore asset sales to reduce debt and improve our liquidity,” said CEO Nicholas Sutton. “We look forward to closing this transaction in the coming weeks, at which time we will provide a more detailed breakdown of the assets sold, and the production and cost impact on Resolute for the calendar year 2015.”

Wunderlich Securities analyst Jason Wangler said in a note that it looks as if the company is selling its OTB and Big Spring assets in Howard and Martin counties. “These are predominantly vertical Wolfberry targets with minimal horizontal operations nearby, and given the 2,200 net acre size, we believe this move is a strong one for Resolute given its need for debt reduction,” Wangler wrote.

He added that the apparent price of $19,000 per acre, if the company sold its entire position, is “strong” and “likely more than most would expect.”

Proceeds are to be initially applied to the company’s credit revolver, Resolute said. There is $235 million outstanding on the $330 million credit facility, Wangler said. “This [sale] would push the outstanding balance under $200 million and comes at a good time given the redetermination of the [credit] facility should be ongoing or occurring in the coming weeks.”

Total debt outstanding at Resolute is $775 million, according to Wangler.

“Overall, the sale is small but positive news,” said Wells Fargo Securities analyst David Tameron, “but given the level of debt outstanding, there is still more work for REN to do. In the near term, REN’s Denton Field (Lea County, NM) is the next likely candidate to trade hands if it garners enough interest.”

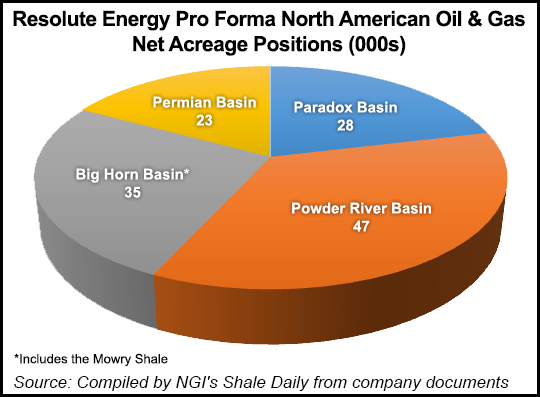

Resolute has a deep bench of potential assets to sell, Wangler said, with holdings in multiple basins. “…[W]e believe there could be additional sales to help right-size the balance sheet further. Specifically, we believe the additional noncore Permian assets could be a candidate to further reduce debt in the near term.”

Assuming similar asset sales to come, Wangler said Resolute should be able to survive the commodity price downturn and emerge as a more efficient operation. Wunderlich has a “hold” rating on the company; Wells Fargo rates it “market perform.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |