Natural Gas Forwards Values Fall Last Week on Slack Demand

Natural gas forwards markets were generally lower last week as unconvincing weather forecasts, returning production and bearish storage data weighed on prices.

The steepest declines occurred in New England, where the Algonquin Gas Transmission citygates’ prompt-month package shed 48 cents between Jan. 16 and Jan. 22 to reach plus $7.508/MMBtu, according to NGI’sForward Look.

Markets were closed that Monday in observance of the Martin Luther King, Jr. holiday.

The Algonquin March package picked up a modest 3.7 cents to hit plus $4.112/MMBtu, while the summer 2015 strip climbed 7.4 cents to minus 5.2 cents/MMBtu.

Winter strips further out the Algonquin curve put up substantial gains for the week, adding on to the previous week’s stout increases. The winter 2015-2016 package tacked on 35 cents to reach plus $6.62/MMBtu, resulting in a two-week gain of $1.30. The winter 2016-2017 strip was up 20 cents to plus $4.39/MMBtu, a two-week gain of 80 cents.

Despite the recent strength in these Algonquin winter strips, basis is within 20 cents of where it priced at the start of January, according to historical NGI Forward Look data.

Meanwhile, last week’s weakness at the front of the Algonquin curve comes as demand in the region is expected to peak at 3.82 Bcf/d on Tuesday — up from an expected 3.47 Bcf/d Friday — before sliding back to 3.39 Bcf/d Jan. 30 and averaging around that same level for the first week of February, according to Genscape (see Daily GPI, Jan. 23).

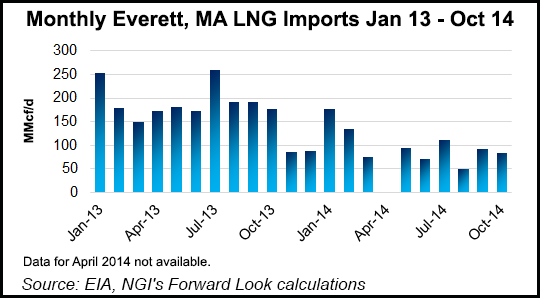

In addition to the overall downturn in demand, the region recently received LNG supplies and more are ready to be delivered.

Genscape unit Commodity Vectors estimates the GDF Suez Neptune was slated to arrive in Boston on Jan. 25. Data from Vessel Tracker indicates the ship left Trinidad & Tobago on Jan. 20 and was last seen Friday just south of Bermuda.

The GDF Suez Neptune had already delivered a cargo to New England earlier this month.

“LNG deliveries into New England this winter are at their highest rates in three winters,” according to Genscape’s Senior Natural Gas Analyst Rick Margolin. “Send-out from Everett this winter-to-date has totaled 4.48 Bcf, its highest rate since Winter 11-12. Everett sent out 0.26 Bcf/d on gas day Jan. 7, a single-day record for that terminal. Prior to gas day Jan. 22, month-to-date send-out from Everett had been averaging 0.18 Bcf/d. In the past two-days, however, volumes have fallen to just 0.06 Bcf/d.”

In addition to send-out from Everett, this winter saw the Excelerate offshore system put LNG volumes into the New England market for the first time since March 2010, Margolin said. Beginning Jan. 6, Excelerate has delivered a total of 0.99 Bcf to Algonquin Gas. Volumes peaked at 0.2 Bcf/d on gas day Jan. 7 and have since fallen to just 5 MMcf/d, he said.

Elsewhere in the Northeast, the New York market remained strong as production in that region continues to recover from recent freeze-offs, and the threat of additional freeze-offs at the end of the month lingers.

“Current volumes are averaging 18.56 Bcf/d (a 7-day low), which is 0.36 Bcf/d (2%) off the December average,” Margolin said. “Some of those volumes may be attributed to freeze-offs, however, we believe a lot of that gas lost may be a product of price- and demand-induced shut-ins. In the past two winters we’ve seen a bit of an uptick in the correlation between Northeast demand and production, suggesting producers are adjusting production volumes based on demand.”

Indeed, a Northeast trader said producers in the region are more sensitive to price swings than ever before, and with cash prices steadily holding $1 handles, they are more apt to respond by shutting in production.

“We have a few producers that drilled the last few weeks but stopped the trucks and did not frac the wells,” the trader said.

The forward curve at Dominion South point was also relatively strong, with the prompt-month climbing about 15 cents to minus $1.129/MMBtu, and the summer 2015 rising 12.2 cents to minus $1.126/MMBtu.

With current weather forecasts showing a cold end of the month for the East, Margolin said the potential for additional freeze-offs is a bit of a “wait-and-see situation in which we’ll need a bit more near-term clarity.”

“East producing areas have slightly more tolerance to cold weather, though not radically so,” Margolin said. “Also, East production is demonstrating some responsiveness to demand. So there’s the possibility that if cold-weather returns and causes demand to ramp up we could see some of that throttled-back production came back into the market.”

Genscape’s current demand outlook for the Appalachian region shows demand peaking at 19.89 Bcf/d on Monday, up from an expected 18.62 Bcf/d Friday, and then sliding to an average around 18.13 Bcf/d for the first week of February.

Other markets across the U.S. posted decreases of less than 10 cents for February basis, falling in tandem with Nymex futures, although not to the same extent.

The Nymex February gas futures contract plunged 29.2 cents between January 16 and Thursday, with part of the fall attributed to a smaller-than-expected draw from storage.

In the Midwest, Chicago Citygates February basis fell 6.2 cents between Friday and Thursday to reach plus 15.8 cents/MMBtu, and summer 2015 slipped 1.8 cents to minus 7.8 cents/MMBtu.

Points along the Northern Natural Gas Pipe Line posted similar declines for the week as demand in the region is projected by Genscape to peak at 13.17 Bc/f on January 28 before averaging around 13.18 Bcf/d during the first week of February.

In the Rockies, Northwest Pipeline-Wyoming pool February basis was down 6.4 cents to minus 18.9 cents/MMBtu, while the summer 2015 package was down 1.7 cents to minus 35.1 cents/MMBtu.

The weakness in the Rockies comes as production in the region has fully recovered from recent freeze-offs, coming in at just under 10.3 Bcf/d on Thursday, on par with December levels, Margolin said.

Healthy storage inventories in the region have also contributed to the price weakness.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |