Bakken Shale | E&P | NGI All News Access | Permian Basin

North America’s Bakken, Permian Verticals Pressured Most as Spending Declines, Says Barclays

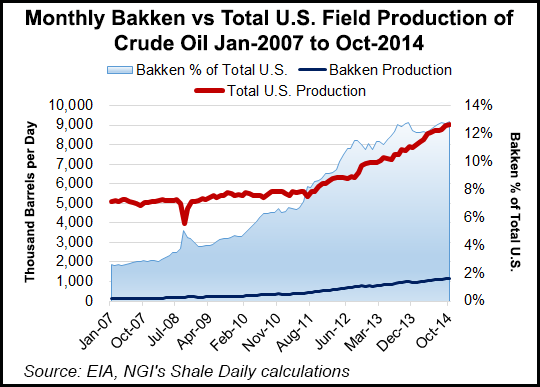

North America will be the hardest hit global energy region as producers pull back this year, with the Bakken Shale taking the brunt of the impact from falling rigs and capital spending cuts, a Barclays Capital analyst said Friday.

Dave Anderson shared the results of the firm’s 30th annual global exploration and production (E&P) survey. However, the latest figures are only a snapshot because the survey of expected spending levels this year of more than 225 oil and gas companies worldwide was conducted in December — and much already has changed.

The survey results are based on $70.00/bbl Brent and $65 West Texas Intermediate (WTI), which indicates a “clear downside risk if current oil price levels hold or move lower,” Anderson said. “With oil prices steadily moving lower, the outlook for 2015 upstream spending is a moving target, particularly for North America, which is entirely predicated on cash flow.”

The annual survey, conducted Dec. 1 through Jan. 5, actually was conducted later than in previous years because of the dramatic swing in prices.

“With commodity futures prices already $10 below those levels and trending lower, we would expect a downward revision to the survey results in the coming months,” particularly in North America spending, Anderson said.

As of Friday, Barclays is predicting a near 16% cut in North American spending by large-cap E&Ps, with the smaller-cap E&Ps likely to reduce spending by close to 23% — in line with forecasts by other analysts (see related story). Per Barclays, U.S. international oil companies (IOC), including the largest domestic natural gas producer, ExxonMobil Corp., should reduce their capital expenditures (capex) by “only 6.2%, which may be a result of not wanting to slow down relatively new unconventional programs.”

Privately held E&Ps expected in December to trim back their spending levels by about 15% this year, while the IOCs/national oil companies not based in the United States expected to cut 10% of their capital spending.

E&P capex is driven almost entirely by cash flow, so North American spending “could easily take another leg down in the coming months as companies report year-end results,” Anderson said. “In the meantime, we’ve already seen some early signs of the slowdown with 118 rigs dropped over the past six weeks, and many operators citing rapid pricing discounts for rigs and pressure pumping as service companies try to lock in utilization wherever possible.

“We expect the full magnitude of the slowdown to commence late 1Q2015, then bottom out in the fourth quarter with operators dropping 500 rigs over the course of the year and service costs falling as much as 20%.” By the end of 2015, Barclays expects the U.S. onshore rig count to be about 1,250.

“By using assumptions on well costs by basin and rig efficiency, we estimate the average U.S. onshore rig count will fall by 18%, with declines more heavily skewed toward the Bakken and vertical drilling in the Permian. We expect the brunt of the declines to occur in 2Q2014 and 3Q2014.” Horizontal drilling in the Permian should be stable, Anderson said during the conference call.

The average U.S. rig count for December was 1,882, down 43 from November, and up 111 year/year, Baker Hughes Inc. reported Friday. The average Canadian rig count for December was 375, down 46 from November but up three rigs from a year earlier.

North America provides the best visibility for upstream spending in any region, “and 2015 is not a pretty sight,” Anderson said.

“North America will get hit the hardest during this downturn, with upstream spending expected to fall at least 14.1% this year. When surveyed over the past four weeks, we found most E&Ps didn’t have much conviction when basing financial projections on oil prices staying in the $60-70/bbl range. Consequently, oil prices have fallen further…”

E&Ps always plow back cash flow and usually more.

“Cash flow means everything,” Andersen said. “Large-cap E&Ps have spent an average of 112% of cash flow in the past three years” compared to 91% in 2009, while the small/medium-caps have spent an average of 157% over the same period. According to our survey, E&Ps still plan to spend at or above cash flow, albeit less than in 2014.”

The cyclical North American market “is directly linked to independents…representing more than 85% of rigs drilling in North America.” That means there’s “considerable downside” in the North American picture.

Service costs expected to move lower, with E&Ps expecting to see a decline of more than 10% this year — the complete opposite of 2014.

“The service market tightened considerably in 2014, particularly in pressure pumping, with 44% of respondents seeing a 10% or greater increase in completion costs. But in 2015, E&Ps are expecting a complete reversal, expecting a 10% or greater decrease in drilling and completion costs on average, once again, driven by pressure pumping, a market that will loosen considerably in this downturn.”

Drilling fluids, pressure pumping and directional drilling are expected to loosen the most, with proppants remaining tight. International service costs appear to be more stable, with 70% expecting cost to remain largely flat.

“North American spending in unconventional basins is binary,” Anderson said. “Hyperbolic decline rates in unconventional production, and the increased scale of operations and logistics to drill and complete wells, has resulted in binary activity levels in the major basins: it’s either on or it’s off, depending on the price of oil and the basin break-even costs…

“Most of the unconventional oil basins are still economic at $65/bbl WTI (on), but it’s a different story at $50/bbl WTI (off).”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |