M&A | E&P | Infrastructure | Markets | NGI All News Access

Global Upstream Oil, NatGas Investments Down 12% in 4Q2014, EIA Says

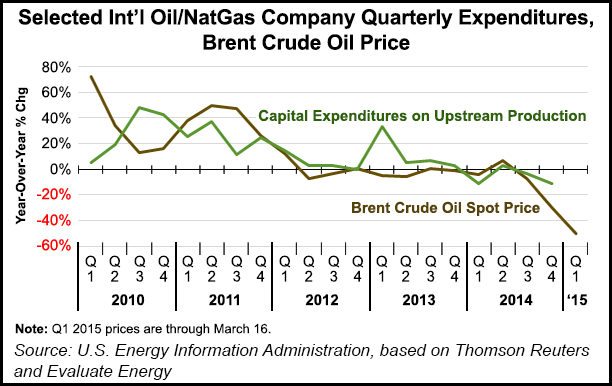

Spending on upstream investments by nearly two dozen international oil and natural gas companies in the final three months of 2014 was down $77 billion (12%) compared with the same period in 2013, according to the Energy Information Administration (EIA).

In the first nine months of 2014 there were year-over-year declines in spending, bringing full-year 2014 upstream capital expenditures (capex) to $297 billion, 6% less than full-year 2013 spending for the 23 companies analyzed by EIA. Upstream spending on exploration and development typically accounts for the bulk of investment expenditures, the agency said.

“Much more so than midstream and downstream investments dealing with the refining, distribution, and sale of oil and natural gas, spending in the upstream segment tends to correlate with changes in crude oil prices, because prices are a significant factor in any project’s potential rate of return,” EIA said. “Average crude oil prices, such as the North Sea Brent benchmark, were 30% lower in fourth-quarter 2014 compared to the same quarter in 2013, likely contributing to the postponement or curtailment of some upstream projects…

“Lower oil prices reduce expected returns from future production, decreasing incentives for upstream investment spending. As a result, new exploration and development projects may be delayed or canceled, and reduced investments in producing fields can ultimately slow the growth in production.”

Projects can have lead times of many years, so the effects may not be immediate, but if the trend continues, future production growth could be lower than originally anticipated. “With crude oil prices continuing to fall from last year’s levels, some companies have already announced further capital expenditure [capex] reductions for 2015.”

Global upstream spending began to peak last year before the oil price meltdown, but capex cuts for 2015 have moved into a league of their own, i.e. “austerity on steroids,” Raymond James & Associates Inc. analysts said this week (see Daily GPI, March 24). Capex reductions by global exploration and production companies are estimated to be 20-25%, the lowest level since 2010, the analysts said.

“As oil prices and upstream investment spending fall, reduced demand for rigs and other oilfield services will tend to reduce the price of those services,” EIA said. “Lower costs for oil services can make upstream investment more attractive and partially offset the effect of reduced upstream budgets on the level of upstream activity.”

The decline in U.S. rigs on a year/year basis is gaining momentum, with the total U.S. rig count down 41% year/year for the week ending March 20, according to Baker Hughes Inc. data (see Daily GPI, March 20).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |