Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

WPX Delaying NatGas Well Completions in Piceance

WPX Energy Inc., one of the largest natural gas producers in the Piceance Basin of Colorado, plans to delay completions on at least 20 drilled wells until “economics improve.”

The Tulsa-based operator revealed in a blog posting that it would halt the completions, noting more wells could be impacted “since we have rigs in the area that are working.” WPX operates more than 4,400 gas wells in the Piceance, including some of the biggest gushers to date in the Niobrara formation (see Shale Daily, Oct. 28, 2013; April 9, 2013).

The decline in commodity prices has been “great for consumers filling up a vehicle or paying a heating bill, but not for companies like WPX who produce energy and depend on prices to run our business,” the explorer noted. Lower commodity prices “are affecting what we can do…

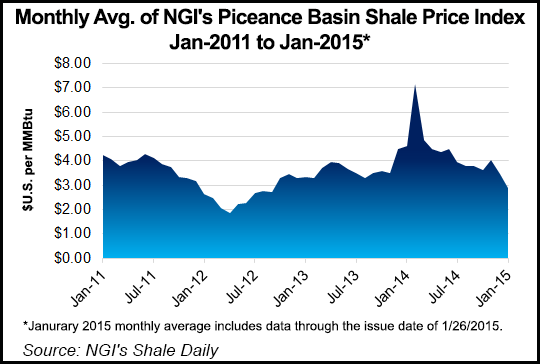

“Last year we saw natural gas prices over $4.00/Mcf. Now we’re seeing prices dip below $3.00. These prices directly impact profitability and revenue. This is an economic reality…Specifically, we’re going to wait to complete most of the wells we recently drilled rather than finishing them now. This means less work for contractors and service companies.”

WPX, created through a spinoff from Williams, is working with vendors and “asking for help on the cost side. Lower costs certainly can help jump start activity. Once the economics improve, we’ll start completing wells again. This is the obvious goal for everyone involved…In the meantime, we are looking for ways to save costs in all of our operations. It’s imperative in this environment. We’re evaluating everything. One thing that hasn’t changed, however, is our long-term commitment in the Piceance Basin.”

No layoffs were announced. WPX employs 380 people in Colorado through offices in Denver and Parachute.

Standard & Poor’s Ratings Services (S&P) credit analysts earlier this month downgraded WPX to “BB” from “BB+” to reflect their “estimate for increased leverage due to the reduction in our oil and natural gas price deck assumptions.” S&P, which set a “stable” outlook, now expects funds from operations (FFO)/debt to fall and remain below 45%, with debt/earnings to approach 2.5 times for the next few years (see Shale Daily, Jan. 22).

“The stable outlook reflects our expectation that WPX Energy will reduce 2015 capital spending relative to 2014 levels and maintain funds from operations to debt of about 30% over the next two years,” said S&P’s Carin Dehne-Kiley. “Our rating reflects our assessment of WPX’s business risk as ‘fair,’ its financial profile as ‘significant,’ and liquidity as ‘adequate,’ noting that at the end of 2013, proved reserves totaled 4.9 Tcfe, about 75% natural gas and 58% classified as developed.

“Production from continuing operations in the third quarter of 2014 averaged 1.1 Bcfe/d (72% natural gas). We expect production to decline slightly over the next two years as the company reduces capital spending.”

WPX is expected to devote most of its capital spending toward liquids-rich acreage in the Rockies — the San Juan and Piceance basins and the Bakken Shale — while divesting the rest of its Marcellus Shale acreage (see Shale Daily, Dec. 3, 2014). S&P expects WPX’s profitability should improve relative to peers over the next few years.

The company has hedged more than 70% of its projected 2015 gas output for at a weighted average price of about $4.00/MMBtu. It also has hedged more than half of its crude oil output at a West Texas Intermediate price of nearly $95.00/bbl. For 2016, more than 30% of gas volumes are hedged at an average price of $4.00/MMBtu.

“The stable outlook reflects our view that FFO/debt will remain above 30% over the next 12 months,” Dehne-Kiley wrote. “We could lower the rating if WPX’s FFO/debt fell below 20% for a sustained period, which would most likely occur if the company’s operating margins deteriorated below our current expectations, or if the company’s capital spending exceeded cash flows by more than we currently anticipate. We would consider an upgrade if the company improved its FFO/debt back above 45% for a sustained period. This would most likely occur if the company completed additional noncore asset sales and improved operating margins.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |