Markets | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

BP’s Biggest Global Economic Contributor Still the U.S.

The United States continues to be BP plc’s top global economic priority, even though the domestic business is smaller than it was in 2012, the British-based supermajor said Tuesday.

BP’s review of the U.S. business, including an overview of holdings and employment in many of the states, is detailed in its second-annual economic impact report.

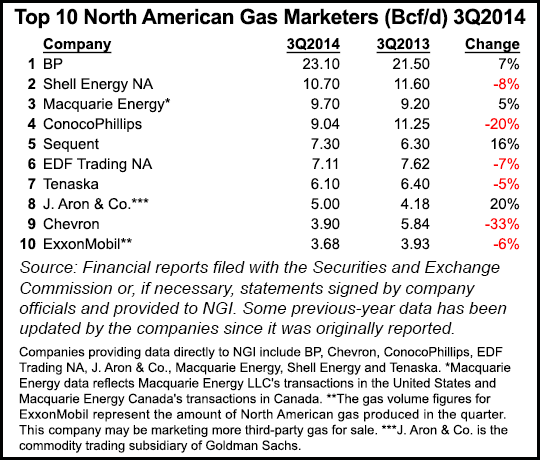

U.S. capital expenditures, acquisitions, vendor sales and salaries/benefits all fell in 2013 from 2012, according to the producer. Although its production is down largely in part on asset sales, BP continued to be the largest natural gas marketer in North America in 3Q2014, according to NGI‘s most recent survey. BP marketed 23.1 Bcf/d in North America between July and September, 7% higher year/year.

“We have 18,000 employees and nearly 200,000 additional workers we support across the supply chain” in the United States alone, said BP America Chairman John Mingé. “That’s nearly 220,000 U.S. jobs and $143 billion in economic impact from coast to coast.”

The United States, he noted, “is central to BP’s global business strategy. We have a larger economic footprint in the U.S. than in any other nation where we operate. Nearly 40% of our shares are held in America. And we employ more people and invest more dollars in the U.S. than in anywhere else in the world.

“In fact, every dollar of profit we earn here, we reinvest here. We also spent more than $22 billion with U.S. vendors in 2013.”

However, Mingé acknowledged that the domestic operations have evolved as the company positions for the future. BP’s interests are widespread, with its biggest investments today in the Gulf of Mexico (GOM), despite the Macondo tragedy almost five years ago.

Litigation and settlements may continue to plague BP, but the GOM remains its biggest focus.

“We have invested more money in the Gulf than any other company has over the past 10 years, and it’s paying off,” said Mingé. Over the two years BP has started up projects at two of four production platforms, Na Kika and Atlantis. It’s made more investments in the Thunder Horse platform, “while also pursuing plans for a major expansion at the fourth, Mad Dog. “

In Alaska, the company also is “spending heavily” to develop Prudhoe Bay’s reserves and is working to advance one of the largest liquefied natural gas export proposals to take North Slope gas to global markets, said Mingé.

The Lower 48 states also hold big prospects, as BP prepares to separate the business to manage prospects “in a more strategic way. This business is being designed to adapt to the rapidly changing and hyper-competitive energy landscape in the continental U.S.”

BP announced plans to create a separate U.S. onshore business early last year (see Daily GPI, March 4, 2014). At the end of 1Q2014, BP’s U.S. onshore had about 7.6 billion boe spread across 5.5 million acres and 21,000 wells. In August former SandRidge Energy Inc. COO David Lawler was named CEO for the enterprise (see Shale Daily, Aug. 20, 2014). Lawler is the younger brother of Chesapeake Energy Corp. CEO Doug Lawler.

Total domestic spending on capital expenditures and acquisitions fell to $9.1 billion in 2013 from $10.5 billion in 2012, while vendor spending dropped slightly to $25 billion to $22 billion. Salaries and benefits fell to $4.9 billion from 2012’s $5.5 billion.

Divestments led to the loss of around 2,000 U.S. jobs between 2012 and 2013, with the workforce standing at around 18,000. Those sales forced production to decline to about 628,000 boe/d in 2013, compared with 675,000 boe/d in 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |