Marcellus | E&P | NGI All News Access | Utica Shale

Wattenberg Costs Continue to Fall For PDC

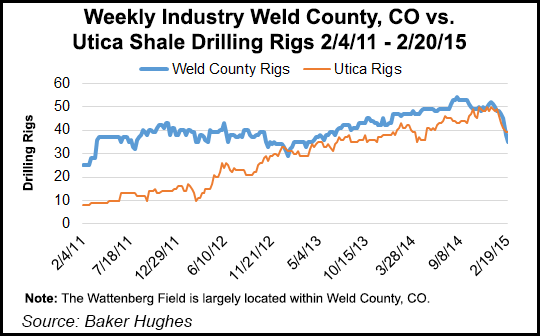

PDC Energy Inc. plans to focus almost entirely on its core Wattenberg Field acreage in Colorado this year to drive production up 50% after writing down its Utica Shale assets in Ohio in the fourth quarter and selling off its last dry gas assets in the Marcellus Shale last year (see Shale Daily, July 30, 2014).

Costs in the Wattenberg, management said, have fallen sharply as oilfield service companies have made concessions with the steep fall in oil prices. Declining costs combined with a suite of improving completion techniques in the field have the company turning its back on the Utica Shale for plans to drill 119 operated Niobrara and Codell wells in Colorado this year.

“In the Wattenberg, it’s pretty much across the board reductions. We’re seeing most of our suppliers recognizing the circumstances that we are in as an industry today,” said Scott Reasoner, senior vice president of operations. “We’ve had good conversations and obviously we’ve seen the benefit of those in terms of cost reductions.

“But when you look at Ohio, I think a couple of things are happening there. I think the [service] prices there were much greater because of all the work going on in the Utica and Marcellus. There’s also a number of completions out there that will need to get pulled out of the queue before we see significant costs reductions there.”

Management said individual well costs in the Wattenberg have decreased from $4.3 million last year to $3.6 million this year. That reduction, combined with an anticipated slowdown in its non-operated assets in the area led the company to once again cut its 2015 capital spending plans to $473 million from the budget of $557 million it announced in December (see Shale Daily, Dec. 10, 2014).

An extended lateral program, which will push the company’s horizontals up to 7,000 feet on its Niobrara and Codell wells completed with 16-25 fracture stages, is expected to help push production up this year.

Full-year production increased 42% to 9.3 million boe. Fourth quarter production increased to 28,060 boe/d, compared to 21,738 boe/d in the year-ago period. Sequential production increased 10%.

Management said volumes would have been higher if it hadn’t been for extremely cold weather in Colorado late last year and delays in third-party midstream start-ups. Year-end proved reserves increased 11% to 250 million boe.

About 91% of the company’s full-year production came from the Wattenberg field, with the rest produced in the Utica Shale. Falling commodity prices forced PDC to take a $163.5 million writedown on its Utica assets. It has already idled its sole drilling rig in that play and will complete just four wells there this year.

“In terms of returning to drilling, we’re continuing to work on the cost side obviously, and as we see more data coming out of the Cole and Dynamite [pads], we’ll be more excited about the economics at that point,” Reasoner said of the company’s Utica assets. “In that $60-70/bbl of oil range, we’ll start to see it look like it’s a positive economic picture. We still have to get some adjustment in capital structure before we get there.”

Full-year revenue increased to $856.2 million from $392.7 million in 2013. Fourth quarter revenue also increased to $407.7 million from $135.4 million in the year-ago period. PDC will rely heavily on its hedge book through 2016 to insulate it from the recent drop in oil prices.

It has about 85% of this year’s crude production hedged at $89/bbl and about 75% of its natural gas production hedged at $4/Mcf. Through 2016, the company said it has 4.1 million bbl of oil protected at $85/bbl and 29.8 Bcf of natural gas hedged at $4/Mcf.

The company reported net income of $155.4 million ($4.24/share) in 2014, up from a net loss of $22.3 million (69 cents/share) in 2013. Fourth quarter net income also increased to $131.8 million ($3.64 cents/share) from $13.2 million (36 cents/share) at the same time last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |