Markets | NGI All News Access | NGI Data

Falling Power Prices Tackle Eastern Markets; Futures Rise Following Storage

Next-day gas prices plunged in Thursday’s trading as power prices and power loads retreated. Multi-dollar losses were the rule in New England and the Mid-Atlantic, yet hefty declines were noted at all market points with the exception of a handful of locations in the Marcellus.

Traders weren’t overly impressed with an Energy Information Administration (EIA) natural gas storage report Thursday morning that indicated a decrease slightly less than the market had been expecting.

Midwest Market Zones as well as Producing Zones in the Gulf, Midcontinent, Rockies and San Juan Basin commonly experienced losses of 20 cents. The overall market fell 83 cents. Futures prices got a boost off supportive storage figures, but traders see little likelihood the day’s gains will be lasting. At the close February had added 5.6 cents to $2.927 and March was up 6.0 cents to $2.925. February crude oil is showing some signs of stabilizing and added 14 cents to $48.79/bbl.

Tumbling power prices across key eastern population centers along with a forecast of slight moderation to the brutal cold pounding the East was enough to prompt multi-dollar next-day gas price declines. IntercontinentalExchange reported that peak power Friday into New York ISO Zone G (eastern New York) dropped $40.18 to $85.00/MWh and peak power Friday at the ISO New England’s Massachusetts Hub skidded $45.30 to $71.33/MWh. Peak power at the PJM West terminal shed $38.15 to $52.80/MWh.

Gas bound for New York City on Transco Zone 6 fell $5.11 to $8.64, and packages on Tetco M-3 came in $4.46 lower at $6.54.

Not to be outdone, New England points posted their own set of sharp declines. Friday gas at the Algonquin Citygates fell $4.79 to $7.75, and deliveries to Iroquois Waddington dropped $4.47 to $5.43. Gas on Tennessee Zone 6 200 L plummeted $4.50 to $7.46.

Although trading at sharply lower levels, Marcellus points managed gains. Gas on Millennium added 28 cents to $1.83, and deliveries to Transco Leidy rose by 20 cents to $1.57. Deliveries to Tennessee Zone 4 Marcellus gained 22 cents to $1.64, and gas on Dominion South changed hands 56 cents higher at $1.94.

Traders explained the strength in the Marcellus as resulting from higher prices in New York City. “I think the Tennessee Zone 5 300 L Pool has been strong, and that is more of a function of what Transco is trading in New York,” said an industry marketing veteran.

“Transco Zone 6 New York at $8.31 is higher than anything on Tennessee Zone 5 or Zone 6, so buyers on Transco Zone 6 are doing everything they can to pull gas off Tennessee as long as they have capacity. Tennessee Zone 5 will drive the Marcellus and serve as a point to move gas into New York City,” he said.

Even with the higher demand at eastern market points, “there is a lot of gas-on-gas competition in the Marcellus, so you won’t see big rises in price,” he added.

Friday temperature forecasts did call for warming in major energy markets. AccuWeather.com predicted that Thursday’s high in Boston of 20 would climb to 33 Friday before slipping back to 24 Saturday, 12 degrees below the seasonal norm. New York City’s 21 high Thursday was seen rising to 32 Friday and dropping to 23 Saturday. The seasonal high in New York is 38. In Washington, DC, Thursday’s maximum of 24 was forecast to reach 38 Friday and fall to 27 Saturday, 16 degrees below normal.

Beyond that, near-term weather is not expected to let up anytime soon. “Waves of frigid air will continue in the Baltimore/Washington, DC, area into the weekend,” said AccuWeather.com meteorologist Alex Sosnowski. “[Wind chill] temperatures will dip below 0 F at times into Saturday, driven by arctic air and blustery conditions. Actual temperatures have been low enough to slow the operation of some of the trains in the area.

“The weather at Foxboro, MA, for the NFL postseason game will be frigid. Fans heading to the game will need to wear layers of warm clothes. The second Alberta Clipper of the week will swing through the Northeast on Friday. However, this time the storm will pass north of the city with only spotty snow and flurries. Gusty winds during and in the wake of the storm will not only impact how cold it feels but can also be strong enough to cause sporadic airline delays,” he said.

Producing zones fell by double digits as well. Gas for Friday delivery on ANR SE fell 13 cents to $2.87, and deliveries on Transco Zone 3 shed 14 cents to $2.92. Packages on Tennessee 500 L changed hands 14 cents lower at $2.89, and gas at the Henry Hub fell 16 cents to $2.91. Parcels at Katy were seen 20 cents lower at $2.89.

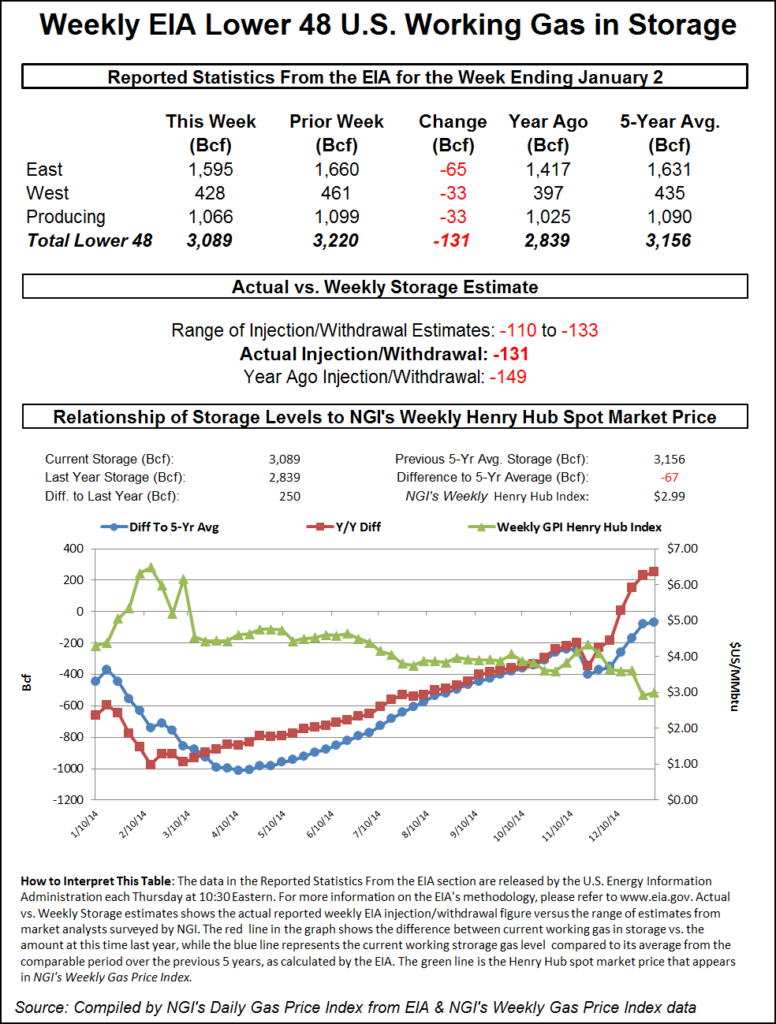

EIA’s 10:30 a.m. EST release of storage figures gave a boost to the bullish case, but traders were only modestly impressed. The EIA reported a decrease of 131 Bcf, about 10 Bcf greater than estimates. February rose to a high of $2.934 after the number was released and by 10:45 a.m. February was trading at $2.927, up 5.6 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for a decrease of about 120 Bcf. IAF Advisors analysts calculated a 120 Bcf decline, and a Reuters survey of 21 industry cognoscenti revealed an average 121 Bcf. Bentek Energy’s flow model predicted a 123 Bcf withdrawal. The firm said demand was about the same as the Nov. 21 storage week when the EIA announced a 162 Bcf withdrawal.

“However, the holiday week combined with strong production growth since that week will lessen the reliance on storage significantly. The weak withdrawals within the Producing Region add some risk to forecast for a weaker withdrawal for the region. With the brunt of the cold occurring in the Midcontinent region, where there is a poor sample, withdrawals were likely significantly stronger than the past several weeks.”

Three-dollar technical resistance is still intact. “Even with this rally we are still under $3. I don’t think there is any panic by the shorts to cover,” said a New York floor trader. “It doesn’t look like anyone is taking money off the table.”

Some see timing issues in play. “The larger than expected 131 Bcf net withdrawal for last week following the smaller than expected 26 Bcf draw in the prior week suggests there may have been some timing issues between the two periods,” said Tim Evans of Citi Futures Perspective. “The larger build for last week also calls into question the apparent weakening of the underlying supply/demand balance, with supportive implications for the reports to follow.”

Inventories now stand at 3,089 Bcf and are 250 Bcf greater than last year and 67 Bcf below the five-year average. In the East Region 65 Bcf were withdrawn and the West Region saw inventories fall 33 Bcf. Stocks in the Producing Region declined by 33 Bcf.

Natgasweather.com said intense cold will persist for the next few days before a warm surge is expected. “Extremely cold temperatures will continue over the Midwest and Northeast, where lows of single digits to 15F below [zero] are expected the next few nights. Temperature anomalies 20-35F colder than normal will persist through Saturday before the Arctic grip eases into early next week. It will still be relatively chilly over the northern U.S., but anomalies will return to being within 10F of normal. We still expect milder conditions to surge out of the southern U.S. and into the Midwest and Northeast through Wednesday as Arctic air retreats into Canada.

“However, there will be a fast-moving Canadian weather system and associated cold blast moving into the north-central and eastern U.S. late next week with at least a few regions experiencing a quick blast of colder temperatures.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |