E&P | Infrastructure | NGI All News Access

Alberta Oilsands NatGas Demand to Drive NGTL Expansion

Traffic on TransCanada Corp.’s western pipeline grid, Nova Gas Transmission Ltd. (NGTL), will increase by 42% over the next 10 years as thermal oilsands production grows and spreads across northern Alberta, the system’s planners said.

Construction is to start this summer on the first step in the forecast rise in deliveries to 14.1 Bcf/d as of 2025 from the current 9.9 Bcf/d after NGTL obtained approval to supply a landmark plant that opens a new bitumen belt development frontier.

The C$144 million (US$115 million) pipeline, the Wolverine River Lateral, will carry gas that a breakthrough Shell Canada project called Carmon Creek will burn to make steam for boiling oil out of a complicated deposit 600 meters (1,960 feet) deep.

The plant, now in construction and drilling stages, will initially use 810 wells and two processing sites to extract 80,000 b/d of bitumen in a readily accessible area near the farm and oilfield service town of Peace River in northwestern Alberta.

In field trials dating back to the 1960s, Shell devised a new extraction system to start tapping the previously all but untouched western end of the 140,000-square-kilometer (56,000-square-mile) oilsands zone that arcs across northern Alberta between the province’s boundaries with British Columbia and Saskatchewan.

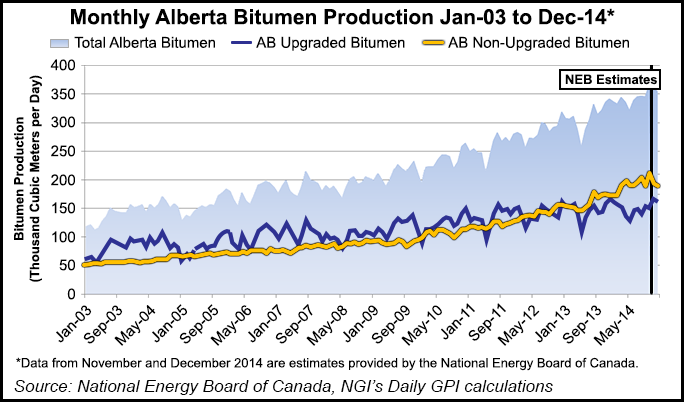

The new pipeline and production facilities highlight the immense scale of the Alberta resource. The Florida-sized bitumen lode currently pumps out about 2.1 million b/d. Projects now under construction will increase production by 150,000 b/d this year and another 150,000 b/d in 2016, according to a scorecard kept by the Canadian Association of Petroleum Producers.

Carmon Creek is scheduled to need gas from NGTL’s new Wolverine River Lateral as of April 1, 2016. Shell’s oilsands leases in the area alone, a half-hour by road northeast of Peace River, contain an estimated 4.9 billion bbl of recoverable bitumen reserves.

Details of the project, including costs and gas use, are classed as confidential commercial matters. Industry observers forecast a total price tag of C$3.6-7 billion (US$3-5.6 billion), depending how investments are counted such as associated work by other firms that includes an Atco 690 megawatt, gas-fired steam and electricity cogeneration plant.

Thermal bitumen extraction burns an average of 1 MMBtu of gas per barrel of oil production, with mines using less and “in-situ” underground operations often requiring much more, said the Alberta Energy Regulator (AER).

Initial gas deliveries to the Carmon Creek site will be 208 MMcf/d, said the pipeline approval decision by the National Energy Board (NEB). The new NGTL pipe will be capable of carrying up to 344 MMcf/d.

Demand for natural gas as oilsands extraction fuel in the Peace River area will keep on rising, according to NGTL forecasts, which are partly based on confidential data collected from its transportation service customers.

In the emerging western bitumen production region pioneered by the Carmon Creek project, “the peak [gas] demand forecast was estimated by NGTL to increase from 15 MMcf/d in 2013-2014 to 276 MMcf/d in 2019-2020 through to 2024-2025,” NEB said.

The oil price drop since last summer has slowed down but far from stopped Alberta bitumen belt development. Shell, Total SA and Statoil ASA have lately withdrawn development applications to the AER. But the withdrawals to date only stop expensive engineering and regulatory work on projects that were deferred even before oil prices fell, due to steeply rising costs for entirely new production sites in remote northeastern Alberta muskeg swamps and forests.

To tap the western Peace River oilsands Shell devised an approach called vertical steam drive. The technique uses hexagonal clusters of vertical wells that do double duty in cycles as heat injectors and production bores.

The deposit has shale layers that prevent use of the favorite in-situ extraction method in the eastern sands: steam-assisted gravity drainage with horizontal well pairs that simultaneously inject heat and pump out production.

Company investment literature raises a possibility of continuing development by spreading out installations of the new production system at a growth pace determined by market conditions. Three phases are projected.

At the initial production rate of 29 million bbl per year, the 80,000 b/d Carmon Creek plant would take 167 years to extract the 4.9 billion bbl in Shell’s Peace River leases. A 240,000 b/d, 88 million bbl per year, operation would last 50-60 years, which is regarded as the normal lifespan for oilsands complexes.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |