Regulatory | Infrastructure | NGI All News Access

Sempra Utilities’ Gas Pipeline Plans Draw Criticism

Natural gas transmission pipeline additions proposed by Sempra Energy’s two major California utilities, Southern California Gas Co. (SoCalGas) and San Diego Gas and Electric Co. (SDG&E), have drawn criticism from consumer advocates who question the motivations behind requests to add more than $1 billion in gas system infrastructure.

In the meantime, state regulators have suspended the schedule for one new Sempra utilities transmission pipeline project pending a number of questions that are being sorted out, according to a Sempra spokesperson. “We’re still waiting to get the full ruling with the timing and everything,” the spokesperson said.

Since Sempra last month said it was working with Petroleos Mexicanos south of the border to determine if Sempra’s Energia Costa Azul liquefied natural gas (LNG) receiving terminal along the Baja California Pacific Coast should be turned into an export facility (see Daily GPI,Feb. 19), consumer groups have suggested that Sempra might be thinking of using added intrastate California transmission pipeline capacity to feed gas supplies into Baja for export.

The Utility Reform Network (TURN) and the Office of Ratepayer Advocates (ORA) at the California Public Utilities Commission (CPUC) have alleged the export tie-in while urging the CPUC to not approve utility ratepayer funding for the proposed pipeline projects.

“The concerns raised by TURN have no basis in fact; SoCalGas and SDG&E proposed [the disputed pipeline projects] in 2013, and their need is distinct and separate from the business goals of any other project or company,” a Sempra spokesperson told NGI.

Several years ago, the Sempra California utilities proposed a $1.4 billion, four-year upgrade to their natural gas pipelines (see Daily GPI, July 10, 2012).

ORA has steadfastly pushed to have Sempra shareholders — not SoCalGas/SDG&E ratepayers — pay for most of the safety upgrade work, which was called for after the 2010 Pacific Gas and Electric Co. (PG&E) pipeline rupture and explosion in San Bruno, CA. Both Sempra gas utilities and PG&E have submitted pipeline enhancement plans to the CPUC that have drawn pushback from ORA and other consumer organizations.

SoCalGas has asked the CPUC to charge utility customers for $587 million of its proposed pipeline upgrade costs through 2015. The rest of the costs would be collected over a number of years after 2015.

What is in play now is a proposed north-south transmission project designed to connect the southern and northern ends of system serving both utilities. It includes a 65-mile, 36-inch diameter pipeline estimated to cost $484 million and $136 million to rebuild a major compressor station at Adelanto in the high desert about 120 miles north of Los Angeles. This is a joint SoCalGas-SDG&E project that is currently suspended at the CPUC.

A second proposal by SDG&E alone that is only in the conceptual stage would build a 32-inch diameter transmission pipeline from Rainbow in North San Diego County to run southward into the city of San Diego. A TURN attorney has alleged that his project — still not formally filed with the CPUC — would be a way for utility ratepayers to subsidize the corporation’s international expansion plans.

Nearly four years ago after the San Bruno explosion, SDG&E retrofitted segments of the existing 51-mile Rainbow 16-inch diameter transmission pipeline (see Daily GPI, June 6, 2011). The retrofit was to include installing pipe supports, fittings and valves that would enable a sophisticated sensor to traverse the pipeline’s interior for safety testing purposes.

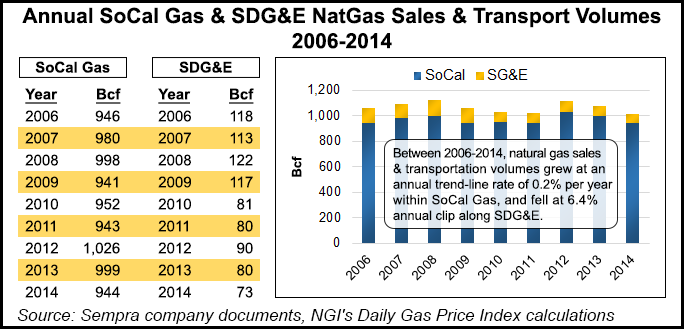

Between 2006 and 2014, natural gas sales and transportation volumes grew at an annual trend-line rate of 0.2% per year within SoCal Gas, and fell at 6.4% annual clip along SDG&E.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |