Markets | NGI All News Access | NGI The Weekly Gas Market Report

Unexpected NatGas Price Strength Shields Alberta From Oil Blow

Natural gas showed unexpected strength and warded off the worst early effects of the blow that falling oil prices dealt to the government of Alberta — Canada’s chief producing jurisdiction.

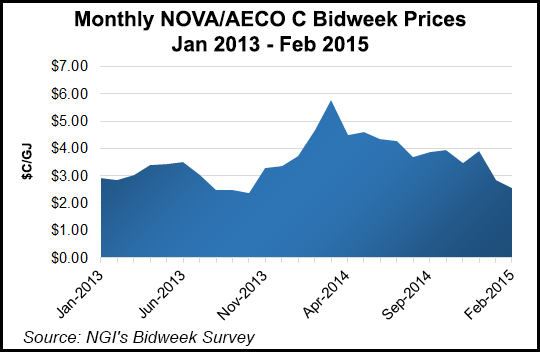

The Alberta Reference Price, a weighted average for provincial gas royalties, performed 16% better than expected to hit C$3.81/gigajoule (US$3.20/MMBtu) in the first nine months of the government’s fiscal year, which ends March 31.

The province’s production also exceeded expectations, prompting Finance Minister Robin Campbell to increase the government forecast of 2014-2015 total Alberta output by 26% to 4.7 Tcf. However, the first six months of the oil slide since last summer alone are forecast to cut Alberta bitumen royalties by C$644 million ($515 million) to C$4.9 billion ($3.9 billion), 12% less than forecast by the provincial budget a year ago.

When Campbell released nine-month financial statements Tuesday, Alberta Premier Jim Prentice repeated predictions that the oil setback will blow a C$7 billion ($5.6 billion) hole in annual provincial revenues during the 2015-2016 fiscal year.

Annual gas royalties remain stuck in the C$1 billion ($800 million) range, down nearly 90% since prices and production peaked seven years ago. Bitumen royalties are expected to fare as badly over the next full fiscal year, under a sharply revised forecast for oil to average only US$44.00/bbl.

The Alberta royalty regime partially shields industry against market gyrations by using a sliding scale of rates that creates an ability-to-pay feature. The royalty rates drop as prices go down. Not only does the revenue pie shrink, but so does the province’s piece.

Oilsands royalties add an extra protective dimension to the shield, as a “net-profit” regime enacted in the 1990s to provide an inducement for industry to build high-cost plants. The rates apply only to revenues after expenses including a deemed fair return comparable to interest on national government bonds.

The current energy price trough has prompted Prentice and Campbell to vow that the next budget would break a generations-old habit of relying heavily on gas and oil royalties by starting a 10-year plan of diversifying revenue sources. The pledge spells tax increases for a province that has long boasted of possessing an “Alberta advantage” of the lowest government burdens on citizens and corporations alike.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |