Marcellus | E&P | NGI All News Access

EIA Sees Henry Hub Prices Staying Sub-$4/MMBtu Into Late 2016

A glut of natural gas isn’t likely to go away anytime soon, leading the U.S. Energy Information Administration (EIA) to cut its Henry Hub spot price forecast for the winter to $3.52/MMBtu and for 2015 to $3.44/MMBtu, according to the agency’s most recent Short-Term Energy Outlook (STEO).

That’s down considerably from the previous STEO, in which EIA estimated Henry Hub spot prices would average $3.98/MMBtu this winter and $3.83/MMBtu in 2015 (see Shale Daily, Dec. 9, 2014). Higher natural gas production this winter, combined with lower-than-expected space heating demand, will squash spot prices compared to last winter ($4.51/MMBtu) and 2014 ($4.39 MMBtu), EIA said. The agency expects the Henry Hub natural gas spot price to average $3.86/MMBtu in 2016.

The Henry Hub spot price averaged $3.48/MMBtu in December, a decline of 64 cents from November. The agency projects Henry Hub prices to remain under $4.00/MMBtu until the fourth quarter of 2016

Gas futures prices for April 2015 delivery (for the five-day period ending Jan. 8) averaged $2.88/MMBtu. Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for April 2015 contracts at $1.90/MMBtu and $4.36/MMBtu, respectively. At this time last year, the natural gas futures contract for April 2014 averaged $4.19/MMBtu and the corresponding lower and upper limits of the 95% confidence interval were $3.21/MMBtu and $5.46/MMBtu, EIA said.

“Natural gas futures prices have fallen more than $1/MMBtu since mid-November, and on December 31, the February 2015 futures contract settled at $2.89/MMBtu, the lowest settlement price for a front-month contract since September 2012,” EIA said. “Prices have rebounded somewhat since, but they remain at relatively low levels, reflecting abundant supplies.”

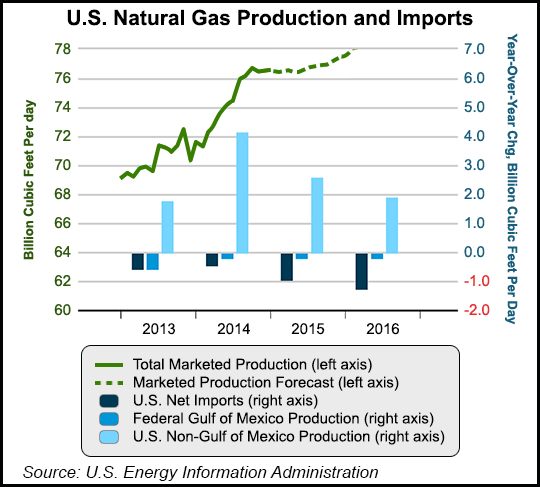

EIA said it still expects natural gas marketed production to grow through 2016, with continued strong increases in the Lower 48 states offsetting declines in the Gulf of Mexico, despite decreasing prices for gas. Dry natural gas production was 4.6 Bcf/d greater in October 2014 than in October 2013, according to EIA.

“Although natural gas prices have declined, and this month’s STEO lowers the Henry Hub spot price forecast, EIA expects that increases in drilling efficiency and growth in oil production (although at a slower rate) will continue to support growing natural gas production in the coming years,” EIA said. “Additionally, with most growth coming from the Marcellus Shale, a backlog of drilled but uncompleted wells will continue to support production growth as new pipeline infrastructure comes online in the Northeast.”

Growing domestic production is expected to continue to put downward pressure on natural gas imports from Canada and spur exports to Mexico. Exports to Mexico, particularly from the Eagle Ford Shale in South Texas, are expected to increase because of growing demand from Mexico’s electric power sector and flat Mexican production.

EIA expects total natural gas consumption to average 73.8 Bcf/d in 2015, up slightly from an estimated 73.6 Bcf/d in 2014, and increase again to 74.8 Bcf/d in 2016. Growth is expected to be largely driven by the industrial and electric power sectors, while residential and commercial consumption is projected to decline in 2015, then remain flat in 2016. Natural gas consumption in the power sector is expected to average 23.0 Bcf/d this year, a 3.2% increase compared with 2014, and it is expected to grow to 23.4 Bcf/d in 2016. Industrial sector consumption is projected to increase by 4.5% and 2.1% in 2015 and 2016, respectively, as new industrial projects come online, particularly in the fertilizer and chemicals sectors.

Natural gas working inventories totaled 3,089 Bcf as of Jan. 2, which is 250 Bcf greater than at the same time in 2014 and 67 Bcf lower than the previous five-year (2010-2014) average. “Natural gas inventories at the end of the winter heating season in late March should be about 9 Bcf above the five-year average, much higher than the same time last year when inventories were approaching 1 Tcf below normal,” said EIA Administrator Adam Sieminski.

Liquefied natural gas (LNG) imports have fallen over the past five years because higher prices in Europe and Asia are more attractive to LNG exporters than the relatively low prices in the United States, EIA said. The agency projects that gross LNG exports will average 0.8 Bcf/d in 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |