NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

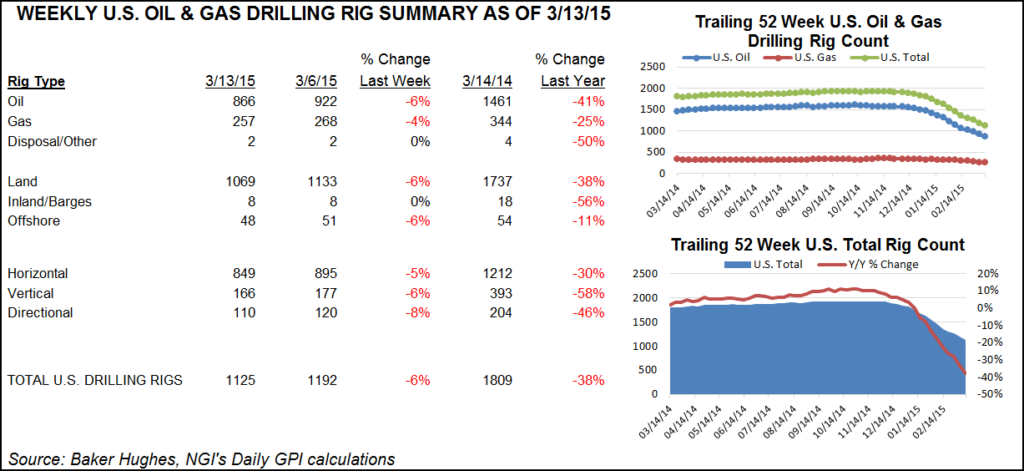

U.S. Rig Count Down 38% From Year Ago

The active drilling rig count saw losses for the week nearly across the board, with declines of 4-8% in all categories except for disposal wells and inland/barge drilling, according to Baker Hughes data.

Producers continue to favor more costly horizontal drilling because of the much larger payoff it provides in unconventional resource plays.

What’s not revealed in the chart is that although drilling continues to decline, producers are delaying completions, creating a stockpile of drilled wells that can be quickly brought online whenever there’s a convincing enough recovery in prices.

Executives at EOG Resources and Marathon Oil Corp. recently discussed the growing backlog of uncompleted wells (see Shale Daily, Feb. 23). Continental Resources also has been deferring completions, and COO Jack Stark said earlier this year that other producers have been doing the same (see Shale Daily, Feb. 12).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |