E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Texas Oil/Gas Industry Barometer Falling; Job Losses Climbing

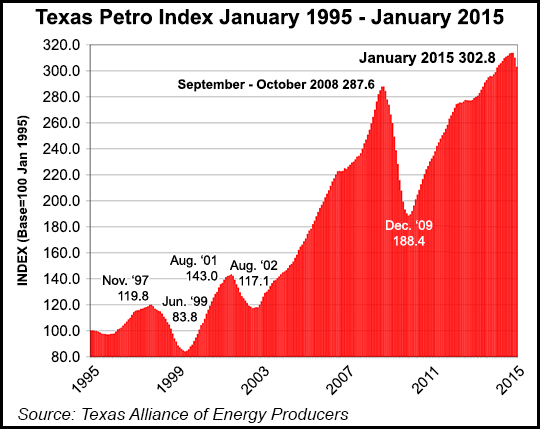

If the economic health of the Texas oil and gas industry were an elevator, its only direction would be down — down for crude oil prices, rig count, drilling permits and employment — and for the Texas Petro Index (TPI), which most recently has shed seven points, according to an economist who has been keeping score.

Total oil and gas employment in the Lone Star State declined by about 3,300 jobs in January from an estimated level of 305,000 jobs in December.

“January 2015 employment data was just released in March as a part of the Texas Workforce Commission annual revision process, and the estimates appear to indicate what we knew was coming: that the number of oil and gas jobs in Texas was going to begin to decline at some point and it looks like that is now the case,” said Karr Ingham, consulting petroleum economist for the Texas Alliance of Energy Producers and TPI’s creator.

“Several thousand jobs were lopped off the original industry employment estimates for the latter part of 2014, and it now seems likely that upstream oil and gas payroll employment in Texas peaked in December at about 305,000 jobs,” he said. “The January monthly decline very likely represents the onset of industry employment contraction on the way to what will ultimately be tens of thousands of jobs lost.”

The TPI fell seven points to 299.6 following the rapid decline in crude oil prices, the rig count, and drilling permits, indicating further weakness in the Texas oil and gas economy, Ingham said.

Crude oil prices declined 51.3% from last year’s $91.32 to $44.46/bbl and are down by more than 55% compared to the June 2014 peak. Every economic indicator decreased in February, including the drilling rig count, oil and gas completions, and drilling permits, Ingham said.

The industry added nearly 25,000 jobs in Texas last year, pushing total upstream employment to more than 300,000 for the first time and stimulating the creation of thousands of jobs elsewhere in the state’s economy, Ingham said.

“But for now that run is over, and 2015 will be a year of dramatic contraction in Texas oil and gas employment,” he said, adding that the contraction gripping oil and gas exploration and development in Texas still is in the early stages.

“The TPI only peaked in October,” Ingham said. “Production continues to climb, inventories are stacking up, and the expectation simply must be that future pressure on price will be downward, not upward, until this situation of oversupply begins to correct. These trends will continue for months to come, and we should be prepared to settle in for a fairly long period of downturn before the industry begins to recover.

“Now that this process has been set into motion, there is no stopping it until the events driving it have played out.”

A composite index based upon a group of upstream economic indicators, the TPI in January was 299.6, 0.8% higher than in January 2014, but 7.1 points (2.3%) lower than the TPI in December of 306.7 (which was revised in accordance with updated industry employment data). Before embarking upon the current economic downturn, the TPI peaked at a record 310.5 in November, the zenith of an economic expansion that began in December 2009, when the TPI stood at 187.7.

Among leading TPI indicators during September: Crude oil production in Texas totaled an estimated 102.1 million bbl, about 20.3% more than in January 2014. With crude oil prices in January averaging $44.46/bbl, the value of Texas-produced crude oil totaled about $4.54 billion, 41.4% less than in January 2014.

Estimated Texas natural gas output was nearly 687.4 Bcf, a slight year-over-year monthly decline of about 0.1%. With natural gas prices in November averaging $2.93/Mcf, the value of Texas-produced gas declined 36% to about $2 billion.

The Baker Hughes count of active drilling rigs in Texas averaged 773 in January, about 7.5% fewer than the 836 active rigs in January 2014. Drilling activity in Texas peaked in September 2008 at a monthly average of 946 rigs before falling to a trough of 329 in June 2009. During the economic expansion that began in December 2009, the statewide average monthly rig count peaked at 932 in May and June 2012.

The number of Texans on oil and gas industry payrolls totaled 301,700, according to statistical methods based upon Texas Workforce Commission estimates, about 7.2% more than in January 2014. Average upstream oil and gas employment in Texas peaked in December at an estimated 305,000 after increasing steadily from a nadir of 175,700 in October 2009.

The Texas taxman and his counterparts in other big producing states are feeling the effects of the oil and natural gas downturn. The oil price plummet has cut production tax revenues during the last half of 2014 and the first month of this year in some of the biggest producing states, the U.S. Energy Information Administration (EIA) said.

Texas, North Dakota, Alaska and Oklahoma are four of the five top producing states, and they derive a significant share of their unrestricted operating revenues from taxes on oil and natural gas production. Although California produces more oil than both Alaska and Oklahoma, its economy is much larger, making it relatively less affected by changes in oil and natural gas prices and production, EIA said.

Texas collected $583 million in tax receipts from oil and gas production in August 2014, but tax revenue declined by 40% to $352 million in January, based on state data, EIA said. EIA estimated that crude oil and lease condensate production in Texas also increased through December, growing from 88 million bbl to 107 million bbl from January to December 2014.

Last year the Texas oil and gas industry paid a record $15.7 billion in taxes and royalties, according to data from the Texas Oil & Gas Association (see Shale Daily, Feb. 25).

North Dakota’ s tax revenue from production decreased from $323 million in August to $254 million in January, a 21% decline. Monthly production in North Dakota continued to increase through December, even as prices declined, according to the latest production data, EIA said. However, more recently the state’s production has declined (see Shale Daily, March 12).

Alaska relies on revenue from crude oil production for 90% of its operating budget. The state’s 2015 revenue projections assumed oil prices of $105/bbl, EIA said. According to state data, monthly oil and gas production tax revenue in August was $108 million, substantially higher than the $26 million received in January, according to EIA.

Oklahoma collected $62 million from production taxes in August. Receipts declined to $43 million in January, a drop of roughly 30%, based on information from the Oklahoma Tax Commission, EIA said, adding that the state’s production was relatively flat during this period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |