NGI Data | NGI All News Access

Surging Northeast Natural Gas Values Tug Overall Week Sharply Higher

For the week ending Jan. 9, weekly spot gas prices for the most part either fell, or moved quietly higher on a national basis. Try telling that, however, to Northeast traders, who are having to deal with intense weather-driven volatility. Most sections of the country saw losses of more than a dime up to gains of a few pennies or double digits in the case of the Midwest. The Northeast regional average for the week packed a whopping $3.03 advance to $5.77, which was enough to drive the NGI Weekly Spot Gas Average up 81 cents to $3.77.

Of all market points Transco Zone 6 New York led the pack with a rise of $9.37 to average $12.51. The week’s biggest loser was Kingsgate with a slide of 22 cents to $2.73. Weekly quotes in the Rockies shed 14 cents to average $2.93 and California was only slightly better, giving up 11 cents to $3.10.

Everywhere else saw gains. South Texas added 2 cents to $2.93, and both East Texas and South Louisiana rose 3 cents to $2.95 and $2.98, respectively.

The Midcontinent rose 9 cents to $3.16 and the Midwest was higher by a dime to $3.22.

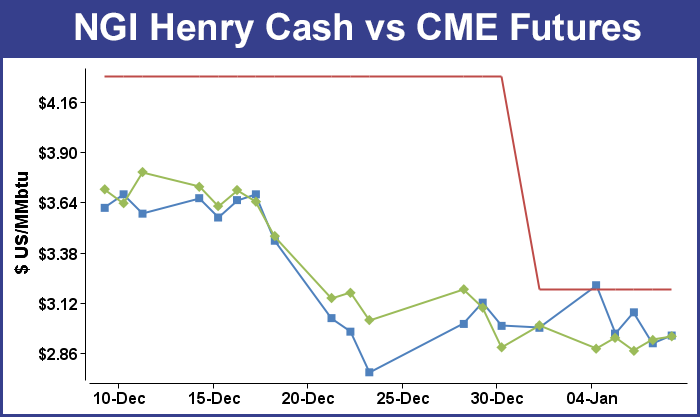

February futures for the week eased an indecisive 5.7 cents to $2.946 but in Thursday’s trading prices got a boost off supportive storage figures. Traders, however, saw little likelihood the days gains would be lasting. At the close Thursday, February had added 5.6 cents to $2.927 and March rose 6.0 cents to $2.925.

In its 10:30 a.m. EST report Thursday for the week ending Jan. 2, the Energy Information Administration (EIA) reported a decrease of 131 Bcf, about 10 Bcf greater than estimates. Prior to the release of the data analysts were looking for a decrease of about 120 Bcf. IAF Advisor analysts calculated a 120 Bcf decline, and a Reuters survey of 21 industry cognoscenti revealed an average 121 Bcf pull. Industry consultant Bentek Energy utilizing its flow model predicted a 123 Bcf withdrawal. The firm said demand was about the same as the Nov. 21 storage week when the EIA announced a 162 Bcf withdrawal.

“However, the holiday week combined with strong production growth since that week will lessen the reliance on storage significantly. The weak withdrawals within the Producing Region add some risk to forecast for a weaker withdrawal for the region. With the brunt of the cold occurring in the Midcontinent region, where there is a poor sample, withdrawals were likely significantly stronger than the past several weeks,” Bentek said.

Three-dollar technical resistance is still intact. “Even with this rally we are still under $3. I don’t think there is any panic by the shorts to cover,” said a New York floor trader. “It doesn’t look like anyone is taking money off the table.”

Some see timing issues in play. “The larger than expected 131 Bcf net withdrawal for last week following the smaller than expected 26 Bcf draw in the prior week suggests there may have been some timing issues between the two periods,” said Tim Evans of Citi Futures Perspective. “The larger build for last week also calls into question the apparent weakening of the underlying supply/demand balance, with supportive implications for the reports to follow.”

Inventories now stand at 3,089 Bcf and are 250 Bcf greater than last year and 67 Bcf below the 5-year average. In the East Region 65 Bcf were withdrawn and the West Region saw inventories fall 33 Bcf. Stocks in the Producing Region declined by 33 Bcf.

Top traders are in a “sell the rally” mode. “[Thursday’s] trade provided some mixed signals, but we saw nothing that would alter our bearish bias. While the approximate 6-7 cent price advance off of the EIA release appeared appropriate, the lack of counter-intuitive response to the number suggests a market that will likely test the $3 mark one time during the next couple of sessions,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday.

“The 131 Bcf withdrawal was roughly 10 Bcf larger than the average street expectation. Nonetheless, the supply deficit against five-year average levels has now shrunk to a mere 2%, or just 67 Bcf. While next week’s release will disrupt this dynamic of deficit contraction, we feel that a surplus against normal levels will be established early next month. Meanwhile, year-over-year comparisons are looking more bearish as a 250 Bcf overhang against last year will be providing a significant cushion to this week’s extreme cold. While temps are expected to remain below normal next week, deviations from usual are expected to be small.

“Furthermore, some outlooks are beginning to take on a neutral/slightly bearish appearance across the second half of this month. So while short-term temperature views will continue to rule over the near term, we also believe that a near-record production pace will be reducing the impact of the weather factor once the winter approaches its mid-point. We still see price advances much above the $3 mark as unsustainable. We are allowing for a brief price spike to as high as $3.10-3.15 if upcoming weekend temperature views lean back toward the cold side. However, such a rally should be viewed as a new selling opportunity.”

In Friday’s physical gas trading quotes for weekend and Monday gas were widely varied with large advances at New England points along with widespread gains across the Gulf Coast offsetting weakness in the Marcellus, Midwest and Rockies.

New England was expected to see a weekend cold snap along with high wind chills, and the overall market gain was 17 cents. Futures were unable to trade above the psychologically important $3 level but did manage to post limited gains for the session. At the close February was 1.9 cents higher at $2.946 and March had added 2.2 cents to $2.947. February crude oil fell 43 cents to $48.36/bbl.

New England posted multi-dollar gains as forecasters called for temperatures to drop Saturday along with bone-rattling wind. Wunderground.com reported that Hanover, NH’s Friday high of 25 degrees was forecast fall to 16 Saturday but reach 33 by Monday. The normal high in Hanover for early January is 23. Boston’s Friday high of 29 was seen dropping to 21 Saturday with winds of 10 to 16 mph before making it back up to 35 Monday. The seasonal high in Boston is 36. Residents of Hartford, CT, should see their Friday high of 33 drop to 20 by Saturday before climbing back to 33 Monday. The normal early January high in Hartford is 32.

Weekend and Monday gas at the Algonquin Citygates changed hands at $10.02, up $2.27, and deliveries to Iroquois Waddington were seen $2.68 higher at $8.11. On Tennessee Zone 6 200 L gas jumped $2.30 to $9.76.

Prices were mixed in the Mid-Atlantic. Gas bound for New York City on Transco Zone 6 vaulted $2.71 to $11.35, but deliveries to Tetco M-3 shed $1.35 to $5.19.

In the Marcellus quotes came in lower. Gas for weekend and Monday delivery on Millennium fell 18 cents to $1.65, and packages at Transco Leidy fell 26 cents to $1.31. Gas at Tennessee Zone 4 Marcellus was seen 16 cents lower at $1.48, and on Dominion South parcels changed hands at $1.58, down 36 cents.

Expected weather over the weekend varied for the different market zones. The National Weather Service (NWS) in southeast Massachusetts said an “Arctic front will move through the region tonight [Friday] bringing cold, dry weather to the region tomorrow lasting into Sunday. Another cold front will move through New England Monday followed by high pressure and dry cool weather midweek.”

To the south the Mid-Atlantic was seen buffeted by a series of high-pressure systems. NWS in New York City forecast that “high pressure over the middle section of the country builds east into the Tennessee and Ohio valleys by Saturday. The high then builds off the middle Atlantic Coast Saturday night and continues out to sea on Sunday. Weak low pressure will pass to the north on Monday, dragging a cold front across the area. Strong high pressure then builds from the northern plains through the middle of the week, [and] a coastal storm may impact the area at the end of the week.”

Monday peak power prices tumbled. According to IntercontinentalExchange, Monday peak power at the eastern New York ISO Zone G fell $24.05 to $60.95/MWh and packages at the PJM West terminal skidded $12.79 to $40.01/MWh.

Midwest market zones along with producing regions saw prices weaken. Gas for weekend and Monday delivery on Alliance shed 7 cents to $3.07, and deliveries to the ANR Joliet Hub fell 8 cents to $3.07. Gas at the Chicago Citygates skidded 11 cents to $3.06, and gas on Consumers was seen off 2 cents at $3.04. Deliveries to Michcon added 9 cents to $3.04.

Prices at Rocky Mountain points were mostly lower. At the Cheyenne Hub, weekend and Monday parcels fell 3 cents to $2.82, and gas on CIG Mainline gave up 2 cents to $2.78. At Opal gas changed hands at $2.81, flat, but gas on Northwest Pipeline WY rose 1 cent to $2.77.

Weather forecasts looking out to the 11- to 15-day period see a cold, warm, cold scenario developing. Commodity Weather Group in its Friday morning report said the overnight model runs “added some demand compared to yesterday’s outlook especially for early to middle next week across the Midwest and East during the colder side of the pattern before the bigger warmer shift commences. The models continue to struggle during this transition period as big chunks of remnant cold interact with increased jet stream energy, offering some winter storm risks next week.

“Despite the net colder changes, the bigger 11-15 day warm-up is still progressing forward with day 10 now featuring widespread above to much above normal temperatures from the Midwest to Tennessee Valley all the way into the West,” said Matt Rogers, president of the firm. “That warming still dominates the East in the 11-15 day with good model agreement and warmer risks, but the models still rebuild eastern Pacific to Gulf of Alaska ridging that sets the stage for colder changes later in the 11-15 day, which like last time, should go more into the West before coming east.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |