Anadarko Opts In On 550-Mile DJ Basin Crude Pipeline Project

Magellan Midstream Partners and Plains All American Pipeline LP announced Wednesday that a subsidiary of Anadarko Petroleum Corp. has exercised its option to purchase a 20% equity interest in Saddlehorn Pipeline Co., a company with designs to build a pipeline that would tap crude oil production from the Denver-Julesburg (DJ) Basin.

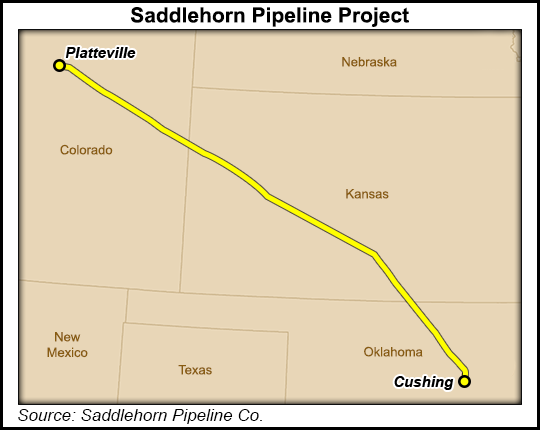

Following the exercised option, the equity ownership in Saddlehorn would be 40% Magellan, 40% Plains and 20% Anadarko. Saddlehorn plans to construct, own and operate a 550-mile pipeline to transport various grades of crude oil from the DJ Basin, and potentially the broader Rocky Mountain area resource plays, to storage facilities in Cushing, OK, owned by Magellan and Plains. The 20-inch pipeline would have an ultimate capacity to transport up to 400,000 b/d, but the initial capacity is expected to be closer to 200,000 b/d.

The companies noted that an extension to Carr, CO, is also under consideration for connection to existing crude oil assets owned by Plains in that region. The lateral is being designed to provide additional shippers with flexible options and access into the Saddlehorn system.

In welcoming Anadarko into the fold, Magellan CEO Michael Mears and Plains All American CEO Greg L. Armstrong, said, “Anadarko is a committed shipper and has a significant production presence in this region, adding further value to the pipeline project to deliver crude oil to the Cushing hub.”

The project, which is expected to cost between $800-850 million, would be headed up by Magellan, which would also serve as the pipeline operator of the Saddlehorn system once it is complete. Assuming receipt of necessary permits and regulatory approvals, the pipeline is could be operational by mid-2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |