E&P | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton, Baker Hughes Hesitant to Set Bottom on North American Activity

Halliburton Co. and Baker Hughes Inc. both beat market expectations in the final three months of 2014, but a sharp turnaround in North American business activity has clouded expectations for 2015, company CEOs said Tuesday.

The Houston-based oilfield services (OFS) giants announced a $34.6 billion merger in November, which would combine the No. 2 (Halliburton) and No. 3 operators (see Shale Daily, Nov. 17, 2014). The combination was expected to lead to workforce reductions, but the oil market downturn is pressuring Baker, which plans to lay off 7,000 before the end of March. Halliburton also is laying off employees, but it did not detail any numbers. Those layoffs follow No. 1 OFS operator Schlumberger Ltd.’s announcement last week that it would fire 9,000 people worldwide (see Shale Daily, Jan. 16).

Push has come to shove, Halliburton CEO Dave Lesar told analysts during a conference call.

“We delivered an excellent 2014, but it is clear that 2015 will be a challenging year for the industry,” Lesar said. “As a result of the weakening outlook, during the fourth quarter of 2014 we took a $129 million restructuring charge to temper the impact of anticipated activity declines. Halliburton has successfully weathered multiple industry cycles. We are confident that we have the right people, technology and strategies in place to outperform throughout this cycle too, and emerge as a stronger company.”

Halliburton has been through similar downturns before, and the downturn this time is no different, Lesar said.

“I’ve heard the word ‘distraction,’ and I’ve heard other comments about what’s going to happen. You’ve got to remember, we’ve been through asbestos. We’ve been through Macondo. We’ve been through the Iraq war. And none of those distracted us from making sure our business franchise remained strong…My view is, you know us, we’re the execution company. We’re not going to get distracted through this.

“This is a tough market, but we’ve been through these kinds of things before…Clearly, we’re not going to get distracted…I’m not going to permit it to happen.”

Asked about the specific impact on North American operations, COO Jeff Miller said the company was working with vendors to reduce supply costs. Like Schlumberger, Halliburton and Baker separately have been negotiating with their customers.

Halliburton took steps early in the fourth quarter on headcount and “reacted quickly to what we could see there,” Miller said. “The timing around getting supplier cost reductions in place don’t sync up perfectly. But for the visibility that we have, we are taking actions to address that.”

The decline in North American activity is happening faster than anywhere else in the world. However, Halliburton is not seeing a growing inventory of uncompleted wells.

“Put yourself in the operator’s mind, especially one who is concerned about cash flow,” Lesar said. “It would be crazy to drill a well and then put it in inventory because you’ve got cash flow out but no cash flow coming in. I think the decision is very quickly going to, do you drill a well?

“If you drill a well, you’re going to complete it. If you’re not going to complete it, there’s no sense in drilling it. That’s the dialogue that’s going on now.”

While headcount drops and spending is cut back, the last thing to be overhauled is research and development. Once the market strengthens, the best technology still wins, Lesar said.

“The reality is, a customer may…say, ‘we want to cut our costs by 15%.’ But…differentiated technologies still make a difference. Having that technology, having the efficiency, having the people on the ground ends up being what you sell to that customer. Customers also know…who they want to use for particular products and services in various parts of the world. In general, they move to make sure that when they go through a cost reduction effort like this, that they keep the strong players strong.”

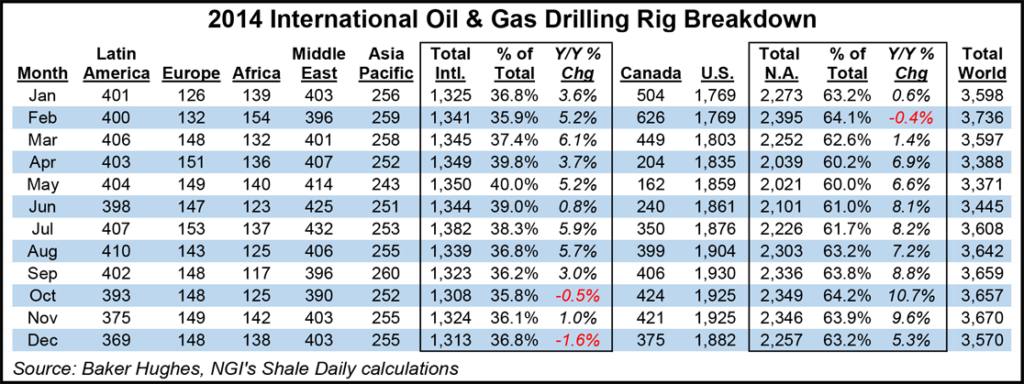

Baker CEO Martin Craighead said it was difficult to “look beyond the first quarter” for clarity on the market. “We are approaching it one quarter at a time,” he told analysts. The average U.S. rig count now is 15% lower than the 4Q2014 average.

Unlike Halliburton, Baker is seeing a growing inventory of wells drilled but not completed — wells that customers are electing to delay. As a result of the reduction in activity, there’s been a decreased demand for well construction product lines. In general, artificial lift and chemicals are “more insulated,” Baker CFO Kimberly Ross said.

In addition to reducing its workforce, Baker is “reviewing operations for asset impairments for facility closures,” she said. “At the same time, we are increasing our rigor around capital deployment.” Baker has reduced its capital expenditure plans by 20% from 2014 and plans to “remain focused on returns.”

The industry is “clearly in the early stages of a down cycle that happens once or twice a decade,” Craighead said. “Which customers have cut spending and by how much, and where and when we reach the bottom…We don’t have predictable answers. But we’ve been through this before. We’ve learned in the past, that when the market turns down, it turns swiftly…We see no reason to believe this cycle is any different…But the coming months will be challenging.”

The “bearish sentiment that has pervaded our industry is understandable, considering the steep drop in commodity prices in recent months,” he said. “While market demand ended up being more resilient in the fourth quarter than many had predicted, the recent declines seen in rig counts will clearly affect results in 2015.

“We are taking proactive steps to manage the business through these challenges, and we are well positioned financially for the months ahead. Our strategy remains unchanged as we continue to focus on execution and delivering new technologies that lower the cost of well construction, optimize well production and increase ultimate recoveries.”

Halliburton reported a profit of $901 million ($1.06/share) in 4Q2014, versus year-ago profits of $793 million (93 cents). The company took a $129 million restructuring charge in the latest quarter on layoffs and costs related to the merger. Excluding charges, earnings were $1.19/share, about 9 cents ahead of Wall Street forecasts. Revenue jumped almost 15% to $8.77 billion.

Baker earned net income of $663 million ($1.52/share) in 4Q2014, up from $248 million (56 cents) a year ago. Revenue rose 13% to $6.64 billion, ahead of analyst estimates of $6.41 billion. The North American segment, the company’s largest, reported a 20.4% increase to $3.3 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |