Markets | NGI All News Access | NGI Data

Bears Prowling Following Season’s First Storage Build

Natural gas futures scooted lower following the release of government inventory figures showing a storage build somewhat greater than what traders were looking for.

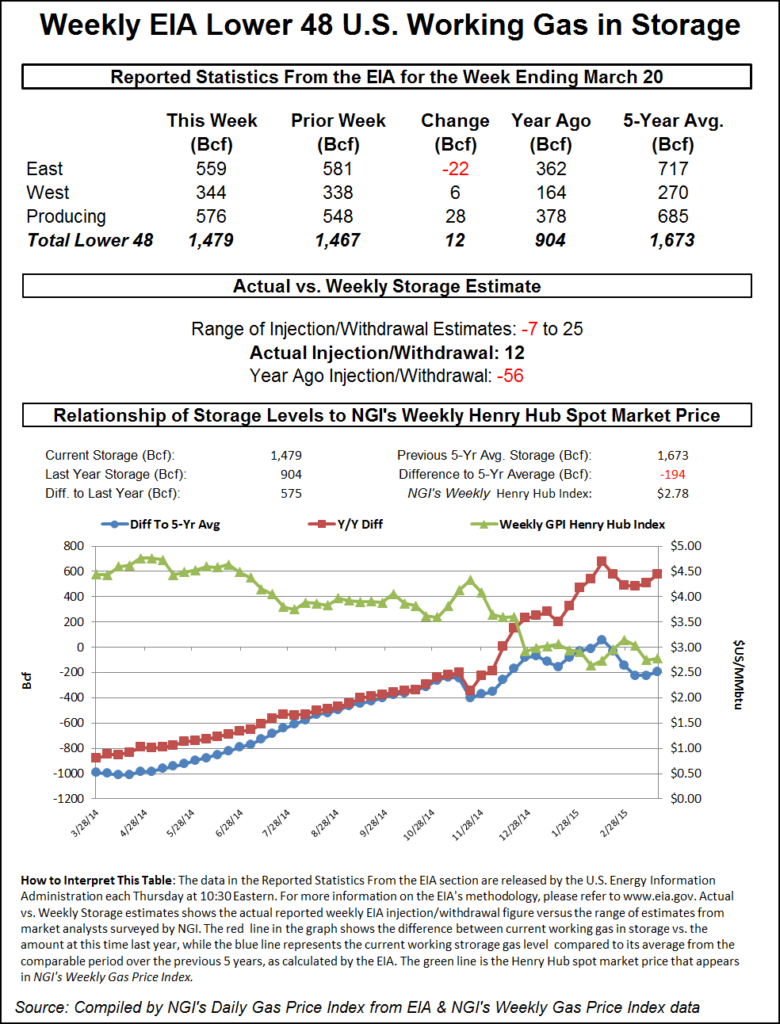

For the week ended Mar. 20 the Energy Information Administration (EIA) reported an increase of 12 Bcf in its 10:30 a.m. EDT release. April futures fell to a low of $2.686 after the number was released and by 10:45 a.m. April was trading at $2.649, down 7.4 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase averaging less than 10 Bcf. A Reuters survey of 22 traders and analysts showed an average 6 Bcf with a range of minus 7 Bcf to plus 25 Bcf. Analysts at First Enercast were looking for a 23 Bcf build, and Bentek Energy’s flow model predicted a 7 Bcf increase.

“Earlier in the week I was hearing negative numbers, but as of yesterday I was hearing plus 6 Bcf. We are still in a trading range from $2.50 to $3 and not much has changed,” said a New York floor trader.

“The build for last week was more than expected and also bearish compared with the 20 Bcf five-year average net withdrawal,” said Tim Evans of Citi Futures Perspective. “It also suggests a weaker background supply-demand balance, with bearish implications for the reports to follow relative to the base case.”

Inventories now stand at 1,479 Bcf and are 575 Bcf greater than last year and 194 Bcf below the five-year average. In the East Region 22 Bcf was withdrawn and the West Region saw inventories increase by 6 Bcf. Stocks in the Producing Region rose by 28 Bcf.

The Producing Region salt cavern storage figure was up by 13 Bcf to 121 Bcf, while the non-salt cavern figure increased 15 Bcf to 455 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |