NGI Data | NGI All News Access

Few Points Turn Positive As Weekly Natural Gas Prices Deflate

For the week ending Feb. 6 the weekly natural gas physical market was awash in a sea of red ink, as moderate temperatures and stout supplies helped a vast majority of national pricing points lower. Although a few locations in the always volatile Northeast posted gains, all others were down about 20 to 30 cents. TheNGI Weekly National Spot Gas Average fell 24 cents to $2.97.

Of the actively traded points the strongest proved to be Texas Eastern M-3 Receipts, which advanced 74 cents to $2.99. Biggest losers included Transco Zone 6 non New York North at a $2.36 decline to average $3.53. Transco Zone 6 New York was not far behind with a $1.50 drop to $7.10 and Tetco M-3 shed $1.47 to $3.91.

Regionally West Coast and Rocky Mountain points fell the most as a result of a force majeure declared by eastbound Rockies Express (REX) pipeline. Briefly flows of up to 1 Bcf/d were backed up into Rockies and western points. The Rocky Mountain regional average for the week fell 35 cents to $2.24 and California saw its weekly average fall 33 cents to $2.52.

The Northeast saw prices decline 25 cents to average $4.25 and South Louisiana, South Texas, and the Midcontinent all fell 24 cents to $2.59, $2.51, and $2.44, respectively.

East Texas gas was off 23 cents to $2.53 and the Midwest declined 16 cents to $2.76.

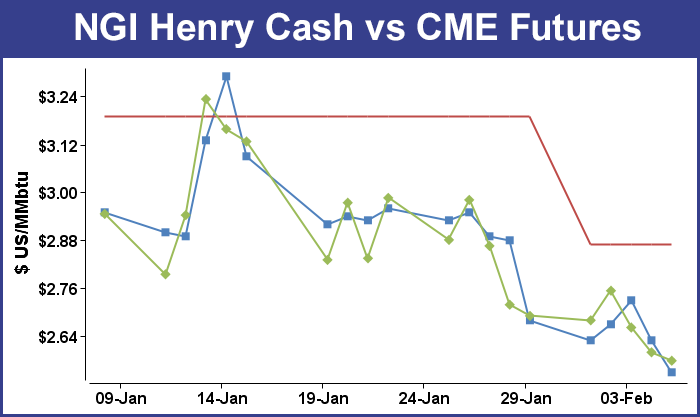

March futures declined 11.2 cents on the week to $2.579, and the first salvo ahead of the broad market decline Thursday was fired early when March futures opened 3 cents lower. Subsequently the Energy Information Administration (EIA) reported a withdrawal from storage of 115 Bcf, about 5 Bcf shy of expectations, and prices posted the lows of the session immediately after the figure was released. At Thursday’s close March had fallen 6.2 cents to $2.600.

The EIA report was a further reminder of the well-supplied nature of the market The number was just a few Bcf below estimates, but miles away from last year’s 259 Bcf withdrawal and a five-year average of 165 Bcf. March futures fell to a low of $2.578 after the number was released.

Prior to the release of the data analysts were looking for a decrease of about 120 Bcf. IAF Advisor analysts calculated a 111 Bcf decline, but a Reuters survey of 21 industry observers revealed an average 122 Bcf with a range of 104 Bcf to 141 Bcf. Analysts at ICAP Energy were looking for a 119 Bcf pull, and industry consultant Bentek Energy utilizing its flow model predicted a 112 Bcf withdrawal.

“Both production and demand edged higher during the week, with residential/commercial and power burn demand gaining 1.0 Bcf/d and 2.3 Bcf/d, respectively,” Bentek said. “This was offset by slight gains in production, which continued to recover from freeze-offs and posted its highest weekly average for 2015 at 72.4 Bcf/d. The majority of the cold during the week was centered in the Northeast, with temperatures moderating significantly in the West and only falling slightly in the Producing Region.”

“The market stayed down on the number,” said a New York floor trader once the storage data was released. “There is nothing bullish about the market although there was some sympathy with crude the other day when the market rallied. There is no bullish sentiment in natural gas although you may see some anomalies on profit taking.”

Tim Evans of Citi Futures Perspective saw the number as bearish. “The net withdrawal of 115 Bcf was both less than expected and below the 166 Bcf five-year average for the date, a clearly bearish result. The draw was less than anticipated for a third consecutive week, helping to reinforce the idea that the background supply/demand balance has weakened, with bearish implications for future reports.”

Inventories now stand at 2,428 Bcf and are 468 Bcf greater than last year and 29 Bcf below the 5-year average. In the East Region 87 Bcf were withdrawn and the West Region saw inventories fall 4 Bcf. Stocks in the Producing Region declined by 10 Bcf.

Analysts see March futures zeroing in on $2.50. “Although [Friday’s] trade provided no clear cut clues to next week’s price direction, we still see a high probability of a test of the $2.50 level within the next 3-4 trading sessions,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments. “A couple of smaller than expected storage draws have virtually erased the long standing supply deficit against normal levels for this time of the year and short of an arctic blast that is sustained for a couple of weeks, we see nothing that would disturb our expectation for a significant seasonal supply bottom north of the 1.7 tcf level. While next week’s EIA storage report will again be upsized appreciably given this week’s colder than normal patterns, the supply draw can still be smaller than usual especially in comparison to last year.

“This week’s chart breakdown into 29 month lows combined with a newly established contango of almost 2 ½ cents in the closely watched March-April spread will likely force fresh selling next week even allowing for some possible bullish updates to the short term temperature views. The weather factor is gradually losing pricing power and will soon be replaced by supply side factors that will be featured by a record pace of production. While y over y output gains of around 5-6% as seen recently will not be sustained, production will remain strong enough through the spring period to upsize supply builds early in the injection cycle. We are maintaining a bearish stance but would continue to limit fresh shorts in rallies at least to above the 2.70 area.”

In Friday’s activity Traders took a look at weather outlooks for the weekend into Monday as well as spot power prices and for the most part decided to pass on purchasing much in the way of three-day packages when any needed gas can usually be purchased via convenient electronic communications.

Weekend and Monday quotes took the biggest dive in New England and the East, with losses above $2 common. The Gulf was down about a nickel, and the Midcontinent, West Texas, and Rockies were off about a dime. Overall, the market fell 35 cents to $2.59. Futures fared little better, with March falling 2.1 cents to $2.579 and April sliding 1.2 cents to $2.602.

Gas for delivery in the Northeast plunged as Monday peak power prices careened lower. Intercontinental Exchange reported that peak power Monday at the New York ISO Zone G terminal (eastern New York) tumbled $30.42 to $34.58/MWh and Monday peak power at the ISO New England’s Massachusetts Hub shed $17.27 to $77.89/MWh. Peak power at the PJM Interconnection’s West Hub dropped $11.80 to $33.47/MWh.

Gas at the Algonquin Citygates for weekend and Monday delivery was seen $2.71 lower at $8.65, and gas at Iroquois Waddington skidded $2.33 to $4.41. Packages on Tennessee Zone 6 200 L fell $2.41 to $8.37.

Gas bound for New York City on Transco Zone 6 fell $2.66 to $3.47, and deliveries to Tetco M-3 fell $1.49 to $2.45.

Marcellus points took lesser hits. Gas on Millennium shed 20 cents to $1.39, and gas was quoted at Transco Leidy 16 cents lower at $1.27. On Tennessee Zone 4 Marcellus points, gas changed hands at $1.21, down 19 cents, and packages on Dominion South fell 7 cents to $1.99.

Eastern points were expected to see a warming trend over the weekend. AccuWeather.com reported that Boston’s Friday high of 21 degrees was expected to rise to 30 Saturday and reach 33 by Monday. The seasonal high in Boston is 37. New York City’s Friday maximum of 25 was forecast to jump to 38 Saturday and climb further to 40 on Monday. The normal early February high in New York is 40. Philadelphia’s Friday peak of 32 was seen reaching 43 by Saturday and 42 on Monday, 2 degrees above normal.

The trend of warmer temperatures was expected to be even more pronounced farther west. AccuWeather.com meteorologist Brian Lada said, “While the calendar may read early February, it will feel more like early May across the Plains through the weekend and into the start of next week. This translates to highs 20 to 30 degrees above normal. The warmest air will focus on a zone stretched from western Texas through eastern Colorado where highs are forecast to climb into the 70s each day through Monday, [and] some areas in this zone could even top out above the 80-degree mark on Saturday.

“Some warmth will spill into the Southeast, Ohio Valley and the southern part of the mid-Atlantic region as well. Highs in this area will generally range from the 50s to the 60s. Sunshine and near-record warmth will continue to eat away at the snow cover across the Plains, which is already running below normal for this time of year. This is partly due to the mild pattern that closed out the month of January. By the end of the weekend, much of the Plains could be left with little to no snow on the ground.”

Gas for the weekend and Monday in the Midwest firmed, and quotes in the Gulf were seen lower. Deliveries on Alliance added 3 cents to $2.66, and packages at the ANR Joliet Hub came in 4 cents higher at $2.65. Gas at the Chicago Citygates fell 3 cents to $2.59, and quotes on Michcon added a penny to $2.70.

On ANR SE, gas for weekend and Monday delivery shed a nickel to $2.51, and packages at the Henry Hub fell 8 cents to $2.55. Gas on Florida Gas Transmission Z3 was seen off by 6 cents to $2.56, and at Katy parcels were quoted at $2.43, down 4 cents.

In early physical trading Friday, gas buyers for the weekend and Monday were confronted with a choice of whether to buy weekend packages in preparation for temperatures predicted to be well below normal in several regions of the country, or to punt and rely on spot purchases as needed.

Kari Strenfel, a meteorologist at Wunderground.com, forecast that “[a] cold front will dip south southeastward over the northern Plains and the upper Midwest. Energy moving across the northern Rockies will bring a chance of snow showers to the northern Plains. Light snow showers will also develop ahead of this frontal boundary over parts of the upper Midwest, the Great Lakes and the Northeast.

“Additionally, temperatures are forecast to be 10 to 20 degrees below normal across the lower Great Lakes and the eastern Ohio Valley. High pressure will bring a calm weather pattern to the central and southern Plains, the middle and lower Mississippi Valley, the Gulf Coast, the Deep South and the Mid-Atlantic.”

Forecasters also see elevated wind generation in association with the cold front. WSI Corp. said in its Friday morning report the broad MISO footprint could experience “a southwest wind around departing high pressure and ahead of another cold front…lead[ing] to partly cloudy skies and much warmer, above average temperatures [Friday] into Saturday. However, the aforementioned cold front and ripple of low pressure may slowly sag southward as the weekend progresses with a chance of light rain, snow and/or mix. This will also allow some colder air to slowly bleed back into the power pool by the start of next week.

“An Alberta Clipper-like system will begin to track into the north-central U.S. during Tuesday with a chance of snow. This will likely be the harbinger for some much colder air by the middle to end of next week. A variable, diurnally influenced wind will support periods of elevated wind generation during the next two to three days. Output may occasionally top out near 7 GW. Wind generation may subside late Sunday into Monday, but the clipper may cause generation to improve during Tuesday.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |