NGI Archives | NGI All News Access

Northeast Natural Gas Basis Continues Freefall Despite Current Frigid Temps

There was no stopping the sharp slide Northeast natural gas forward basis prices have been on this week, with prompt-month prices plunging as much as nearly $2, as weather forecasts are calling for a warm-up in temperatures after a few more days of frigid conditions.

Extremely cold temperatures will continue over the Midwest and Northeast for the next few days, sending overnight lows to more than 10 degrees below zero, but the region will begin to thaw next week and temperatures will return to seasonable or above-average levels for at least the next week and a half.

“It won’t be until around January 21st before the threat of colder temperatures again approach the northern US. How this plays out will likely determine whether deficits will be fast turning into surpluses, or whether cold temperatures will again arrive in time keep supplies in the red,” said forecasters with NatGasWeather. “It’s difficult to say how prices behave from here as there is still strong short-term demand and a few large draws to be counted, but longer term weather patterns are looking bearish to counter.”

Not surprisingly, the largest declines in basis occurred in New England, where Boston high temperatures are forecast by AccuWeather to hover in the 20s and 30s over the next week, but then climb into the 40s by the third week of January.

More so than the weather, though, the availability of more supplies in the region drove prices lower this week. Excelerate, Cove Point and Everett all began sending LNG shipments into the region this week, with Excelerate sending gas into Algonquin for the first time since March 2010 and Everett posting its highest single-day nomination for the winter since at least the winter of 2007-2008, according to Genscape’s Rick Margolin, senior natural gas analyst.

“I think this is all a product of the weakness in global LNG prices rather than an indication of anything happening in the US market,” Margolin said. “Prices at JKM [Japan Korea Marker] and NBP [National Balancing Point, UK] have fallen substantially in the last eight months due to the drop in global crude oil prices, the reinstatement of nuclear facilities in Japan, and the lackluster demand in the Asian and European summer markets.”

Furthermore, winter forward prices at JKM and NBP also were reportedly trading below Algonquin Gas Transmission city-gates this past summer, Margolin said.

“We don’t have forward prices for JKM or NBP, but have heard from clients that the winter forwards for those markets were trading this summer at about $10-$12/MMBtu. Meanwhile, last summer the Algonquin winter strip was averaging $14/MMBtu,” Margolin said. “The Jan.15 contract averaged $19.42/MMBtu and reached as high as $22.12/MMBtu. The Feb.15 contract averaged $18.44/MMBtu, including a peak day of $21.11/MMBtu. While those prices aren’t that high relative to where the AGT forward winter strip used to trade in past summers, they do seem to offer the best spreads a global LNG supplier could get this summer.”

Algonquin February basis tumbled $1.783 from Monday to reach plus $5.492/MMBtu Thursday. March was down $1.245 to plus $3.272/MMBtu, while the next two winter strips fell $1.25 and 95 cents, respectively.

Other Northeast points also posted steep declines. Transco zone 6-New York February basis fell 94.7 cents between Monday and Thursday to reach plus $3.45/MMBtu, while March slid 14.8 cents to plus 5.3 cents/MMBtu.

Further out the curve, though, the New York winter 2015-2016 package edged up 3 cents to plus 6.5 cents/MMBtu, and the winter 2016-2017 jumped 10 cents to plus $2.02/MMBtu.

A trader said the modest strength at New York is likely a technical correction after prices have lost such significant ground over the last few weeks.

“We think its really a function of things coming off too hard too fast, nothing more,” the trader said. “Markets can’t always go straight down and straight up, even though that’s been the case the last few weeks.”

The trader said he expected the Nymex to continue moving lower, but said basis posting the multi-dollar declines it did in January likely would not continue.

“You got to watch the fixed price of the gas in the Northeast with basis so negative. If Nymex goes to $2.50/MMBtu, is basis going to be $-1.40’s/MMBtu? No way,” the trader said.

Nevertheless, it appears the market has all but called off the winter season.

“Everyone was more than prepared for it,” the trader said.

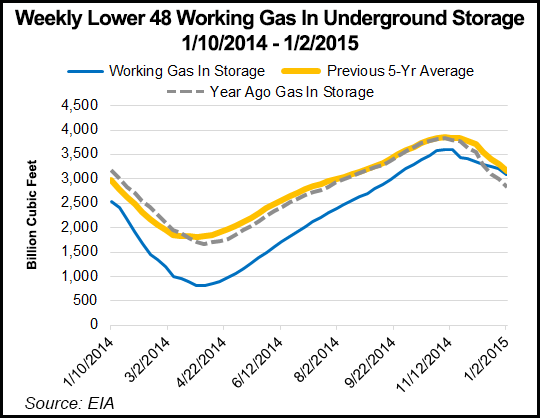

The US Energy Information Administration on January 8 reported a larger-than-expected 131 Bcf draw from storage for the week that ended January 2, only the second triple-digit draw of the season. Inventories are now at 3,089 Bcf, which is 2.1% below the five-year average of 3,156 Bcf, but above last year’s level of 2,839 Bcf.

With the recent cold blasts and resulting production cuts related to well freeze-offs, NatGasWeather expects the EIA to report storage well above-average storage pulls for the next two weeks.

“The next two weeks draws will be greater than normal and will likely come in over 200 Bcf as these Arctic blasts and production freeze offs are factored in. This will also keep supply deficits ongoing through January,” NatGasWeather said.

Total production was down more than 2 Bcf from December averages earlier this week, with the Rockies and Texas being hardest hit, Genscape’s Margolin said. Volumes were expected to begin recovering quickly, however, as temperatures began rising in the affected areas, and a lack of significant snowfall will make it easier for maintenance crews to reach the wells, he added.

Furthermore, even with the the potential for a couple more above-average storage withdrawals this winter season, Margolin said year-over-year production is so much higher, that inventories will likely end the traditional withdrawal season at around 1.8 Tcf, if not higher.

“All along we’ve been saying the key to preventing a surplus headed into summer is a cold November, and we just didn’t get that (despite that late month cold shot),” Margolin said. “So from this point forward, we would not only need to see extremely cold temperatures, but those temperatures would need to be geographically widespread and trigger severe production disruptions to trigger any concerns about end-of-season inventories. We just have so much YOY production.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |