E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rig Count May Level Off by Mid-Summer But Future Path Still Unclear

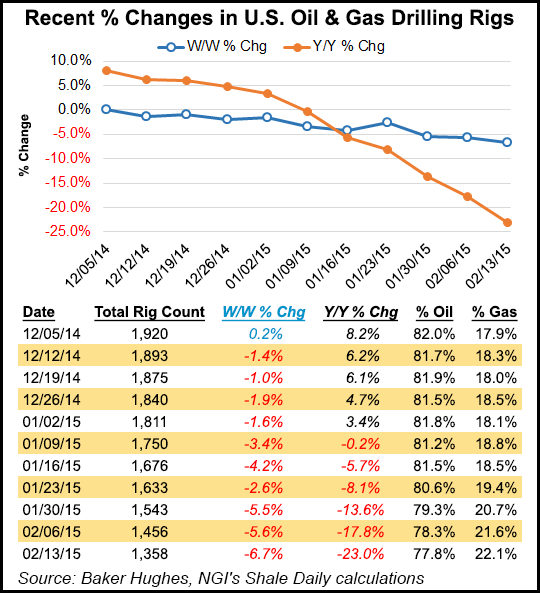

The U.S. rig count may level off by August to about 1,000 following the rapid decline this year, which included 200 that were dropped in the first two weeks of February, Wood Mackenzie Ltd. said Thursday.

The reduction in the first half of this month followed a sharp decline in January, when the domestic count fell by almost 200 rigs to 1,616 from a peak of 1,859 in November. Since then, the “pace of land rigs being idled continues to accelerate,” the consultancy said.

Per Baker Hughes Inc.’s U.S. rig count as of last Friday (Feb. 13), 1,398 oil and natural gas rigs were in operation, down 98 from the week before, when 84 were dropped (see Shale Daily,Feb. 13). Drilling rigs “are currently being stacked at an alarming rate,” said Wood Mackenzie Research Director Scott Mitchell.

Goldman Sachs analysts said Monday the rig count implies U.S. oil production growth year/year of 600,000 b/d by 4Q2015. Rigs dropped last week included 52 horizontals, 18 verticals and 14 directionals, said Goldman analysts Damien Courvalin and Raquel Ohana.

The momentum in the U.S. rig count cuts “suggests that the U.S. rebalancing is on track,” but recent comments by exploration and production (E&P) companies “suggest that these indiscriminate rig cuts reflect an initial focus on cost cutting rather than asset optimization (high grading), providing limited information on the future path of the rig count.”

Patterson-UTI Energy Inc. CEO Andy Hendricks earlier this month said producers were “indifferent to the type of rigs released” (see Shale Daily,Feb. 5).

Even with the dramatic drop in the rig count, it’s still not enough to rebalance the oil market, according to Goldman.

“The flexibility in cutting noncontracted rigs and associated cost deflation, along with the producer hedging that has occurred over the past weeks and the recent wave of equity issuance, raise the risk that the U.S. production slowdown will be delayed.”

Could some relief arrive this summer? Wood Mackenzie suggested that if oil prices recover slightly, the domestic count may flatten. It is pegging average 2015 oil prices at $53.25/bbl for West Texas Intermediate (WTI).

“However, if prices are sustained in the $40-50/bbl range for WTI, then the impact on rig counts will be even more severe, dropping to less than 900 by the summer,” said Mitchell. “This would represent a 50% cut in the number of operational U.S. land rigs from the November 2014 peak.”

Wood Mackenzie is forecasting that WTI in 2016 should average about $64.00/bbl.

“The resulting impact on the rig market is a slow but steady recovery, averaging an additional 15 rigs per month through the end of 2016,” said Mitchell.

For the fifth time in five months, Standard & Poor’s Ratings Services on Thursday revised down its WTI assumptions in 2015 to $50.00/bbl from $65.00. Brent assumptions were cut to $55.00 from $70.00. Prices are seen recovering in 2016 to average $60.00/bbl WTI and $65.00/bbl Brent.

A big consequence of the declining demand for rigs is lower dayrates. Last year a high-specification horizontal rig could command a contract rate of $27,000/day, according to Mitchell. Those rates could fall by almost one-third this year to average about $19,000.

“The rig contractors will clearly suffer in such an environment,” Mitchell said, “and those with the newest fleets, loaded toward horizontal walkable rigs, will fare better than their competitors.”

The picture for domestic E&Ps is mixed because the budget cuts mean fewer wells are drilled and completed. “However, service and equipment costs are reducing, allowing activity to continue in areas, which would otherwise be rendered sub-economic,” he said.

A Devon Energy Corp. executive said Wednesday the company’s oilfield service costs have fallen by about 10% since the end of 2014 already, and vendor costs could decline by as much as 25% this year (see Shale Daily,Feb. 18).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |