NGI Data | NGI All News Access

March Madness Finds Nearly All Points Lower In Weekly Trading

Market bears were draining 3-pointers left and right in trading for the week ended March 13. Of all market points tracked by NGI, only two made gains and those were for a nickel or less. The NGI Weekly Spot Gas Average swan-dived $1.12 to $2.49.

Tennessee Zone 4 Marcellus added 5 cents to $1.27 and Transco Leidy was right behind with a gain of 4 cents to $1.33, but all other actively traded points were in the red. The week’s greatest loser was Algonquin Citygates, which dropped $7.02 to $3.87.

Regionally, the Northeast fell the most, sliding $2.79 to $2.23. The best performance was put in by California, which lost 19 cents to $2.62.

Midwest quotes also suffered a triple digit drubbing with a setback of $1.35 to $2.82, and the Midcontinent was trapped for a 63-cent loss to $2.49.

East Texas fell 34 cents to $2.64 and South Louisiana was off 32 cents to $2.69. Both the Rocky Mountains and South Texas fell 29 cents on the week to $2.33 and $2.64, respectively.

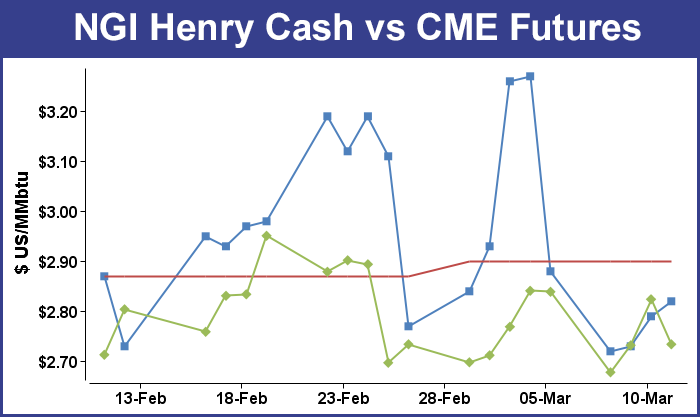

April futures fell 11.2 cents for the week to $2.727 and most of that came at the hands of the weekly Energy Information Administration (EIA) storage report. Traders on Thursday were not all that surprised by the initial non-response to what at first glance appeared to be supportive storage figures. Once the 198 Bcf figure hit trading screens, April futures rose to the high of the day at $2.864, but by 10:45 EST April was trading at $2.824, unchanged from Wednesday’s settlement. At that point, however, the sellers weren’t finished. At the close April had dropped 9.0 cents to $2.734 and May was off 8.5 cents to $2.765.

Prior to the release of the data, analysts were looking for a decrease in the low 190 Bcf range. A Reuters survey of 23 traders and analysts showed an average 191 Bcf with a range of 171 Bcf to 201 Bcf. Coming in right on the money were analysts at IAF Advisors looking for a 198 Bcf pull, and industry consultant Bentek Energy utilizing its flow model predicted a 198 Bcf withdrawal as well.

“We were looking for a 191 Bcf draw, but I had seen anywhere from the low 170s to 211 Bcf or so,” said a New York floor trader. “It looks like traders were waiting for a move to the upside like this to sell. They took advantage of the rally and just hit it. There is no indication that the market can hold higher prices. If it couldn’t make $3 with this number, what is it going to take?”

Others saw a more bullish tone to the report. “The 198 Bcf drop in storage was near the top end of the range of market expectations, a bullish surprise. As a second consecutive bullish miss, this suggests that the background supply/demand balance may be somewhat tighter than anticipated,” said Tim Evans of Citi Futures Perspective. “There’s not a great deal of seasonal heating demand still ahead of the market, but we continue to see potential for a short covering rally to the $3.10-3.20 area and today’s data gives the market a push in that direction.”

Inventories now stand at 1,512 Bcf and are 483 Bcf greater than last year and 225 Bcf below the 5-year average. In the East Region 104 Bcf were withdrawn and the West Region saw inventories decrease by 16 Bcf. Stocks in the Producing Region declined by 78 Bcf.

Analysts concede that the week’s temperature outlook may be cooler than earlier reports, but at this late stage of the withdrawal season, any market impact is likely to be minimal. “[S]ome of the outlooks that we monitor appear a bit more supportive than yesterday as temperatures within the heavily populated northeast region are looking colder, while mild trends across most of the country are expected to end by the middle of next week,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients. “Consequently, a couple more storage withdrawals could be forthcoming before the shoulder period begins to force injections.

“We feel that the market is likely discounting a supply draw in next Thursday’s EIA release of around 30-50 Bcf. As a result, a seasonal supply bottom below 1.5 Tcf would appear likely in keeping supply well below five-year average levels by a margin of around 10-12%. But this deficit is apt to be erased next month as strong production replaces the weather factor as primary driver of supply trends. We will continue to emphasize that updated weather outlooks suggestive of significantly below-normal temperatures will not be packing the pricing punch as similar deviations from normal during the month of January.”

In Friday’s trading, weekend and Monday natural gas proved to be a tough sell as major population centers were expected to see temperatures by Monday reach levels 15 to 20 degrees above seasonal norms.

Only a few points in the Northeast made it into positive territory, and losses of a dime or more were common in the Mid-Atlantic, Marcellus, Gulf Coast, Midcontinent and California. The overall market dropped 11 cents to $2.43. Futures prices moved little, and at the close April had eased 0.7 cent to $2.727 and May was lower by 0.9 cent to $2.756. April crude oil tumbled $2.21 to $44.84/bbl.

A forecast of rising temperatures throughout the weekend was all it took to keep gas buyers from committing to three-day deals and instead relying on laptops and smart phones to make any needed gas purchases over the weekend. Wunderground.com reported increasing temperatures at major Midwest points. Milwaukee’s Friday high of 67 degrees was expected to drop to 57 Saturday before jumping to 62 Monday, 21 degrees above normal. Chicago’s 61 high Friday was seen easing to 54 Saturday before making it back to 62 on Monday. The seasonal high in Chicago is 46. Detroit’s 55 high Friday was seen sliding to 53 Saturday before vaulting to 65 Monday, well ahead of the seasonal norm of 42.

Gas for weekend and Monday delivery on Alliance shed 16 cents to $2.67, and gas at the Chicago Citygates fell 17 cents to $2.61. Packages on Michcon were seen 11 cents lower at $2.83, and gas on Consumers fell 13 cents to $2.85.

Eastern points were hit with falling prices as well. Deliveries to the Algonquin Citygates fell 32 cents to $3.49, and packages at Iroquois Waddington dropped 5 cents to $3.03. Gas on Millennium came in 14 cents lower at $1.31.

Gas bound for New York City on Transco Zone 6 tumbled 28 cents to $2.52, and parcels on Tetco M-3 fell 9 cents to $1.68.

In the Marcellus, gas on Transco Leidy changed hands at $1.25, lower by 14 cents, and weekend and Monday deliveries to Tennessee Zone 4 Marcellus were quoted up a penny at $1.28. Gas on Dominion South fell 12 cents to $1.45.

The Midwest and Great Lakes were anticipated to see a warming trend. AccuWeather.com’s Katy Galimberti said, “The weekend and early next week will offer a true taste of springlike weather for the Detroit area. With highs resting in the 50s F for much of the weekend, Monday could hit near the 60 degree mark. Normal highs for this time of year are in the mid-40s. Showers may dampen the warmer weather into Saturday. However, rain will be spotty.”

“It will feel noticeably cooler on Sunday, though,” said AccuWeather.com meteorologists. “However, Monday will bring one last push of warm air. Temperatures could hit in the 60s, marking for an ideal day to spend time outside. The shot of warm air will not last, however, as temperatures will fall back to normal levels on Tuesday. We’re in a transient pattern, [and] conditions are changing rapidly this time of year.”

Weekend and Monday gas also fell at West Coast points in spite of indications of weather-driven cooling load.

Gas for weekend and Monday delivery at Malin dropped 12 cents to $2.38, and packages at the PG&E Citygates shed 14 cents to $2.86. Gas at the SoCal Citygates changed hands 11 cents lower at $2.63, and gas at the SoCal Border was seen 12 cents lower at $2.45.

Industry consultant Genscape said, “SoCal demand should near 3.0 Bcf/d by Monday as potential record-setting heat triggers cooling load. Accuweather’s forecast high for Los Angeles [Friday] is 90 degrees F. Evening nominated sendout is at 2.6 Bcf/d. Highs on Saturday are expected to reach 92 degrees and 90 degrees F again on Sunday and Monday. Today’s previous record high was 89 degrees F in 1994; the March 14 record was 88 degrees F in 1951.

“The daily average temperature in the region through Monday is 76 degrees F. There are no observations in Genscape’s data set back to 2008 of any March daily average temperatures that exceeded 73.1 degrees (March 2011). There are only two observations of daily average temperatures in April exceeding 73.5 degrees F. As a result, our SoCal demand forecast is a linear projection based on the region’s demand-per-degree history for March and April. However, the risk to the demand forecast is to the downside as there has been a marked downward shift in demand-per-degree in recent years due to the rapid growth of renewable generation in the CAISO market, particularly behind-the-meter solar.”

Weather forecasters are calling for a shot of cold air next week, but any significant impact on supply-demand balances going into the injection season seems doubtful. “The latest weather data continues streaming in, and it’s confirming our concerns about the cold blast arriving Tuesday and Wednesday of next week not pushing far enough into the Midwest, and thus will only impact the Northeast with any truly cold temperatures,” said Natgasweather.com in a noon update Thursday.

“While it will drop overnight lows below freezing over much of the northern U.S., lows of teens and 20s will only be found across the upper Great Lakes and Northeast, which isn’t likely going to be enough coverage to expect it would lead to a stronger-than-normal withdrawal during the sample period used for the EIA report. There will be stronger cold blasts pushing into the northern U.S. late in the week, which is likely to have better success advancing across the Midwest with colder than normal temperatures, but if additional cold blasts fail to follow after March 23-24th, heating demand will be quite light over the U.S.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |