Markets | NGI All News Access | NGI Data

‘Tip Off’ Goes to Bears; April Slides Following Storage Stats

Natural gas futures retreated following the release of government storage figures showing inventory drawdowns to be somewhat less than what traders had been looking for.

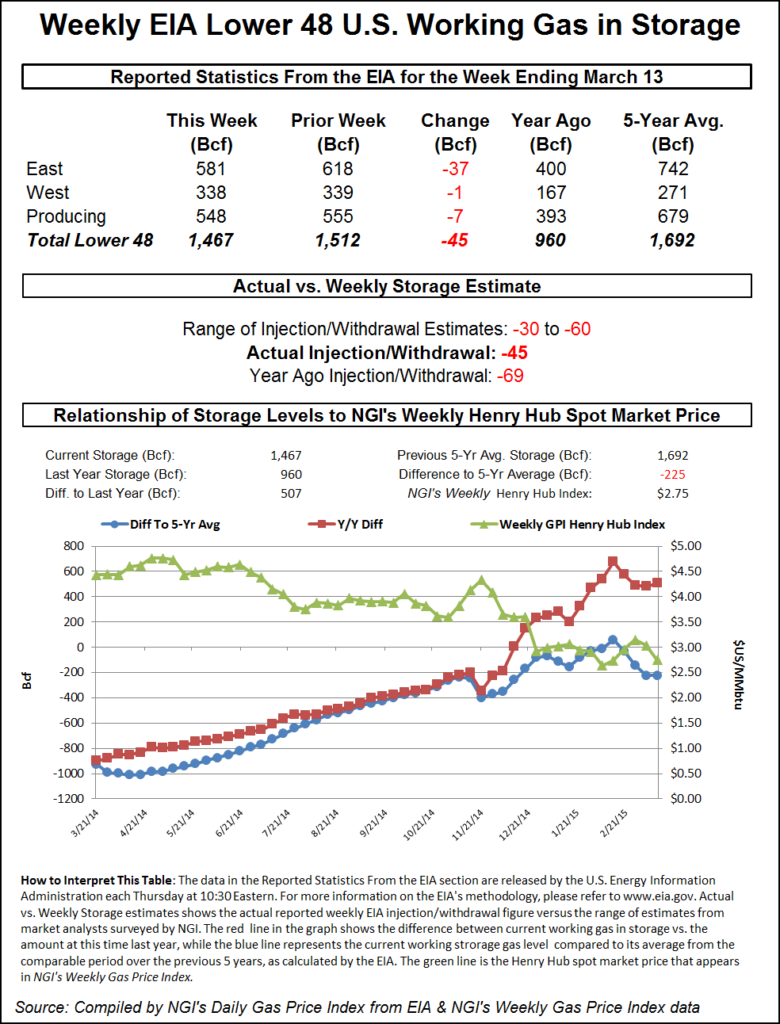

For the week ended Mar. 13, the Energy Information Administration (EIA) reported a decrease of 45 Bcf in its 10:30 a.m. EDT release. April futures fell to a low of $2.792 after the number was released, and by 10:45 a.m. April was trading at $2.803, down 11.7 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease in the 50 Bcf area. A Reuters survey of 23 traders and analysts showed an average 48 Bcf with a range of 30 Bcf to 60 Bcf. Analysts at United ICAP were looking for a 52 Bcf pull, and Bentek Energy’s flow model predicted a 55 Bcf withdrawal.

“We’re back to our $2.75 to $3.00 range. I don’t think $2.75 will be big support, but $3 has been there a while as a resistance level. It would have to close above that for a few days to maintain some substance,” said a New York floor trader.

Tim Evans of Citi Futures Perspective saw the report as moderately bearish, but said, “in economic terms, we note this result was an exact match with the five-year average for the date, and so the market is no better or worse supplied than a week ago on a seasonally adjusted basis.”

Inventories now stand at 1,467 Bcf and are 507 Bcf greater than last year and 225 Bcf below the five-year average. In the East Region 37 Bcf was withdrawn, and the West Region saw inventories decrease by 1 Bcf. Stocks in the Producing Region declined by 7 Bcf.

The Producing Region salt cavern storage figure was unchanged at 108 Bcf, while the non-salt cavern figure dropped 7 Bcf to 440 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |