Markets | NGI All News Access | NGI Data

Physical Prices Give Up Gains; Futures Little Moved by Storage Data

What goes up comes down, and just as the physical market staged a meteoric advance in Wednesday’s trading, Thursday’s exchanges turned sharply lower as power prices weakened and weather forecasts were ratcheted down a notch or two.

Multi-dollar drops were seen in the major eastern and Midwest population centers, but in the Gulf Coast, Midcontinent, Rockies and California, next-day gas rose by a nickel to about a dime. Overall, the market fell $1.69 to $5.50.

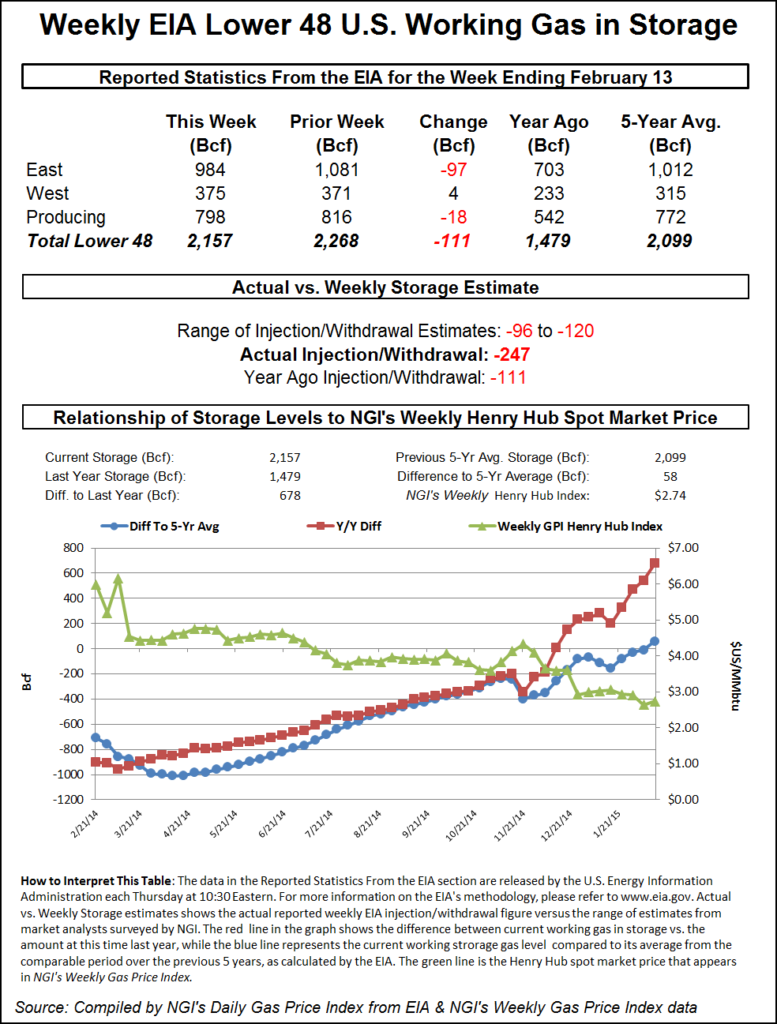

The release of the weekly natural gas storage report was unable to generate anywhere near the usual swings in the cash market. The Energy Information Administration (EIA) reported a withdrawal of 111 Bcf for the week ended Feb. 13, right in line with expectations. Futures traders were unimpressed. At the close, March had risen 0.3 cent to $2.834 and April was up 1.8 cents to $2.875. March crude oil tumbled 98 cents to $51.16/bbl.

The day’s greatest declines came in the East, Northeast and Midwest as power prices and loads eased, and temperature forecasts moderated. Intercontinental Exchange reported that peak power for Friday delivery at the ISO New England’s Massachusetts Hub fell $4.44 to $163.00/MWh and Friday peak power at the PJM West terminal fell $16.99 to $214.55/MWh.

Loads were also generally expected to decline. The PJM Interconnection forecast that Thursday’s peak load of 48,010 MW would ease to 45,443 MW Friday and 40,353 MW Saturday. ISO New England expected Thursday’s peak load of 19,650 MW to rise to 19,800 MW Friday before sliding to 18,390 MW Saturday.

Next-day gas at the Algonquin Citygates fell $4.28 to $17.09, and at Dracut next-day packages shed $3.14 to $16.99. Gas on Tennessee Zone 6 200 L fell $5.22 to $15.09.

The day’s highest trade was posted on Transco Zone 6 non NY North at $80.00, off $45 from Wednesday’s high trade of $125, also seen on Transco Zone 6 non NY North. According to a Transco spokesman, major constraints were in place for that area. On its website Transco showed no additional capacity available for its Marcus Hook and Trenton Laterals serving portions of Pennsylvania and southern New Jersey. The spokesman said capacity would likely become available once weather conditions moderated.

Gas on Transco Zone 6 New York fell $16.50 to $21.65, and deliveries to Tetco M-3 changed hands at $14.81, down $5.67.

Columbia Gas Transmission LLC (TCO) also experienced difficulties and issued Critical Days for both Storage and Transport for its entire system through Monday (Feb. 23)until further notice. TCO continued to experience high loads and peak storage withdrawals due to the extreme cold, which is forecasted to continue through next week.

Tennessee Gas Pipeline said it “anticipates very limited flexibility due to higher pipeline capacity utilization and significantly colder weather moving back into the Northeast next week.” It said it was issuing a Critical Day I OFO for Zone 5 on the 200 Line only and for all of Zone 6 for all Balancing Parties. In addition, all delivery point operators in Zone 5 on the 200 Line and all of Zone 6 are required to keep actual daily takes out of the system equal to or less than scheduled quantities regardless of their cumulative imbalance position, the company said.

Marcellus points fell as well. Deliveries to Transco Leidy were seen 14 cents lower at $1.49, and gas on Tennessee Zone 4 Marcellus came in 2 cents lower at $1.48. Gas on Dominion South changed hands at $2.82, unchanged.

Temperatures along the Eastern Seaboard were forecast to fall then rise. Wunderground.com forecast that Boston’s high of 26 was expected to drop to 17 Friday before rising to 30 on Saturday. The normal high in Boston is 40. New York City’s Thursday maximum of 24 was anticipated to ease to 21 Friday before rebounding to 35 on Saturday, 7 degrees below normal. Philadelphia’s Thursday high of 22 was expected to drop to 19 Friday before jumping to 38 on Saturday. The seasonal high in Philadelphia is 42.

Market points in the Midwest gave up their multi-dollar gains of Wednesday as well, as temperatures were expected to make a strong comeback Friday. Wunderground.com said Minneapolis, MN’s high Thursday of 8 was expected to jump to 29 Friday but ease to 20 on Saturday. Chicago’s 5 degree high of Thursday was seen rising to 21 Friday and reach 33 by Saturday, still 4 degrees below normal for the Windy City. Indianapolis, IN’s 9 degree high Thursday was forecast to reach 22 Friday and 38 on Saturday. The normal high in Indianapolis is 41 this time of year.

Gas on Alliance fell $5.40 to $6.01, and deliveries to the ANR Joliet Hub fell $5.41 to $5.94. At the Chicago Citygates, next-day deliveries shed $4.80 to $6.71, and packages on Michcon fell $4.13 to $5.31. Gas on Consumers was seen off $6.53 to $5.67.

The National Weather Service in Indianapolis said, “Warmer southerly winds will develop on Friday behind the departing high with increasing moisture. This will bring clouds along with chances for snow on Friday night and Saturday. Warmer low level air may enable a wintry mix Saturday afternoon across the southern half of central Indiana before precipitation transitions back to all snow with the arrival of colder air Saturday night. A strong polar high-pressure system will bring a return to well below normal temperatures for much of next week.”

Futures traders Thursday morning awoke to overnight weather models leaning to the cooler side. WSI Corp. in its Thursday morning six- to 10-day outlook said, “[Thursday’s] forecast is similar, if not a bit colder on average across the CONUS when compared to yesterday, due in part to the day shift. The period forecast only added four HDDs (heating degree days). Confidence in the overall forecast is average as medium-range models are in good agreement with the large-scale pattern. However, there are still plenty of technical and localized model differences, which hampers confidences levels on a daily basis.

“The general risk during the period is to the colder side due to an amplified pattern and another arctic outbreak, which may be followed by a southern stream storm system.”

This week’s storage report was expected to be a tempered affair, with a modest 110 Bcf or so draw on the docket. With this week’s cold, however, early estimates for next week’s report of more than 200 Bcf are in the mix.

Most analysts were close to the 111 Bcf draw reported by the EIA. For the week ended Feb. 13, Citi Futures Perspective came in on the low end of the spectrum with a 96 Bcf estimate, and United ICAP calculated a 113 Bcf pull. Bentek Energy’s flow model figured on a withdrawal of 109 Bcf. Last year, a stout 247 Bcf was withdrawn, and the five-year average is for a 181 Bcf pull.

Next week’s report looks to be a humdinger. Next week Evans forecasts a pull of 240 Bcf and says what is likely to be a storage surplus, year-on-five-year will “move back out to a deficit of 118 Bcf as of Feb. 27 before slipping again to 104 Bcf as of March 6. While this prospect hasn’t been enough to spark short-covering so far, we do see potential for a run back up to the $3.20 area last seen in mid-January over the next week or two.”

Evans recommends holding a long April position from $2.83 with a protective sell-stop at $2.57 to limit initial risk on the trade.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |