Bakken Shale | E&P | Eagle Ford Shale | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

Big Seven Plays’ Gas, Oil Output Still Surging, EIA Says

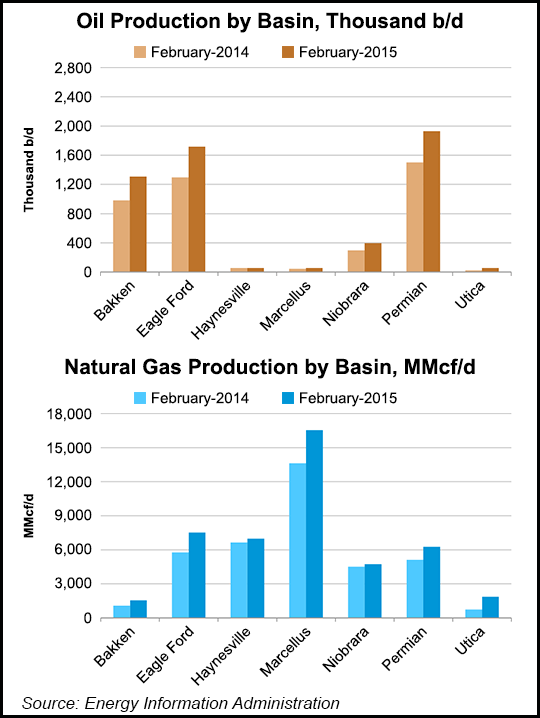

Production from the nation’s seven most prolific shale and tight oil regions continues to surge ever higher and is expected to reach 45.44 Bcf/d of natural gas and 5.52 b/d of oil next month, according to the Energy Information Administration (EIA).

The Marcellus Shale will produce 16.32 Bcf/d of natural gas this month and 16.55 Bcf/d in February, a 1.4% increase month to month, according to EIA’s latest Drilling Productivity Report (DPR). The other major northeast shale play, the Utica, will see natural gas production jump to 1.86 Bcf/d, a 4.2% increase from 1.78 Bcf/d this month, EIA said.

Natural gas production increases compared to the previous month are once again (see Shale Daily, Nov. 11, 2014; Oct. 15, 2014) expected in all of the plays included in the DPR: the Bakken Shale will be up 27 MMcf/d to 1.54 Bcf/d, the Eagle Ford Shale up 97 MMcf/d to 7.53 Bcf/d, the Haynesville Shale up 69 MMcf/d to 6.97 Bcf/d, the Niobrara formation up 41 MMcf/d to 4.74 Bcf/d, and the Permian Basin up 74 MMcf/d to 6.26 Bcf/d. The big seven plays will be up a combined 613 MMcf/d compared to estimated January production, EIA said.

Total oil production from the seven plays in February will increase 103,000 b/d (1.9%) compared to January, but significant increases continue to come from only the three biggest producers, EIA said. The Permian will increase 41,000 b/d to reach 1.93 million b/d in February, the Eagle Ford will increase 25,000 b/d to 1.72 million b/d, and the Bakken will add 24,000 b/d to reach 1.31 million b/d.

Three other plays — the Niobrara, Utica and Marcellus — will increase production by a combined 13,000 b/d, and the Haynesville’s oil production will stay flat at 58,000 b/d, according to the EIA report.

EIA’s estimates come amid recently deflated oil prices. North America will be the hardest hit global energy region as producers pull back this year, with the Bakken Shale taking the brunt of the impact from falling rigs and capital spending cuts, according to one Barclays Capital analyst (see Shale Daily, Jan. 12). U.S. operators have begun implementing various ways to maintain their exploration and development programs in the United States, with some tweaking hedging strategies, others working with lenders and some scrapping expansion plans (see Shale Daily, Jan. 9). Even more appear to be cutting back on employees and contractors, according to a recent jobs report.

There were 1,304 drilling rigs operating in U.S. unconventional production basins on Jan. 9, according to Baker Hughes data, down 31 from the previous week and a 15-rig decrease compared with a year ago.

New wells are becoming more productive, according to the EIA report. New-well gas and oil production is expected to be higher in February than in January across the big seven (except for oil production in the Haynesville, which will remain at 24 b/d), the agency said. On a rig-weighted average, new-well gas production per rig in the plays will be a combined 1.72 MMcf/d, a 3.3% increased compared with January, and new-well oil production per rig will be 334 b/d, compared with 332 b/d this month.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |