NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Lower Tertiary Attracts High Bidders in Central GOM Auction

The Lower Tertiary Trend of the Gulf of Mexico (GOM) drew the most prospectors in the Department of Interior’s offshore lease auction on Wednesday with one block receiving a $52 million-plus bid.

Red Willow Offshore LLC (95%) and Houston Energy LP (5%) together submitted the highest bid for Walker Ridge Block 107 in the Central Planning Area Lease Sale 235 held in New Orleans. Green Canyon, another area in the Lower Tertiary Wilcox Sands, drew the most offers with 52.

John Rodi, who directs the GOM region for Interior’s Bureau of Ocean Energy Management (BOEM), told reporters that bidders continue to be drawn to the Lower Tertiary because of deepwater drilling success, including Chevron Corp.’s recent Anchor discovery in Green Canyon (see Daily GPI, Jan. 6).

Producers are tapping into the “sweet spots in the Lower Tertiary,” Rodi said. “This sale matched what we’ve seen progressing for several years now and is the confirmation of several things,” mainly a push to deeper water and continued pursuit of the Lower Tertiary.

The second highest bid in the auction, $43 million, was by partners Chevron U.S.A. Inc. (75%) and Venari Offshore LLC (25%), to explore Green Canyon Block 761. Chevron and Venari also submitted the third highest bid, $41.12 million, for adjacent block 760. PXP Offshore LLC offered $38.90 million for Atwater Valley Block 153, also in the Lower Tertiary. ExxonMobil Corp. had the fifth highest offer, $33 million for Green Canyon Block 364.

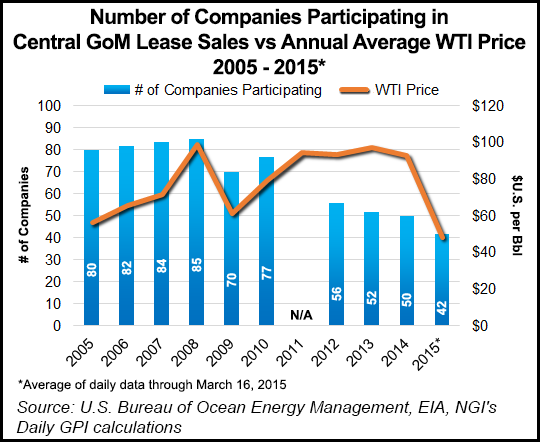

This year, 42 producers offered 195 bids for 169 separate blocks, which together brought in bids totaling $583.2 million.

BOEM had offered producers in the latest auction the opportunity to bid on a total of 7,788 total blocks, 41.2 million acres, ranging from 3-230 nautical miles offshore Louisiana, Mississippi and Alabama in water depths ranging from 9-11,115 feet (up to 3,400 meters).

A year ago, the Central GOM auction (231) drew 50 companies that submitted 380 bids for 326 blocks (see Daily GPI, March 19, 2014). Interior last year netted $850.8 million in winning bids. In 2013, 52 producers had participated in the Central GOM sale.

BOEM Director Abigail Ross Hopper, who joined Rodi at the press conference, was asked about the falling participation in offshore lease sales.

“I do not think this was a disappointing sale,” Hooper said. “It was what we expected given that oil prices are lower than they have been in the last six years.” Price “had an impact, as companies look at their revenues, plans for the future,” and they “perhaps make different decisions when the market is at a different place.”

Overall, “it seems to me that the folks in the room are cautiously optimistic about what is happening” in the offshore, said Hooper.

However, the number of companies participating in offshore auctions has fallen in the past several years. The reason, said Rodi, was the higher interest in the deepwater, costs to operate there “are so great…For so many sales now, we have seen targeted leasing…That’s where the dollars are going.” Only deep-pocketed operators or joint partners are able to bid on those leases.

“We have had a downward trend for several years now,” but “I’m not too concerned about that with a lot of interest in deepwater,” said Rodi. “It is in fact a very, very expensive area. It’s not totally unexpected to see fewer players…”

The Outer Continental Shelf, which holds natural gas-weighted production, has seen interest dropping “because of low gas prices…My expectation is, when that changes, we may see some new players that previously were in the Gulf returning, and the number of participants go up.”

National Ocean Industries Association President Randall Luthi had said ahead of the auction that the sale would be “interesting” because of low oil prices. “But even in this environment, U.S. oil and natural gas companies are planning ahead, and remain committed to the Gulf of Mexico. Shorter time frames for active exploration within the lease terms are factors that may impact bidding in this sale, especially for companies tight on capital.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |