Bakken Shale | E&P | Eagle Ford Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

NatGas, Oil Production From Big Seven Plays Up More Than 1% Feb-March, EIA Says

Production of both natural gas and oil in the nation’s seven most prolific shale and tight oil plays will increase more than 1% between February and March, according to the Energy Information Administration (EIA).

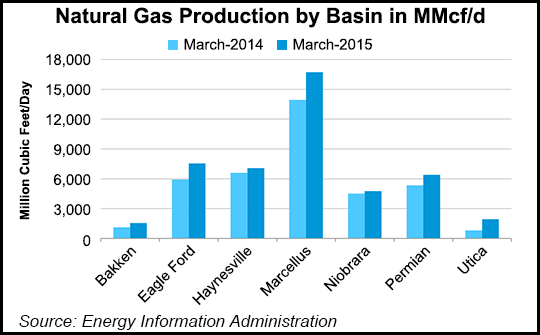

The natural gas side of the ledger continues to be headed by the Marcellus Shale, which is expected to produce 16.72 Bcf/d next month, up 1.0% compared with 16.55 Bcf/d in February (see Shale Daily, Jan. 13), according to EIA’s latest Drilling Productivity Report (DPR). That’s more than double the production of any one of the nation’s three other key plays — the Eagle Ford (7.54 Bcf/d in March, compared with 7.45 Bcf/d in February), Haynesville (7.06 Bcf/d, compared with 6.97 Bcf/d) and Permian (6.39 Bcf/d, compared with 6.33 Bcf/d) — and far outpaces production from the Utica Shale (1.93 Bcf/d, compared with 1.90 Bcf/d) and the Bakken Shale (1.56 Bcf/d, compared with 1.54 Bcf/d).

Total natural gas production from the seven plays analyzed in the DPR is projected to reach 45.94 Bcf/d, a 1.1% increase from 45.48 Bcf/d in February, EIA said

Oil production from the Permian Basin continues to surge, according to EIA’s estimates, reaching 1.96 million b/d in March, a 1.6% increase compared with 1.93 million b/d in February, according to the DPR. The Eagle Ford will increase 17,000 b/d to 1.73 million b/d, and the Bakken will add 13,000 b/d to reach 1.32 million b/d.

The projected aggregate month-to-month production growth rate for those three regions and the Niobrara (398,000 b/d in March, compared with 395,000 b/d this month) is about 40% lower than the January-to-February growth rate, “a sign that the precipitous drop in oil prices and rig counts is beginning to gradually make its way into production growth figures,” according to analysts at Wells Fargo Securities. There were 1,101 drilling rigs operating in U.S. unconventional production basins on Feb. 6, according to Baker Hughesdata, down 66 from the previous week and a 217-rig decrease compared with a year ago.

Total oil production from the big seven plays is expected to reach 5.58 million b/d in March, a 1.2% increase from 5.52 million b/d in February.

New wells continue to become more productive, according to the EIA report. New-well gas and oil production is expected to be higher in March than in February across the big seven (except for oil production in the Haynesville, which will remain at 24 b/d), the agency said. On a rig-weighted average, new-well gas production per rig in the plays will be a combined 1.84 MMcf/d in March, compared with 1.77 MMcf/d this month, and new-well oil production per rig will be 352 b/d, compared with 348 b/d this month.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |