NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rig Count Seen Falling Hard and Fast

The U.S. rig count should fall “further and faster” than consensus this year, with oil prices eventually stabilizing, but the outlook for domestic natural gas prices is worse than it was four months ago, according to Raymond James & Associates Inc.

In a note to clients Monday, analysts J. Marshall Adkins and Pavel Molchanov updated their 2015 outlook for commodity prices and the exploration and production (E&P) sector. For 2015, they expect oil prices to bottom in the first half of the year then modestly firm, averaging below $65/bbl West Texas Intermediate (WTI).

Gas prices also should be lower than most analysts’ currently expect, said the duo. In addition, E&P stocks should bottom with oil prices, “well before” downward earnings revisions stop.

On Monday, onshore drilling and pumping specialist Patterson-UTI Energy Inc. said it had an average of 208 U.S. drilling rigs in operation in December, with eight rigs in Canada. In the final three months, it averaged 2010 U.S. rigs, with nine in Canada. The average is below the company’s forecast in October, when it said it would, by the end of December, have 214 rigs running on U.S. land, with 10 in Canada (see Shale Daily, Oct. 23, 2014).

The Raymond James analysts acknowledged that over the past two years, they have been “bearish and wrong” on oil price forecasts, but that meltdown in the second half of 2014 confirmed the structural imbalance they said they have been warning of since early 2012. “Looking forward, our math suggests the oil price to balance supply and demand is a mid-$60s average for at least a year.”

Raymond James upended its WTI forecast, cutting the price forecast to $62.00/bbl from $75.00, and the Brent forecast was cut to $68.00 from $90.00. “We envision a recovery in 2016, but not back to triple digits,” analysts wrote.

Meanwhile, the domestic gas market “looks terrible in 2015. Like oil, the U.S. gas market has been structurally oversupplied for years. The extreme cold last winter saved gas prices last year, and Henry Hub’s full-year average of $4.38/Mcf ended 17% above our original forecast of $3.75,” issued in September (see Daily GPI, Sept. 8, 2014).

The revised Henry Hub forecast now is $3.00/Mcf, down from $3.65, “which implies prices are likely to fall below $3.00 next summer,” said the duo.

E&P stocks may be poised to recover, but timing is everything, they said. The energy sector “was the worst loser in the S&P 500,” with “the worst absolute performance since 2008.” However, “we think that energy, on the whole, will have an up year in 2015.”

Topeka Capital Markets on Monday was no less optimistic about the domestic E&P sector. Analyst Gabriele Sorbara in a note said to expect a “challenging and volatile year” for oil, natural gas liquids, gas and E&Ps. The first half of the year should be “particularly tough for oil prices and the oily companies,” with prices lingering at current levels or even lower.

“Based on our conversations, the consensus view among investors is for WTI oil prices to fall below $50.00/bbl in the near-term.” However, like Raymond James, Topeka expects prices to reset sometime in the second half of 2015.

“Ultimately, as supply/demand balances we expect WTI crude oil back above $75/bbl, assuming a 10-15% decline in service costs,” Sorbara wrote.

Analysts with Rystad Energy said Monday the “main” U.S. shale plays require an average WTI breakeven price of $58.00/bbl. On Monday morning, WTI for February had slipped below $50 and at midday was trading slightly above $50.

The Norwegian-based consulting firm, with offices in Houston, had said in December that if oil prices were to average $82.50 this year, $150 billion in global energy projects could be canceled (see Daily GPI, Dec. 5, 2014).

That $58.00 price average set point serves as a warning, because “not all companies are exposed to the same acreage quality within the same shale play,” Rystad’s analysts said.

At WTI prices below $50.00/bbl, “only the core areas” of the Eagle Ford Shale and the Niobrara formation “will remain economical,” said Rystad.

Halliburton Co. and Schlumberger Ltd. already are preparing for less business this year, in line with near-daily 2015 capital expenditure reductions by onshore E&Ps (see Shale Daily,Dec. 11, 2014).

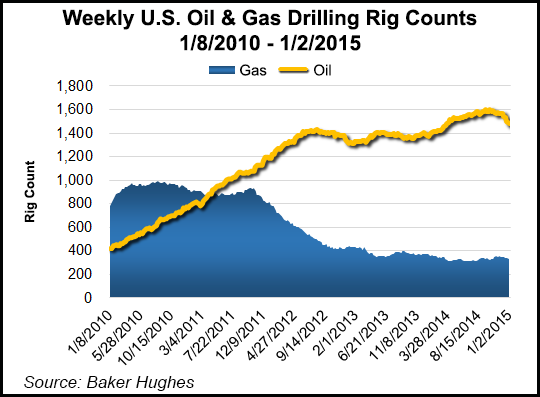

According to Baker Hughes data, the U.S. oil rig count peaked at a record of 1,609 drilling rigs for the week ended Oct. 10. That measure of oil drilling activity had declined to 1,482 as of last Friday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |