Markets | NGI All News Access | NGI Data

Shorts Still Confident Following Bullish Storage Report

Natural gas futures jumped Thursday following the release of government storage figures showing a higher withdrawal than traders had been expecting.

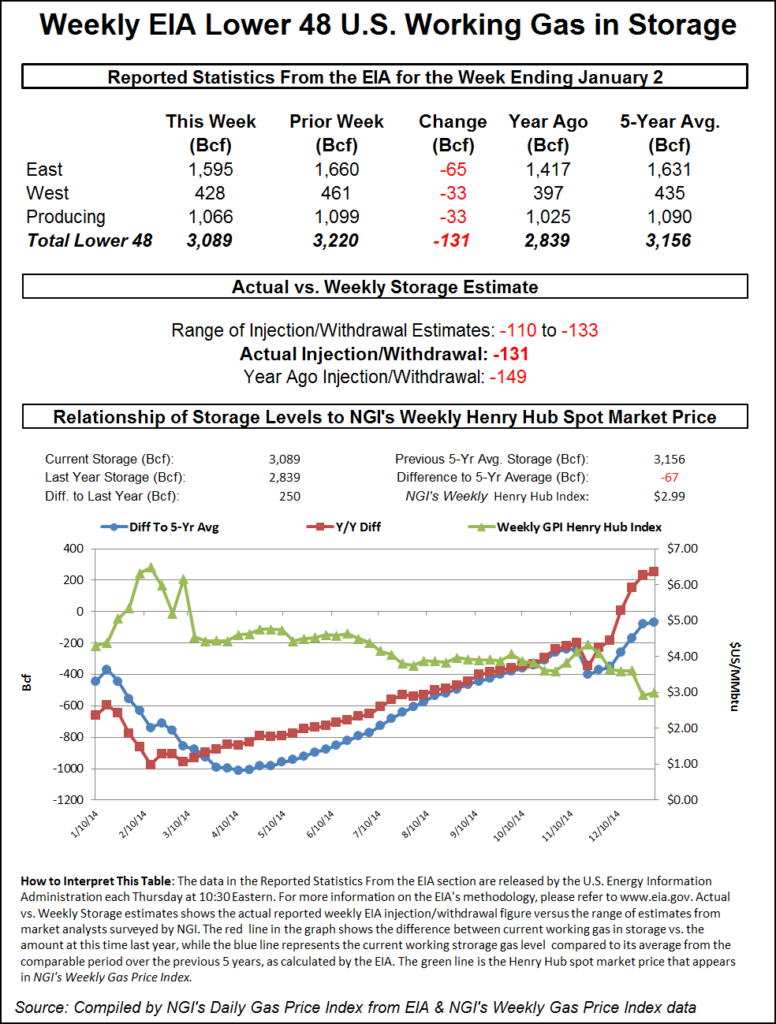

For the week ended Jan. 2 the Energy Information Administration (EIA) reported a decrease of 131 Bcf in its 10:30 a.m. EST release, about 10 Bcf greater than estimates. February rose to a high of $2.934 after the number was released, and by 10:45 a.m. February was trading at $2.927, up 5.6 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease of about 120 Bcf. IAF Advisors analysts calculated a 120 Bcf decline, and a Reuters survey of 21 industry cognoscenti revealed an average 121 Bcf. Bentek Energy’s flow model predicted a 123 Bcf withdrawal.

Three-dollar technical resistance is still intact. “Even with this rally we are still under $3. I don’t think there is any panic by the shorts to cover,” said a New York floor trader. “It doesn’t look like anyone is taking money off the table.”

Some see timing issues in play. “The larger than expected 131 Bcf net withdrawal for last week following the smaller than expected 26 Bcf draw in the prior week suggests there may have been some timing issues between the two periods,” said Tim Evans of Citi Futures Perspective. “The larger build for last week also calls into question the apparent weakening of the underlying supply-demand balance, with supportive implications for the reports to follow.”

Inventories now stand at 3,089 Bcf and are 250 Bcf greater than last year and 67 Bcf below the five-year average. In the East Region 65 Bcf was withdrawn, and the West Region saw inventories fall 33 Bcf. Stocks in the Producing Region declined by 33 Bcf.

The Producing Region salt cavern storage figure fell by 6 Bcf from the previous week to 324 Bcf, while the non-salt cavern figure dropped 26 Bcf to 742 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |