NGI Data | NGI All News Access

Frosty Northeast Pulls Weekly Gains Close To $1

All but a few points recorded double digit gains for the week ended Feb. 13, and the NGI Weekly Spot Gas Average rose by a robust 93 cents to $3.90.

Most points outside of the Northeast averaged gains of about 10-20 cents, but the week’s star performer was New England and the Northeast, with a whopping $2.98 gain to $7.23. Not surprisingly, the biggest gains were also seen in snow-choked New England. Iroquois Zone 2 saw the week’s greatest move, rising $9.07 to $16.46. Second place was hotly contested, but Tennessee Zone 6 200 L edged out a number of points with a posting of a $7.71 advance to $17.81. The week’s biggest loser was also in the Northeast with Lebanon, OH falling a dime to $2.77.

East Texas added 10 cents to $2.63 and South Texas rose 11 cents to $2.62.

Both California and South Louisiana came in at 12-cent gains to $2.64 and $2.71, respectively, and the Rocky Mountains added 14 cents to $2.38.

Midcontinent points rose 20 cents on average to $2.64 and the Midwest was seen up 25 cents to $3.01.

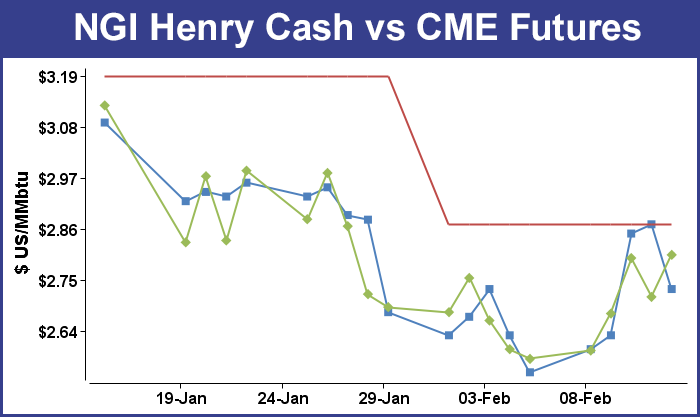

March futures for the week were able to shrug off a bearish inventory report and rise by 22.5 cents to $2.804. The market was able to counter the Energy Information Administration (EIA) reporting a storage withdrawal of 160 Bcf, a bit less than what the market was expecting and futures prices slumped Thursday. At the close March finished 8.4 cents lower at $2.713 and April was off 8.1 cents to $2.733.

The release of inventory figures for the week ended Feb. 6 by the EIA was anticipated to show usage nowhere near the polar vortex-driven period of last year, but consensus estimates still showed a draw below the five-year average. Last year, a humongous 234 Bcf was withdrawn, and the five-year average pace is a 178 Bcf pull.

Bentek Energy’s flow model was relatively low in its estimate of a 156 Bcf withdrawal. The firm cited something of a disconnect between the cold weather of last week and its sample of storage facilities. “Below-normal temperatures during the week in the East increased withdrawals from storage compared to the previous week. However, this was offset partially by nearly no net storage activity in the West Region due to above-normal temperatures during the week.

“Even with the majority of the cold weather centered over the Northeast, facilities in the region, such as Dominion and TCO, failed to report their strongest withdrawals of the season, while fields in the Midwest increased withdrawal activity only marginally compared to the previous week and also kept sample activity lower compared to high-demand weeks this year.

“The sample activity for the week suggests risk toward a weaker withdrawal. However, withdrawals from facilities within Bentek’s sample increased only marginally within the Producing Region, indicating only a modest uptick in demand within the region,” the firm said.

Other estimates included IAF Advisors at a 166 Bcf estimate and ICAP Energy predicted a pull of 170 Bcf. A Reuters poll of 21 traders and analysts revealed an average 168 Bcf with a range of -149 Bcf to -181 Bcf.

Futures traders see a market comfortable at current levels. “As long as prices stay under $3, you won’t see any fear from the shorts. I don’t see anything out of whack across the board,” said a New York futures trader.

Analysts are thinking that ongoing and forecast cold, along with the expected heavy usage, hasn’t been fully priced into inventory draws for upcoming weeks.

“Although the weather outlooks could shift during the upcoming extended weekend, we feel that the severe broadly based cold will be translating to some unusually large supply draws into the month of March and that such a development has yet to be fully priced,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “As a result, we won’t rule out another price lift back to above the $2.80 area where we would suggest short positions into the April contract.”

Just like most analysts, Ritterbusch’s 180 Bcf estimate of Thursday’ Energy Information Administration storage withdrawal was off the mark. “We have overestimated the size of the weekly storage draws for about three consecutive weeks, and it would appear that some bearish shifts in the balances are developing below the surface that have slowed the pace of withdrawals,” he said. “The most obvious factor would appear to be continued production strength that has attracted much less attention than has been the case in the liquids. The market appears to have priced in year over year output gains of at least 3.5% across this year and the fact that this strength is unlikely to be deterred by some probable well freeze-offs during the next couple of weeks has been largely shrugged off.

“With a strong output pace virtually assured across the second quarter and with the long-standing supply deficit against five-year average levels now virtually erased, short position holders are now back on the offensive. The late stage of the heating cycle is also a consideration as is year over year comparisons that are now indicating a supply surplus stretched to beyond 540 Bcf.

In Friday’s trading it was a tale of two markets as prices for the extended weekend for New England points vaulted higher, fed by weather, pipeline restrictions and an extra day of market exposure, and locations from the Marcellus west were generally softer as weather conditions were expected to be more mild. New England posted multi-dollar gains, but Gulf Coast points saw drops of a dime. Midwest locations were mixed, and the Rockies were off about 15 cents. Overall, the market for the four-day period gained 70 cents to $4.80. Futures slumped early but managed a mid-session recovery, and at the closing bell March was higher by 9.1 cents to $2.804 and April had gained 7.9 cents to $2.812.

There were no chocolate and flowers for Northeast buyers, and traders for the extended weekend in New England were taking no chances being caught short of gas as not only was cold weather forecast, but major restrictions were in place on Algonquin Gas Transmission. AccuWeather.com forecast that Boston would receive another nine inches of snow over the weekend and temperatures would stay well below historical norms. Friday’s high of 17 degrees was expected to reach 27 Saturday but fall back to 16 by Monday. The normal high in Boston is 39. Hartford, CT’s Friday high of 16 was seen making it to 28 Saturday before subsiding to 15 on Monday. The normal high in Hartford mid-February is 39 also.

Four-day packages at the Algonquin Citygates surged $5.34 to $23.51, and deliveries to Dracut jumped $4.30 to $21.56. Gas on Tennessee Zone 6 200 L rose $6.00 to $23.72.

Traders who didn’t get their deals done for their customers by Friday morning were basically out of luck. As one industry veteran put it, “if you didn’t get out of the house [buy your gas] by 11 a.m., you were stuck on the road. You then got stuck in the mailbox trying to stay warm and your customer is yelling from the house that he is freezing! It’s better to be long and wrong than short and fired.”

Restrictions were in place Friday all up and down Algonquin Gas Transmission (AGT). The company said on its website that “AGT has restricted interruptible and approximately 90% secondary out of path nominations that exceed entitlements sourced from points west of its Stony Point Compressor Station (Stony Point) for delivery to points east of Stony Point. No increases in nominations sourced from points west of Stony Point for delivery to points east of Stony Point, except for Primary Firm No-Notice nominations, will be accepted.”

Also, “AGT has scheduled and sealed nominations sourced from points west of its Southeast Compressor Station (Southeast) for delivery to points east of Southeast. No increases in nominations sourced from points west of Southeast for delivery to points east of Southeast, except for Primary Firm No-Notice nominations, will be accepted.”

AGT also said that it had restricted interruptible and approximately 87% of secondary out of path nominations greater than entitlement sourced from points west of its Cromwell Compressor Station for delivery to points east of Cromwell. “No increases in nominations sourced from points west of Cromwell for delivery to points east of Cromwell, except for Primary Firm No-Notice nominations, will be accepted.”

Farther west, prices softened in the Marcellus. Four-day gas on Millennium shed 14 cents to $1.60, and deliveries to Transco Leidy were off 17 cents to $1.42. Gas on Tennessee Zone 4 Marcellus slid a dime to $1.27, and packages on Dominion South came in at $2.45, down 29 cents.

Gas in the Mid-Atlantic gravitated to more of an equilibrium pricing. Gas deliveries for New York City on Transco Zone 6 fell $2.00 to $18.06, but packages on Tetco M-3 jumped $5.91 to $15.41.

In the Gulf, Rockies and California, prices weakened. Deliveries to Transco Zone 3 fell 11 cents to $2.74, and gas on Columbia Gas Mainline eased 12 cents to $2.73. At the Henry Hub, gas for the extended weekend was quoted 14 cents lower at $2.73, and gas at Katy fell 11 cents to $2.61.

Gas at the Cheyenne Hub fell 16 cents to $2.36, and at Opal deliveries for the extended period dropped 27 cents to $2.33. Gas at the PG&E Citygates fell 15 cents to $2.83, and deliveries to SoCal Citygates retreated 28 cents to $2.58.

Overnight weather forecasts moderated, prompting a lower futures open. MDA Weather Services in its Friday morning six- to 10-day outlook said, “A mix of changes are seen today, including a much warmer period in the West. This change comes with increased model support for a stronger central Pacific low, and a disturbance in the eastern Pacific, that enhance ridging over the West. Above-normal coverage increases as a result; although, the continuation of strong ridging in the northeast Pacific and over Alaska promotes the intrusion of cold Arctic air to the east of the Rockies. Texas is also less cold early. The East is marginally colder today, particularly early when strong below normal readings are widespread.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |