Markets | NGI All News Access | NGI Data

Cash, Futures Slump on Milder Temps, 216 Bcf Natural Gas Storage Draw

Aided by a smaller than expected inventory withdrawal report and moderating temperatures in much of the East, natural gas prices — both physical and futures — dropped significantly on Thursday.

NGI‘s National Spot Gas Average for gas delivery Friday spiraled 10 cents lower to $2.84, while the February natural gas futures contract did battle with long-term support around the $2.800 price level before closing out Thursday’s regular session at $2.835, down 13.9 cents from Wednesday’s finish.

Thursday morning’s natural gas storage report, which revealed that a whopping 216 Bcf was removed from underground inventories for the week ending Jan. 16, hit natural gas markets with a thud instead of a bang. That’s because while the withdrawal was significantly higher than any historical comparison, it fell short of industry expectations for the week.

The 10:30 a.m. EST report from the Energy Information Administration (EIA) revealed that despite the frigid cold that gripped large sections of the country last week, U.S. natural gas supply is currently strong enough to weather the storm. In the minutes leading up to the release, the February natural gas futures contract was trading around $2.900, about 7 cents below Wednesday’s regular session close, as traders adjusted their predictions of the report to a little less bearish. They apparently didn’t adjust enough. In the minutes that immediately followed the number’s release, the front-month contract dropped to $2.814. The $2.800 level is seen as a key support level, with some industry veterans even calling it a floor (see Daily GPI, Jan. 21).

Citi Futures Perspective analyst Tim Evans, who had been expecting a 230 Bcf withdrawal, deemed the report “bearish,” but he said the number could be viewed differently from another perspective. “The 216 Bcf net withdrawal for last week was below the consensus expectation, implying a weaker supply-demand balance than a week ago, with moderately bearish implications for the storage flows to follow,” he said. “While disappointing compared with expectations, the draw was still more than the 175 Bcf five-year average rate and so still modestly supportive on a seasonally adjusted basis. It’s just not as supportive as expected.”

Prior to the report, analysts at Tudor, Pickering, Holt & Co. said flow data is implying the week’s production is down nearly 2.5 Bcf/d from December’s peak, presumably on freeze-offs. The counterpoint is that the current 2015 strip is pricing in a greater than 3 Bcf/d oversupplied market. “The market is reasonably assuming freeze-offs are skewing the market to ‘balanced’…so it’ll be worth watching trajectory of supply return just in case freeze-offs are not the sole driver of production declines,” they said in a note early Thursday morning.

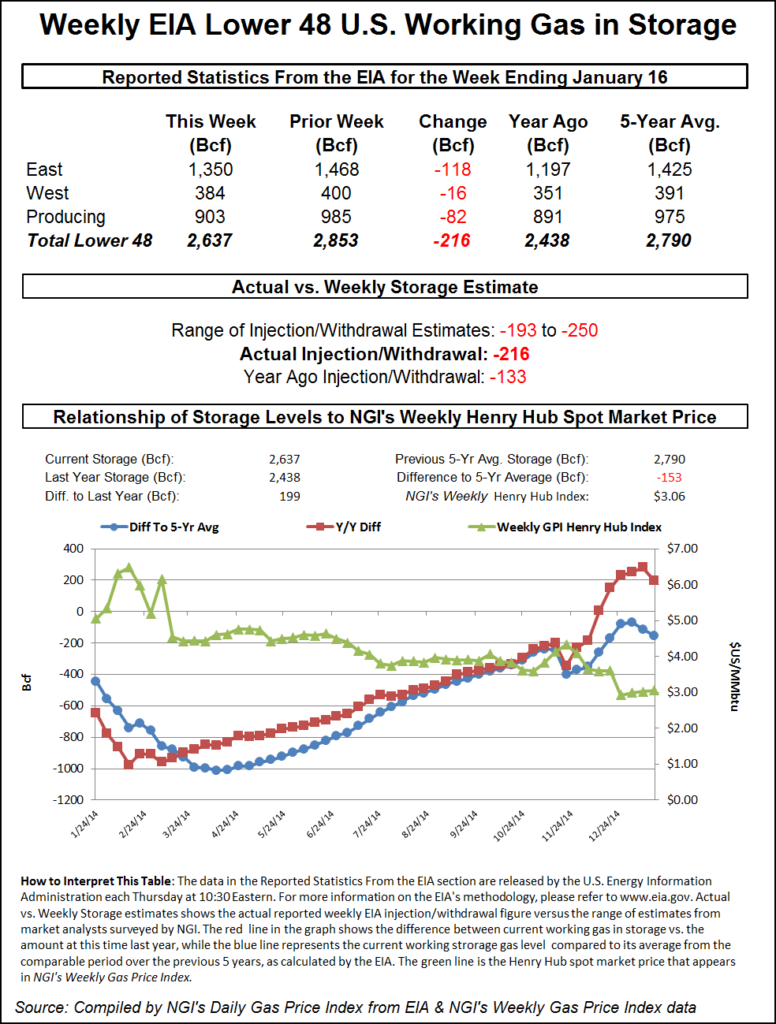

Heading into the EIA report, a Reuters survey of 24 industry veterans produced a 193-250 Bcf withdrawal range with an average expectation of a 227 Bcf pull. While falling below that estimate, the actual 216 Bcf withdrawal was well above both the date-adjusted 133 Bcf pull from the same week a year ago, as well as the week’s five-year average draw of 175 Bcf.

According to EIA data, 2,637 Bcf was in natural gas storage as of Jan. 16. Stocks are 199 Bcf higher than last year at this time and 153 Bcf below the five-year average of 2,790 Bcf. The frigid East region led the charge for the week with a 118 Bcf withdrawal, while the Producing Region removed 82 Bcf and the West Region shed 16 Bcf.

Teri Viswanath, BNP Paribas director of commodity strategy for natural gas, noted Thursday afternoon in a research note that natural gas futures opened Thursday’s trading session lower and “continued to plummet” as intra-day updates failed to discourage growing supply concerns.

“Despite the reappearance of below-normal temperatures in the Midwest and Northeast toward month end, traders appear unconvinced that destocking will accelerate next month,” she wrote. “The slightly lower-than-anticipated stock release coupled with a milder noon weather update simply heightened those concerns.”

Viswanath added that extreme variability in short-term weather forecasts has failed to inspire confidence that heating demand will sufficiently draw down inventories this winter. “With the trend in prices for 2015 largely determined by the mostly uncertain heating demand ahead, the market instead has focused on the mostly certain aspect of supply/demand balances, which is the incremental growth in domestic production. In our opinion, the 4.5 Bcf/d of incremental winter production suggests that a significant inventory surplus will build by end March.”

The bearish commotion in storage was hard to ignore for cash traders, who also were forced to digest downright balmy northeastern temperatures on Thursday that reached north of 50 degrees. Nearly all points across the country were in the red for Friday delivery, with the exception of locations that serve much of the Marcellus Shale region. Transco-Leidy Line, Tennessee Zone 4 Marcellus and Dominion-South all were in the black rising by 2, 5 and 12 cents respectively, to average $1.17, $1.20 and $1.69.

The rest of the country eased lower as milder temperatures settled in, with most points shedding anywhere from a penny to a nickel. In the midwest, Chicago Citygate declined 3 cents to average $2.87, while Michigan Consolidated came off 2 cents to $2.93 and Consumers lightened by 3 cents to $2.92.

Those interested in higher prices might be waiting a bit as temperatures are expected to return to their winter chill soon. Commenting on the bearish storage report, NatgasWeather.com warned that there could be more to come. “Temperatures this week have been much above normal, especially regarding morning lows, which will lead to a much lighter than normal draw for next week, essentially erasing any damage done to supplies from today’s report,” the company said in an afternoon report. “The latest weather data continues to stream in, and just as we have been expecting, it shows seasonal cold blasts to impact the U.S. through around Jan. 30 before a more intimidating one impacts the Midwest and Northeast through the first couple days of February. The core of the coldest temperatures around Feb. 1 are still expected to remain over southern Canada, but there’s still likely to be a strong increase in heating demand for these higher natural gas use regions. However, we still expect the frigid air to struggle pushing southward, keeping the rest of the U.S. in a more tolerable temperature environment for mid-winter.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |