NGI Data | NGI All News Access

January Natural Gas Bidweek Plummets, But Most Points Hold Above $3

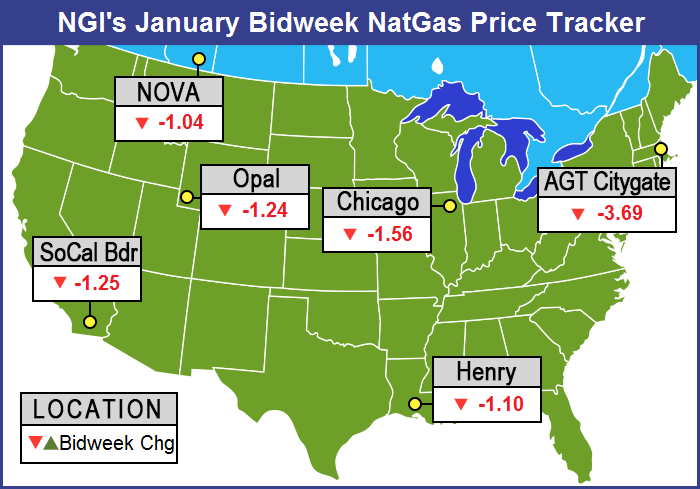

For natural gas buyers 2015 couldn’t have started out on a sweeter note. Stout production and a mild start to winter that contributed to meager storage withdrawals saw January 2015 bidweek prices tumble across the board, with only the Northeast failing to register declines greater than $1. The NGI Henry Hub Bidweek Average for January 2015 dropped $1.10 from the December average to $3.19, the greatest decline in more than four years.

Of the actively traded points, Chicago Citygate and Dawn buyers got some of the sharpest discounts, with January Bidweek coming in at $3.61, down $1.56, and $3.49, down $1.57, respectively. The smallest decline of actively traded points was noted on Tetco M-3, with quotes dropping just 28 cents to $4.35. Marquis points such as Algonquin Citygates dropped a healthy $3.69 to average $10.19 and gas headed for New York City on Transco Zone 6 added $1.21 to $8.44.

Regionally, the Northeast took the smallest hit, with a drop of 71 cents to average $4.33 and sellers into the Midwest groaned with the biggest loss of $1.54 to $3.53.

California Bidweek quotes dropped $1.27 to $3.30, the Midcontinent skidded $1.26 to $3.22, and the Rocky Mountains fell $1.22 to $3.12. East Texas fell $1.12 to $3.07 and South Louisiana shed $1.10 to $3.15. South Texas was seen down $1.08 to $3.11.

The NGI National Bidweek Average for January 2015 retreated $1.04 from December 2014 to $3.55. The $3.55 average is also 99 cents below NGI’s January 2014 National Bidweek Average.

January futures expired at $3.189, down $1.093 from December’s settlement, as shale gas production remained robust, while heating demand lagged. All it took to send January bidweek prices tumbling was lower heating requirements. December heating degree days (HDD) across the country were running more than 8% less than average, and in some major market areas more than 20% less.

According to AccuWeather.com Boston will normally see 937 HDD, but December 2014 brought just 823, a drop of 8.7%. NGI Algonquin Citygate January Bidweek fell $3.69 to $10.19.

In the Midwest, Chicago will typically shiver under 1,115 HDD, but this December the Windy City “enjoyed” just 934 HDD. NGI Chicago Citygate January Bidweek changed hands at $3.61, down $1.56.

Sunny California gas requirements per capita pale when compared to the rest of the county, but the same trend prevailed. In a normal December, Los Angeles will experience just 237 HDD, and December 2014 brought a thin 182 HDD, a decline of 23%. NGI SoCal Citygate Bidweek for January plunged $1.31 to average $3.34.

Some marketers lamented that they weren’t able to participate in the lower price regime to the degree they would have liked. “Even though the [spot] prices got really low, we weren’t able to buy because we made a lot of purchases early on,” said a Great Lakes area trader.

“It’s been a strange month, and we are using a lot of our storage gas.”

Pipelines didn’t have much in the way of issues during December. “Anyone who has firm transport is moving their gas,” said a Houston-based industry veteran. On the final day of bidweek both physical and futures had the trajectory of a safe falling from a 10-story building in Wednesday’s pre-holiday trading.

Gas for Thursday and Friday delivery fell at all but a couple of eastern points on New Year’s Eve, and most locations were down by anywhere from 25 to 50 cents. The overall market skidded 38 cents to average $2.91. The greatest declines were seen at New England locations, but market zones across the country were deep in red ink.

Futures took a pounding Wednesday that sent prices below $3/MMBtu as the Energy Information Administration (EIA) reported a thin 26 Bcf withdrawal for the week ending Dec. 26, well under historical levels, but also smartly less than what traders were expecting. At the close Wednesday, February had dropped 20.5 cents to $2.889, and March was off 20.0 cents to $2.896. February crude oil continued its losing ways falling 85 cents to $53.27/bbl, the lowest in more than five years.

Prior to the release of the storage data, analysts were looking for a decrease of about 40 Bcf. IAF Advisors analysts calculated a 30 Bcf decline, and Citi Futures Perspective analysts figured on a 43 Bcf pull. Ritterbusch and Associates was looking for a 48 Bcf withdrawal.

The price tumble was expected, but “a close below $3 is going to be necessary for a new price regime to stick,” a New York floor trader said shortly after the storage report.

Tim Evans of Citi Futures Perspective said the report “suggest[ed] either a further increase in production or a larger-than-anticipated drop in demand related to the Christmas holiday. It certainly reinforces the dominant bearish sentiment.”

Inventories now stand at 3,220 Bcf and are 232 Bcf greater than last year and 81 Bcf below the five-year average. In the East Region 29 Bcf was withdrawn and the West Region saw inventories stay flat. Stocks in the Producing Region rose by 3 Bcf.

Analysts had a hard time predicting the storage figure. Evans said, “Our storage model produced a somewhat larger 43 Bcf net withdrawal estimate, although we see no sure advantage in anticipating a surprise from the DOE. The larger fundamental concern, in our view, is that we now no longer see the cooler than normal temperatures in the forecast as producing enough heating demand to full offset the apparent growth in natural gas production.”

Evans’ figures show the year-on-five-year deficit contracting to just 54 Bcf by Jan. 16, and although he said the market “continues to become better supplied on a seasonally adjusted basis…at the same time, we do still see potential for prices to climb as heating demand picks up, translating into larger withdrawals in absolute terms, even though at a lower rate than past years.”

Evans suggests working a buy stop at $3.23 in the February contract as a way to enter the market on the long side, and he counsels a protective sell stop at $2.97 to limit risk on the trade.

Physical traders pushed prices lower Wednesday and were more inclined to watch the power screen than follow weather reports. IntercontinentalExchange reported that peak power Friday at the ISO New England’s Massachusetts Hub fell $14.77 to $49.50/MWh and power at the PJM West terminal dropped $5.98 to $33.93/MWh.

Gas at the Algonquin Citygates for Thursday and Friday delivery fell $2.82 to $5.86, and deliveries to Iroquois Waddington dropped 15 cents to $3.53. Gas on Tennessee Zone 6 200 L fell $2.92 to $5.66.

In the Mid-Atlantic, gas bound for New York City on Transco Zone 6 for Thursday and Friday fell 29 cents to $3.16, and gas on Tetco M-3 was seen 73 cents lower at $1.73.

Gas in the Rockies managed to hold on to a slight premium to Midwest Market Zones. Deliveries on CIG Mainline fell 40 cents to $3.12, and gas at the Cheyenne Hub shed 48 cents to $3.09. Gas at Opal changed hands 44 cents lower at $3.13, and deliveries on Northwest Pipeline Wyoming Pool dropped 41 cents to $3.09.

On Alliance, Thursday and Friday volumes fell 28 cents to $3.05, and gas at the Chicago Citygates came in 29 cents lower to $3.04. At the ANR Joliet Hub, gas was seen at $3.06, down by 29 cents, and on Consumers gas fell 28 cents to $3.04. Gas on Michcon lost 28 cents to $3.05.

The plunging prices came in spite of forecasts calling for some of the most brutal cold of the season. “The coldest weather since last winter will settle over the Upper Midwest and northern Plains and will have some people shivering as they say goodbye to 2014 and ring in the new year,” said AccuWeather.com meteorologist Alex Sosnowski.

“While the core of the cold air will be centered over the northern Rockies and High Plains, temperatures will plunge well below zero from portions of the Dakotas and northern Minnesota at night through the end of 2014.

“[Wind chill] temperatures in some cases will be well below zero. Exposure to these temperatures for an extended period of time can lead to frostbite and hypothermia. A weak front dropping in along the Canada border may cause spotty flurries from parts of the Dakotas to Michigan and northern Ohio Wednesday night into New Year’s Day. Any heavy lake-effect will be limited to part of the Upper Peninsula of Michigan through Friday. The exact track and timing of a storm from the Southwest will determine the extent of rain versus snow and ice over the region this weekend.”

Wednesday’s futures trading was dominated by the storage report, but all it took Tuesday to send the market a dime lower was a slight modification to the longer-term weather outlook. The National Weather Service (NWS) eight- to 14-day outlook showed slightly less cold and greater warmth from Monday’s outlook. Monday’s forecast showed a broad ridge of below-normal temperatures north of a line extending from Montana to as far south as Kansas and Missouri and east to Delaware. Above-normal readings were expected south of a broad arc extending from northern California to North Texas and including South Carolina.

“Tuesday’s eight- to 14-day outlook moved the area of below-normal temperatures slightly to the north while the area of above-normal readings moved north as well,” the forecaster said.

In spite of forecasts calling for expansive cold across the nation, the NWS forecasts below-normal heating loads for the week ending Jan. 3 in key population centers. In a report it said New England should see 242 HDD, or 30 below normal, and the Mid-Atlantic should endure 228 HDD, or 24 below normal. The greater Midwest from Ohio to Wisconsin is expected to shiver under 281 HDD, or five below its normal tally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |