Markets | NGI All News Access | NGI Data

Weather, Storage, Production Prod Cash, Futures Sharply Lower

Typically, physical traders will get their deals done early on the day of the Energy Information Administration’s (EIA) natural gas inventory report, and in this case Thursday’s broad market collapse may have been precipitated by April futures opening nearly a nickel lower, well before the inventory report.

If sellers needed further encouragement, futures continued lower up until the EIA report.

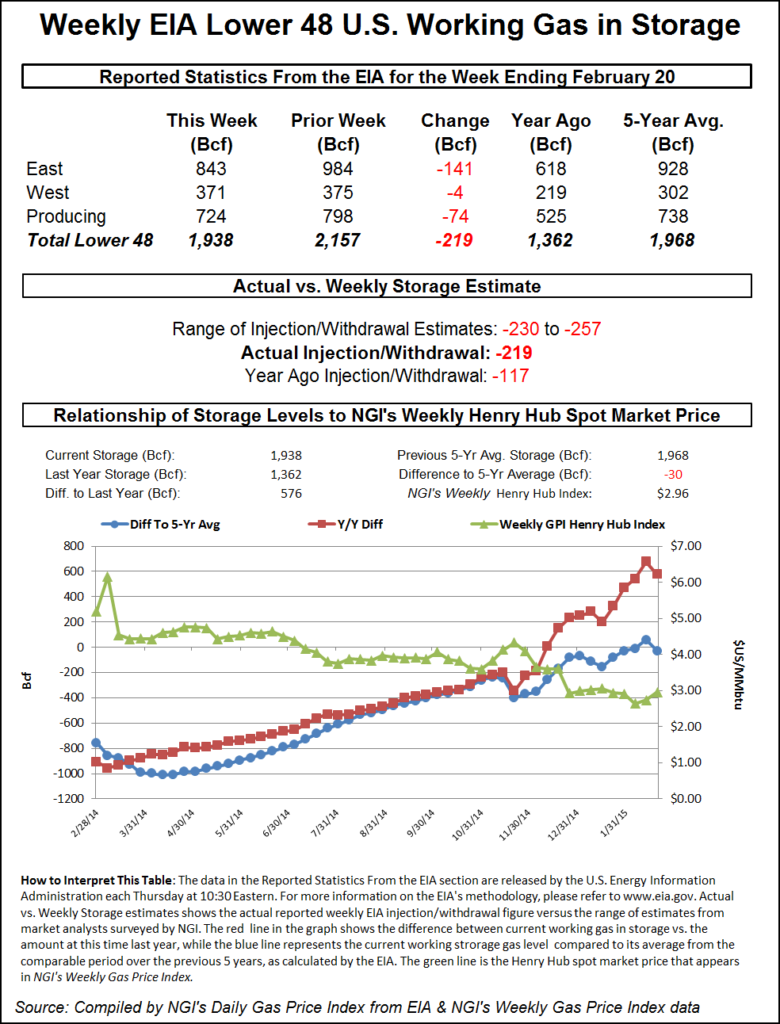

Multi-dollar losses were seen in the Mid-Atlantic and Northeast, but stout double-digit losses were posted in the Midwest as well. Only a handful of lightly traded points made it to the positive side of the trading ledger, and the average overall decline was 77 cents to $4.92. The EIA reported an inventory withdrawal of 219 Bcf, well below consensus expectations, and futures prices tanked. At the close, April settled 16.5 cents lower at $2.697 and May had fallen 15.2 cents to $2.737. April crude oil tumbled $2.82 to $48.17/bbl.

Midwest and Great Lakes points plunged, and although near-term temperature forecasts call for well below normal temperatures, a warming trend is seen next week. According to AccuWeather.com, Minneapolis, MN’s high Thursday of 10 degrees was seen rising to 14 by Friday, 21 on Saturday, and 30 degrees by next Tuesday. The normal high in Minneapolis at the end of February is 33. Chicago’s Thursday high of 17 was forecast to dip to 15 Friday but reach 22 on Saturday and 40 by next Tuesday. The seasonal high in Chicago is 41. Indianapolis, IN’s 19 high on Thursday was also expected to slide to 15 on Friday and climb to 23 on Saturday and 45 by next Tuesday. The normal high in Indianapolis is 45.

Friday gas on Alliance fell 81 cents to $4.04, and packages delivered to the ANR Joliet Hub skidded 85 cents to $3.96. At the Chicago Citygates, next-day gas was quoted at $3.97, down 65 cents, and on Consumers next-day deliveries were seen at $3.89, down 82 cents. Parcels on Michcon shed 77 cents to $3.80, and gas at Demarcation was quoted at $3.68, down 80 cents.

AccuWeather.com sees a warming trend settling in for Minnesota. “Though the weekend will continue the stretch of cold conditions for the Twin Cities, temperatures will be on a rising trend early next week. Skies will remain dry and sunny for the next several days,” said AccuWeather.com meteorologist Dan DePodwin.

“Temperatures will rest in the low teens, continuing the stretch of biting cold conditions. Normal temperatures for this time of year are in the low 30s, a threshold the city has not met since Feb. 11. However, as February comes to a close, moderating temperatures will bring daytime highs into the average range, [and] though a storm system tracks close to the city late in the weekend, the snow will stay to the south. The storm will usher cloudy conditions for Sunday.

“Temperatures will begin to trend upward at the beginning of the workweek and could reach into the low 30s. A system may bring some snow to the region into Monday night,” DePodwin said.

Other areas also saw steep declines. Gas bound for New York City shed $7.32 to $16.04, and deliveries to Tetco M-3 came in $7.21 lower at $13.19.

At the Algonquin Citygates, Friday packages fell $1.61 to $22.81, and gas at Iroquois Waddington skidded $2.83 to $12.40. Gas on Tennessee Zone 6 200 L tumbled $5.78 to $19.66.

In the Marcellus region, setbacks were not quite as severe. Next-day deliveries to Transco Leidy fell 16 cents to $1.42, and gas on Tennessee Zone 4 Marcellus gave up 13 cents to $1.37. Gas on Dominion South fell 41 cents to $2.46.

Reports of rapidly expanding production didn’t help the bullish cause either. Industry consultant Genscape detailed higher well counts and more production from the Utica Shale play in southeastern Ohio. “Since the beginning of the year, well counts in Ohio’s Utica have increased by 134 total, with 109 new producing wells,” the company said in a Thursday morning report.

“Harrison County has had the highest jump in producers overall, with nearly a third of all new producing wells (+32), followed by Guernsey County (+19). Guernsey, while trailing in producing numbers, has showed the most activity this year in well completion, putting 29 wells into drilled-but-not-producing inventory. Carroll and Harrison both have extensive inventories as well, with 67 and 69 wells, respectively.

“Wells completed but not currently producing in Harrison, Jefferson and Belmont counties are of extra interest as Regency Energy Partners is building the Utica Ohio River Project, which is a 52-mile, 36-inch [diameter] gathering trunkline with at least 2.1 Bcf/d capacity, initially delivering to TETCO (2Q 2015) and later into REX (3Q 2015). A lateral from the line in Jefferson will connect to the Cadiz processing plant’s tailgate in Harrison county, increasing options for processed gas to get to market.”

The release of storage data caught a number of traders off guard. For the week ended Feb. 20, the EIA reported a decrease of 219 Bcf. April futures fell to a low of $2.723 after the number was released, and by 10:45 EST April was trading at $2.738 down 12.4 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease in the 240 Bcf area. A Reuters survey of 23 traders and analysts showed an average 241 Bcf with a range of 230-257 Bcf. Analysts at ICAP Energy were looking for a 234 Bcf pull, and Bentek Energy’s flow model predicted a 233 Bcf withdrawal.

Bentek said even with the cold in the East and Midwest, withdrawals didn’t surpass the levels of last year. “Residential and commercial demand increased nearly 20 Bcf/d from the previous week, which averaged more than 63.3 Bcf/d. The increased demand was centered in the East Region as historic cold blanketed the Northeast,” the firm said. “The record low temps increased demand in the Northeast to its single-day record of more than 43 Bcf/d, which was a mark that was posted twice during the week.

“However, withdrawals failed to match the peak demand weeks from last winter, especially considering the West Region only withdrew single digits during the week. Even with the record demand levels in the Northeast, Dominion and TCO only matched their highest withdrawals of the year and failed to post larger withdrawals than peak-demand weeks last year.”

“Everyone was looking for a 240 to 241 withdrawal and the 219 Bcf was [way] less than expectations,” said a New York floor trader. “I’m thinking we’ll settle above $2.75, and still remain within that $2.75 to $3.00 trading range.”

Analysts were scratching their heads as to why last week’s brutal cold didn’t have more of an impact. “The net withdrawal of 219 Bcf was at the bottom of the range of expectations, implying a smaller than expected impact from last week’s cold temperatures,” said Tim Evans of Citi Futures Perspective. “This will also warrant a bearish revision to the forward storage outlook. The draw was still more than the 130 Bcf five-year average for the date but disappointing on a weather-adjusted basis.”

Inventories now stand at 1,938 Bcf and are 576 Bcf greater than last year and 30 Bcf below the five-year average. In the East Region, 141 Bcf was withdrawn, and the West Region saw inventories decrease by 4 Bcf. Stocks in the Producing Region declined by 74 Bcf.

Overnight weather models showed more variability along with indications of moderation in key population centers. “[Thursday] offers a recently relatively rare lower demand change thanks to warmer changes on the guidance consensus for next week in the East and South along with more variability showing up in the 11-15 day period,” said Matt Rogers, president of Commodity Weather Group, in the firm’s Thursday morning report. “Next week is still very tricky as the models struggle to navigate through various pieces of storm energy that translate across the U.S. Tight temperature gradients will be challenging between the South and North next week and our temperatures may continue to fluctuate.

“Cold air coverage is still the strongest, though, such that next week still runs colder than normal nationally. Otherwise, we see more pattern variability for the second week of March with many areas trending toward near-normal temperatures for the 11-15 day time period, but colder risks continue to loom larger than warmer ones, thanks to continued ridging near Alaska and even hints of new ridging around Greenland late in the 11-15 day.”

Tom Saal, vice president at INTL FC Stone, was looking for a big move. In a Thursday morning note to clients he cited the Market Profile of the April contract show[ing] “a ‘developed’ normal (bell curve) distribution…the mode (most popular price) has traded horizontally in 56 ’30-minute’ time slots. Look for a major price movement from the mode price of $2.825.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |