E&P | Infrastructure | NGI All News Access

2014 Natural Gas Imports From Canada Lowest in 20 Years, NEB Says

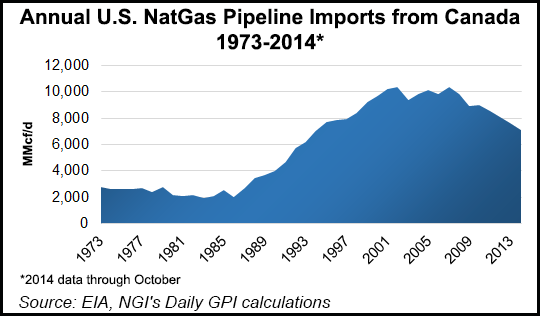

Canadian natural gas exports to the United States likely shrank last year to the lowest volume since 1994, according to the National Energy Board (NEB).

Traffic counts compiled to date by the NEB, covering the first 10 months of 2014, foreshadow a full-year score for southbound pipeline deliveries across the border of 7.3 Bcf/d.

Barring a surprise surge in the still incomplete data for November and December, 2014 Canadian gas export performance is down by 5% from 7.7 Bcf/d in 2013 — and shriveled by 27% from 10 Bcf/d at the 2008 peak of the trade.

Canadian pipeline deliveries into the United States have not been so low since 20 years ago, when gas exports averaged 6.9 Bcf/d in the stages of a long climb on an expanding pipeline network toward the 2008 peak.

Industry and financial analysts often emphasize the roles of depletion of aging gas wells and rising industrial consumption by thermal oil sands plants in the nation’s chief producing jurisdiction, Alberta.

But the NEB adds that the growing competitive force of U.S. shale production must be acknowledged in explanations for the deterioration of exports that were formerly a mainstay of Canada’s entire petroleum industry.

The agency said, “Exports have declined steadily since 2008. A combination of factors contributed to this, the largest being the emergence of highly productive shale gas plays in the U.S. located close to markets traditionally served in part by Canadian exports.” The NEB identifies the competition as “in particular, the Marcellus shale” — and especially from prolific zones of the giant U.S. deposit in Pennsylvania.

The board said, “On a regional basis, exports to the U.S. Northeast market have decreased dramatically, from 2.7 Bcf/d in 2008 to 0.9 Bcf/d in the first 10 months of 2014. Exports to the U.S. West and Midwest markets have been comparatively stable over that period.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |