NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Commodity Exposure Weakens Some Midstream Credit, S&P Says

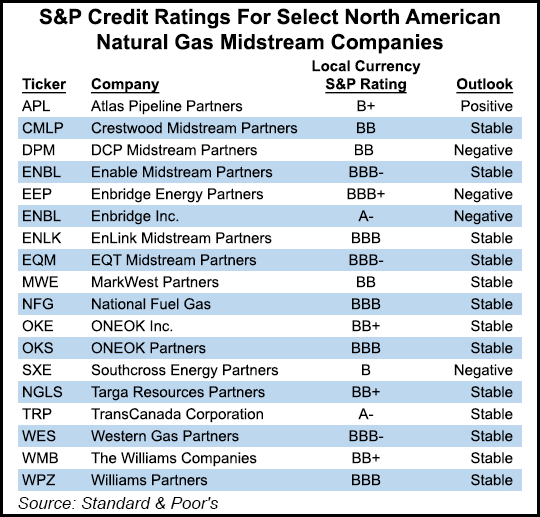

Actions by Standard & Poor’s Ratings Services (S&P) announced Tuesday highlight the value of fee-based contracts for midstream energy companies, particularly when commodity prices are as depressed as they have been of late.

S&P took credit ratings actions on a handful of midstream companies in light of commodity prices. Those that received downgrades are those that rely more heavily on keep-whole or percent-of-proceeds contracts, S&P said.

“Midstream energy companies are generally less vulnerable to commodity price swings due to stable cash flows generated from fee-based contracts,” S&P said. “However, we believe a number of gathering and processing companies, particularly those that incur some direct commodity price exposure from keep-whole or percent-of-proceeds contracts, are susceptible to weaker credit measures when oil and natural gas liquids prices are low.”

While companies with commodity price exposure can manage risks through hedging, their hedges typically don’t extend beyond 12 to 24 months, S&P said, and this limits their margin protection. “We also believe most gathering and processing companies have not hedged meaningful natural gas liquids equity volumes due to relatively weak prices,” S&P analysts said. “In addition, we expect overall gathering and processing volumes, and thus cash flows, to decline as upstream companies reduce capital spending and cut back on drilling due to lower commodity prices.”

The S&P review of the sector was sparked by crude oil and natural gas price declines and S&P’s assumptions for future prices. Many midstream companies will have weaker credit-protection over the next one to two years, the firm said.

S&P lowered its corporate credit rating and unsecured ratings on DCP Midstream LLC to “BB” from “BBB-” and retained a “negative” outlook. “We are also lowering our short-term rating on the company to ‘B.’ The rating actions reflect our expectations that DCP Midstream LLC’s consolidated financial measures will significantly weaken due to materially lower NGL prices,” S&P said.

The firm also lowered its corporate credit rating and senior unsecured ratings on master limited partnership DCP Midstream Partners LP to “BB” from “BBB-” and retained a “negative” outlook. It also lowered its short-term rating on the partnership to “B.”

S&P cut its rating outlook on Southcross Energy Partners LP to “negative” from “stable” and affirmed its “B” corporate credit rating on the partnership. It affirmed its “B” issue ratings and left the “3” recovery rating unchanged on the partnership’s term loan and revolving credit facility. “The negative outlook reflects our expectation that Southcross will have weaker financial measures and liquidity than originally anticipated,” S&P said.

Meanwhile, S&P affirmed its “BB” rating on MarkWest Energy Partners LP with a “stable” outlook. “At the same time, we revised our business risk profile to ‘satisfactory’ from ‘fair’ in addition to the financial risk profile to ‘aggressive’ from ‘significant.’ The stable outlook reflects our view that MarkWest will have sufficient liquidity to fund and successfully execute its growth spending plans in 2015,” S&P said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |