NGI Data | NGI All News Access

Weekly Natural Gas Cash, Futures Markets Drop; February Settles Sub-$3

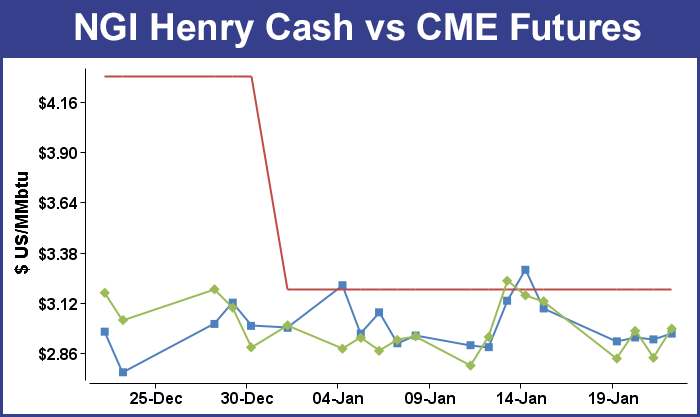

Moderate temperatures for much of the country, combined with ample natural gas supply teamed to push physical natural gas prices lower for the week ending Jan. 23, and natural gas futures jumped onboard as fresh storage data Thursday revealed a smaller withdrawal from inventory than the industry had been expecting.

Most cash points regionally for the week dropped between 15-20 cents, but a significant decline from the warmer-than-normal Northeast region skewed the country’s average even lower. NGI‘s National Spot Gas Average for the week came in at $2.96, down 36 cents from the previous week.

All regions tracked by NGI recorded declines between 13-18 cents, with the exceptions of the Midcontinent and the Northeast — two regions that received a significant reprieve from winter’s chill for the week. The Midcontinent dropped 21 cents to average $2.74, while the Northeast crashed 90 cents lower to $3.35.

Thursday morning’s natural gas storage report, which revealed that a whopping 216 Bcf was removed from underground inventories for the week ending Jan. 16, hit natural gas markets with a thud instead of a bang. That’s because while the withdrawal was significantly higher than any historical comparison, it fell short of industry expectations for the week.

The 10:30 a.m. EST report from the Energy Information Administration (EIA) revealed that despite the frigid cold that gripped large sections of the country last week, U.S. natural gas supply is currently strong enough to weather the storm. In the minutes leading up to the release, the February natural gas futures contract was trading around $2.900, about 7 cents below Wednesday’s regular session close, as traders adjusted their predictions of the report to a little less bearish. They apparently didn’t adjust enough. In the minutes that immediately followed the number’s release, the front-month contract dropped to $2.814. The $2.800 level is seen as a key support level, with some industry veterans even calling it a floor (see Daily GPI, Jan. 21).

Citi Futures Perspective analyst Tim Evans, who had been expecting a 230 Bcf withdrawal, deemed the report “bearish,” but he said the number could be viewed differently from another perspective. “The 216 Bcf net withdrawal for last week was below the consensus expectation, implying a weaker supply-demand balance than a week ago, with moderately bearish implications for the storage flows to follow,” he said. “While disappointing compared with expectations, the draw was still more than the 175 Bcf five-year average rate and so still modestly supportive on a seasonally adjusted basis. It’s just not as supportive as expected.”

Prior to the report, analysts at Tudor, Pickering, Holt & Co. said flow data is implying the week’s production is down nearly 2.5 Bcf/d from December’s peak, presumably on freeze-offs. The counterpoint is that the current 2015 strip is pricing in a greater than 3 Bcf/d oversupplied market. “The market is reasonably assuming freeze-offs are skewing the market to ‘balanced’.so it’ll be worth watching trajectory of supply return just in case freeze-offs are not the sole driver of production declines,” they said in a note early Thursday morning.

Heading into the EIA report, a Reuters survey of 24 industry veterans produced a 193-250 Bcf withdrawal range with an average expectation of a 227 Bcf pull. While falling below that estimate, the actual 216 Bcf withdrawal was well above both the date-adjusted 133 Bcf pull from the same week a year ago, as well as the week’s five-year average draw of 175 Bcf.

According to EIA data, 2,637 Bcf was in natural gas storage as of Jan. 16. Stocks are 199 Bcf higher than last year at this time and 153 Bcf below the five-year average of 2,790 Bcf. The frigid East region led the charge for the week with a 118 Bcf withdrawal, while the Producing Region removed 82 Bcf and the West Region shed 16 Bcf.

Teri Viswanath, BNP Paribas director of commodity strategy for natural gas, noted Thursday afternoon in a research note that natural gas futures opened Thursday’s trading session lower and “continued to plummet” as intra-day updates failed to discourage growing supply concerns.

“Despite the reappearance of below-normal temperatures in the Midwest and Northeast toward month end, traders appear unconvinced that destocking will accelerate next month,” she wrote. “The slightly lower-than-anticipated stock release coupled with a milder noon weather update simply heightened those concerns.”

Viswanath added that extreme variability in short-term weather forecasts has failed to inspire confidence that heating demand will sufficiently draw down inventories this winter. “With the trend in prices for 2015 largely determined by the mostly uncertain heating demand ahead, the market instead has focused on the mostly certain aspect of supply/demand balances, which is the incremental growth in domestic production. In our opinion, the 4.5 Bcf/d of incremental winter production suggests that a significant inventory surplus will build by end March.”

Staring down another winter storm in the East, natural gas prices — both physical and futures — ballooned on Friday as traders looked to cover whatever the weekend might bring. However, as January winds to a close, some market watchers can’t help but notice that the basis blowouts that plagued northeastern pricing points last winter are nowhere to be seen, with potential thanks going to the increase in liquefied natural gas (LNG) imports coming into the region.

Fresh off Thursday’s decline on bearish storage data, the February natural gas futures contract erased its loss in Friday trading by climbing 15.1 cents to close the day at $2.986.

After finishing the previous week firmly at $3.127, the February natural gas futures contract collapsed below the psychological $3 mark to attack more long-term support in the $2.800 level. However, with forecasts for coming cold, traders played it safe, pushing values higher on Friday to the $2.986 close, which still marked a 14.1-cent decline from the previous week’s finish.

“It’s the same old song in natural gas. Everyone is trading off of the weather forecasts, then making corrections or adjustments based on what materializes,” said Tom Saal, vice president at INTL FCStone in Miami. “The reason for the current low prices is because we haven’t seen any real weather recently. The cliche is winter is like the Super Bowl for the gas industry. If you get two exciting teams, i.e., stretches of extreme cold or temperature swings, then you’ll have a lot of interest. We just don’t have that right now.”

Saal told NGI he thought the market had turned the corner to the upside earlier this month, but Mother Nature didn’t comply. “I see us grinding lower unless we get a real long cold snap. We had that cold spell in November, and traders geared up, but it turned into a belly-flop.”

The big story on Friday was in the Northeast, where winter’s most recent chill prompted multiple-dollar gains at a number of daily physical price points, where constraint concerns were running high. Some of the largest gains were seen at Transco Zone 6-NY, which jumped $5.49 to $8.75, and Iroquois Zone 2, which increased by $4.45 to $7.98. Algonquin Citygate (AGT) picked up $2.96 to average $9.52 for weekend and Monday delivery.

While natural gas prices in the Northeast have jumped on threats of cold weather, so far, they have eluded the record spikes of last winter, thanks in part to increased LNG imports to the region, according to analysts at Genscape.

While demand for gas is forecast to rise in the coming week due to chillier temperatures, Genscape believes the scheduled arrival of GDF Suez Neptune in Boston on Sunday, Jan. 25 will likely keep AGT basis prices in check, as has been the case during other peak demand periods this winter.

Data from Genscape unit Vessel Tracker indicates the ship left Trinidad and Tobago on Jan. 20 and was last seen Friday just south of Bermuda. This will be the second GDF Suez Neptune LNG cargo to New England this month.

“LNG deliveries into New England this winter are at their highest rates in three winters,” according to Genscape Senior Natural Gas Analyst Rick Margolin. “Sendout from Everett this winter-to-date has totaled 4.48 Bcf, its highest rate since Winter 11-12. Everett sent out 0.26 Bcf/d on gas day Jan.7, a single-day record for that terminal. Prior to gas day Jan.22, month-to-date sendout from Everett had been averaging 0.18 Bcf/d. In the past two-days, however, volumes have fallen to just 0.06 Bcf/d.”

In addition to sendout from Everett, Genscape noted that this winter saw the Excelerate offshore system put LNG volumes into the New England market for the first time since March 2010. Beginning Jan. 6, Excelerate has delivered a total of 0.99 Bcf to Algonquin Gas, Margolin found. Volumes peaked at 0.2 Bcf/d on gas day Jan.7 and have since fallen to just 5 MMcf/d.

“LNG may be arriving because U.S. markets offered the best forward prices during last summer’s trading of the winter strip,” Margolin said. “During the summer, the Japanese-Korea market (JKM) prompt month price traded between $11-14/MMBtu. At the same time, the Algonquin winter strip averaged $14 and reached a high of $16.30. At one point, the January 2015 contract was trading for as much as $22.12, suggesting that — during last summer — New England offered the best spreads to global LNG suppliers.”

Thanks to back-to-back-to-back polar vortices last winter, which brought frigid temperatures to much of the country and especially the Northeast, AGT daily prices averaged an all-time high of $78.30 for gas delivery Jan. 23, 2014, according to NGI‘s Daily Gas Price Index data. This winter to date, the highest daily average for AGT was $13.60 for gas delivered Jan. 16, 2015.

Genscape believes the restoration and timing of LNG sendout has had a moderating effect on New England gas prices this winter, and as a result, the AGT basis price has not blownout nor has it deviated as much from normal winter basis prices as in previous winters. Last winter, New England demand established a single-day record high on gas day Jan. 3, 2014, Genscape said. That event sent Algonquin basis to $29.64. A few weeks later, on Jan. 22, AGT basis reached a single-day record high of $73.39 when New England demand was just above 3.52 Bcf/d.

“This winter, however, the highest AGT basis has reached has been $10.31 for gas day Jan.16, when New England demand was 3.86 Bcf/d,” Margolin said. “On gas day Jan. 7, 2015, New England demand set a new record high of 4.03 Bcf/d, but AGT basis reached just $9.91. This winter, when New England demand has exceeded 3.5 Bcf/d (the point at which upstream pipeline constraints are typically triggered, causing AGT prices to spike), the AGT basis price has averaged just $6.87. This represents a departure from the winter-to-date average basis price of just $3.52. Last winter, when demand exceeded 3.5 Bcf/d basis prices averaged $21.54, nearly $10.33 greater than the basis average for the winter.”

This delicate balance will likely be tested next week. While there is some disagreement between weather models, most are indicating below-normal temperatures will be present in New England through the end of the January. Genscape’s New England demand forecast shows demand increasing daily the last week of January, rising to a peak of 3.82 Bcf/d by Tuesday, remaining above 3.8 Bcf/d on Wednesday, then receding until Feb. 2.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |