Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

North America NGV Market to See ‘Substantial Growth’ Over Next Decade

The market for natural gas vehicles (NGV) will continue to grow steadily around the globe, increasing from about 2.5 million vehicles annually last year to about 4.3 million in 2024, according to a report released Tuesday by Boulder, CO-based Navigant Research. In the near-term, lower oil prices will have an impact as gasoline and diesel prices drop at the pump.

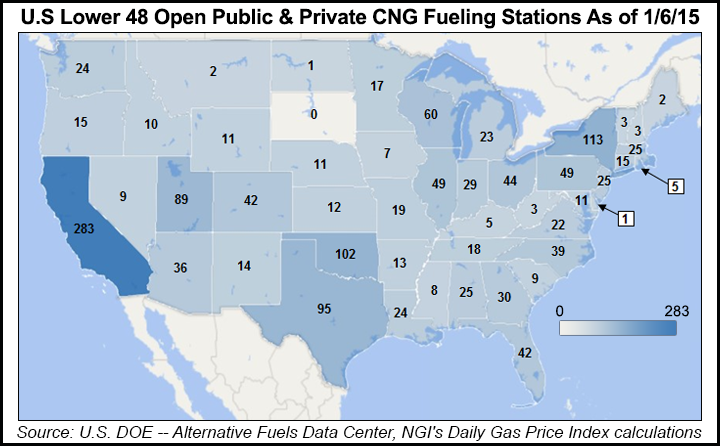

However, the market still is expected to remain a small niche of North America’s total vehicular market, with most of the NGV growth among fleet and commercial operators, many of which would still rely on private fueling stations, senior research analyst Sam Abuelsamid said.

The report addresses a number of key questions about NGVs on a segment-by-segment basis and outlines pros and cons. North America’s NGVs market “is anticipated to exhibit only modest growth in NGV sales over the next decade, particularly in the United States as world oil prices have dropped below $60/bbl,” Abuelsamid said.

The annual volume of light-duty NGVs in North America is expected to reach 56,000 vehicles in 2024. Total NGV sales by then should hit 80,000, only about 9% of that number being passenger cars, according to the report. More than half (49,000 vehicles) of the 2024 North American total would be light-duty trucks.

“Major oil- and gas-producing countries have indicated that they will not do anything in the near to mid-term to prop up oil prices,” the report noted. “Higher fuel taxes in Canada will make natural gas as a transportation fuel more attractive.” This is underscored by estimates that overall North American NGV growth would be 6.1% over the next 10 years, including a 23.9% growth in Canada and a cumulative 2.3% U.S. growth.

“NGV markets in a number of regions are expected to grow significantly over the next decade, particularly China, which is grappling with serious air pollution issues that are affecting quality of life in major urban areas,” Abuelsamid said.

Even with increased demand for natural gas, prices have stayed relatively low with increased production in North America and other regions, along with additional distribution pipelines in Asia-Pacific and Europe, Abuelsamid said.

The report includes market forecasts through 2024 for various product segments, such as NGVs, fueling stations, natural gas consumption, and compressed natural gas (CNG) fuel cylinders.

“Increasingly, stringent fuel economy and tailpipe emissions standards in every major market around the world provide an impetus to vehicle manufacturers to provide alternatives to traditional gasoline- and diesel-fueled internal combustion engines,” the report noted.

The report also noted that its bullish scenarios for NGVs could be sidetracked in the near term in several regions, such as in Eastern Europe, where the supply and price of gas exports from Russia to Western Europe could prove problematic. The report also did not factor in recent global oil price declines.

On the plus side, researchers said natural gas extraction is now at record levels, and production from nontraditional sources, including shale gas, is expected to continue to increase through the remainder of this decade.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |