Markets | NGI All News Access | NGI Data

Futures, Cash Part Ways as Physical Prices Stage Broad Advance; Futures Drop 8 Cents

Next-day gas posted solid gains in Thursday for Friday trading as weather systems proved supportive and the screen continued to make new highs.

New England locations proved to be the day’s greatest gainers as pipeline restrictions were in play and a cold front Friday was expected to drop temperatures deep into single digits and keep overall readings well below normal. Only one market point failed to make a gain. The overall market rose 36 cents.

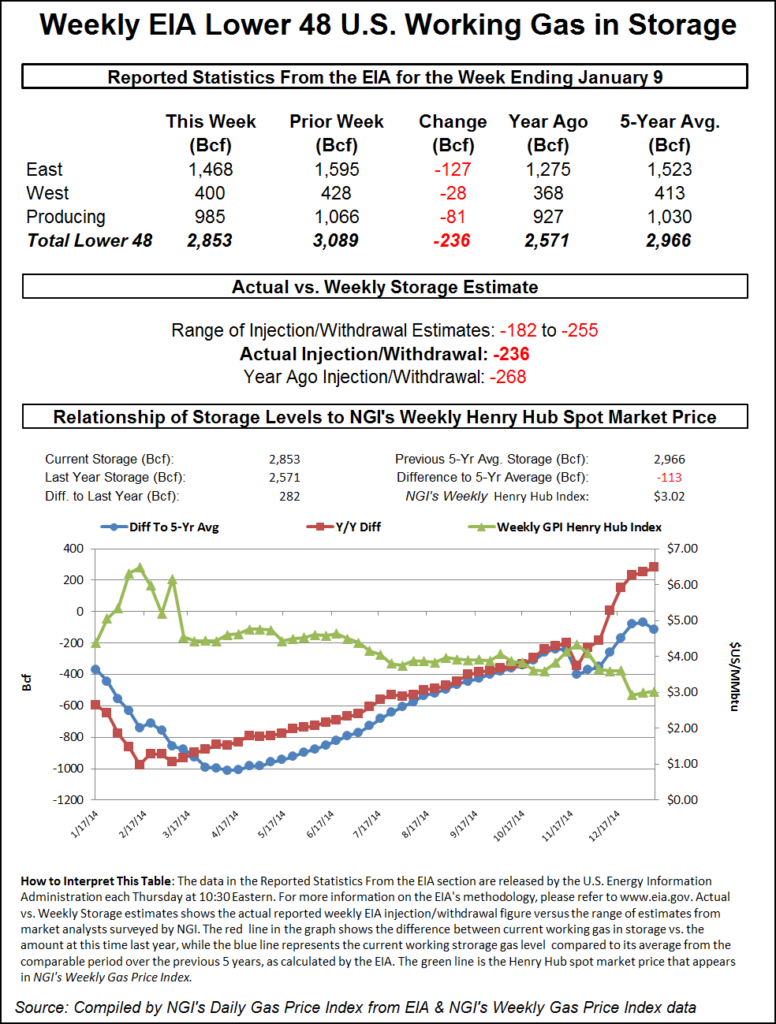

The Energy Information Administration (EIA) reported a withdrawal from storage of 236 Bcf, about 15 Bcf more than expectations, and futures surged to a new high before eventually settling lower on the day. At the close, February had shed 7.5 cents to $3.158 but not before reaching $3.352, nearly a dime higher than Wednesday’s exuberant high. March dropped 8.7 cents to $3.121. February crude oil skidded $2.23 to $46.25/bbl.

Friday deliveries into New England made multi-dollar gains as next-day peak power rose and forecasters called for brutal cold Friday evening. Forecaster Wunderground.com reported that Boston’s Thursday high of 28 degrees would rise to 34 Friday but lows of just 8 were expected during the evening. Saturday’s high was expected to reach 20, 15 degrees below normal. Hartford, CT, was predicted to see its Thursday high of 29 reach 34 Friday, but overnight lows were seen down to 3. Saturday’s high in Hartford was anticipated to reach only 24, 10 degrees below normal.

Gas at the Algonquin Citygates rose $2.80 to $13.60, and deliveries to Iroquois Waddington gained 78 cents to $6.91. Gas on Tennessee Zone 6 200 L gained a robust $3.43 to $13.40.

In the Mid-Atlantic, gas headed to New York City on Transco Zone 6 gained $1.93 to $6.60, and deliveries to Tetco M-3 added $1.23 to $5.20.

Marcellus prices were firm as well. Friday deliveries on Millennium gained 8 cents to $1.32, and gas on Transco Leidy rose 22 cents to $1.23. Gas on Tennessee Zone 4 Marcellus was seen 16 cents higher at $1.31, and packages on Dominion South changed hands 40 cents higher at $2.04.

The National Weather Service in southeast Massachusetts said a low-pressure system would hit eastern Massachusetts with “some light snow and freezing drizzle. This will move off to the east [Friday] during the day. An Arctic front sweeps across the region during the afternoon followed by frigid temperatures Friday night into Saturday morning. A deep and strong area of low pressure then tracks over the area Sunday into Monday.”

IntercontinentalExchange reported stronger peak and off-peak power Friday for the region. On-peak power at the ISO New England’s Massachusetts Hub rose $20.69 to $107.57/MWh and off-peak deliveries gained $10.28 to $85.00/MWh.

Pipelines into the area initiated some healthy restrictions for Friday flow. Algonquin Gas Transmission (AGT) said it had restricted nominations at several points; 92% of secondary out of path nominations that exceed entitlements sourced from points west of its Stony Point Compressor Station (Stony Point) for delivery to points east of Stony Point were restricted. No increases in nominations sourced from points west of Stony Point for delivery to points east of Stony Point, except for Primary Firm No-Notice nominations, would be accepted.

AGT also said it “has scheduled and sealed nominations sourced from points west of its Southeast Compressor Station (Southeast) for delivery to points east of Southeast. No increases in nominations sourced from points west of Southeast for delivery to points east of Southeast, except for Primary Firm No-Notice nominations, would be accepted.

Further restrictions included “approximately 97% secondary out of path nominations that exceed entitlement sourced from points west of its Cromwell Compressor Station for delivery to points east of Cromwell. No increases in nominations sourced from points west of Cromwell for delivery to points east of Cromwell, except for Primary Firm No-Notice nominations, would be accepted,” the company said.

Midwest market points were up over a dime. Deliveries on Alliance gained 11 cents to $3.29, but gas at the ANR Joliet Hub was quoted at $3.29, up 12 cents. Gas at the Chicago Citygates rose 16 cents to $3.31, and deliveries to Demarcation came in 10 cents higher at $3.19.

Producing regions were also solidly in the black. Gas at the Cheyenne Hub changed hands 14 cents higher at $3.07, and deliveries on CIG Mainline added 11 cents to $3.03. At Opal gas was seen at $3.08, up 13 cents and packages on Northwest Pipeline WY rose 11 cents to $3.01.

Natural gas bulls thought they might be in for another shot of redemption following Wednesday’s oil market-driven 29-cent surge when the EIA released storage figures at 10:30 a.m. EST. It reported a decrease of 236 Bcf , about 15 Bcf more than estimates. February rose to a high of $3.352 after the number was released and by 10:45 EST February was trading at $3.280, up 4.7 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease of about 220 Bcf. IAF Advisors analysts calculated a 231 Bcf decline, but a Reuters survey of 24 industry observers revealed an average 224 Bcf. Bentek Energy’s flow model predicted a 218 Bcf withdrawal. The EIA inventory data did give traders and analysts a chance to hone their estimates of final season-ending inventories and determine how much gas will be in place when an estimated 5 Bcf/d of additional production has to be stored during the injection season.

“We had heard a number of about 224 Bcf to 225 Bcf, so it was more bullish than expected, but everyone expected a bullish number. The range on the estimates was pretty big,” said a New York floor trader.

Tim Evans of Citi Futures Perspective saw the figure as “[underscoring] that it really was cold last week, but the 236 Bcf net withdrawal was more than the market was anticipating and well above the 191 Bcf five-year average. With similar weather in the current period, we can anticipate another substantial withdrawal in next week’s report.”

Inventories now stand at 2,853 Bcf and are 282 Bcf greater than last year and 113 Bcf below the five-year average. In the East Region 127 Bcf was withdrawn and the West Region saw inventories fall 28 Bcf. Stocks in the Producing Region declined by 81 Bcf.

Forecasters are calling for a concerted cold pattern to develop in about a week. Commodity Weather Group in its Thursday morning outlook said, “A renewed cold regime continues to push forward on the forecasts, although there are some model disagreements on the evolution in the six-10 day period. The typically more skillful European ensemble is most aggressive on these trends vs. the American and Canadian versions with a stronger Midcontinent cold outbreak as early as days nine-10 now.

“We edged that part of the period colder this morning, but not as aggressively as the European ensemble yet. It shows a powerful ridge spike up the West Coast to displace the cold air fairly quickly into the U.S. The European ensemble model is also the coldest 11-15 day option — even colder than the newly upgraded GFS [Global Forecast System] model — with much below from the interior Northwest to the interior Northeast. For this period, we did go in this stronger direction as all models tend to agree on a powerful cold upper-level pattern with Alaska to Arctic ridging and a big cold trough over the Central to Eastern U.S.,” said Matt Rogers, president of the firm.

Prior to the open Tom Saal, vice president at INTL FC Stone in Miami, called the market’s move Wednesday “impressive” in spite of massive selling (14,126 February contracts) in the last two minutes of the close. “Historically, 200% weekly range extension is usually a max target within the same week. However, [it] does not preclude higher prices next week. There are plenty of higher-priced value areas to be tested,” he said in a Thursday morning note to clients.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |