Markets | NGI All News Access | NGI Data

Futures Scoot Higher on Hefty Storage Pull

Natural gas futures surged but then backed off following the release of government storage figures showing a higher withdrawal than traders had anticipated.

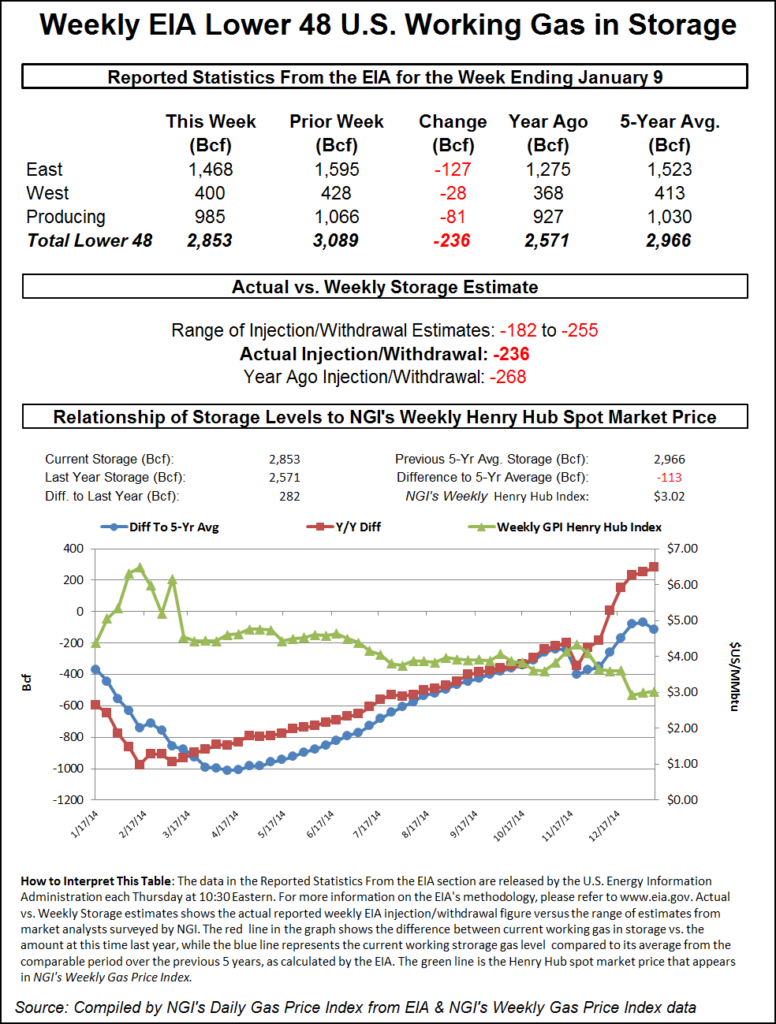

For the week ended Jan. 9 the Energy Information Administration (EIA) reported a decrease of 236 Bcf in its 10:30 a.m. EST release, about 15 Bcf more than estimates. February rose to a high of $3.352 after the number was released, and by 10:45 a.m. February was trading at $3.280, up 4.7 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease of about 220 Bcf. IAF Advisors analysts calculated a 231 Bcf decline, but a Reuters survey of 24 industry observers revealed an average 224 Bcf. Bentek Energy’s flow model predicted a 218 Bcf withdrawal.

“We had heard a number of about 224 Bcf to 225 Bcf, so it was more bullish than expected, but everyone expected a bullish number. The range on the estimates was pretty big,” said a New York floor trader.

Tim Evans of Citi Futures Perspective saw the figure as “[underscoring] that it really was cold last week, but the 236 Bcf net withdrawal was more than the market was anticipating and well above the 191 Bcf five-year average. With similar weather in the current period, we can anticipate another substantial withdrawal in next week’s report.”

Inventories now stand at 2,853 Bcf and are 282 Bcf greater than last year and 113 Bcf below the five-year average. In the East Region 127 Bcf was withdrawn, and the West Region saw inventories fall 28 Bcf. Stocks in the Producing Region declined by 81 Bcf.

The Producing region salt cavern storage figure fell by 33 Bcf from the previous week to 291 Bcf, while the non-salt cavern figure dropped 48 Bcf to 694 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |