Markets | NGI All News Access | NGI Data

Low Natural Gas Storage Draw Has Bears Prowling

Natural gas futures retreated following the release of government storage figures showing a lower withdrawal than what the market was expecting.

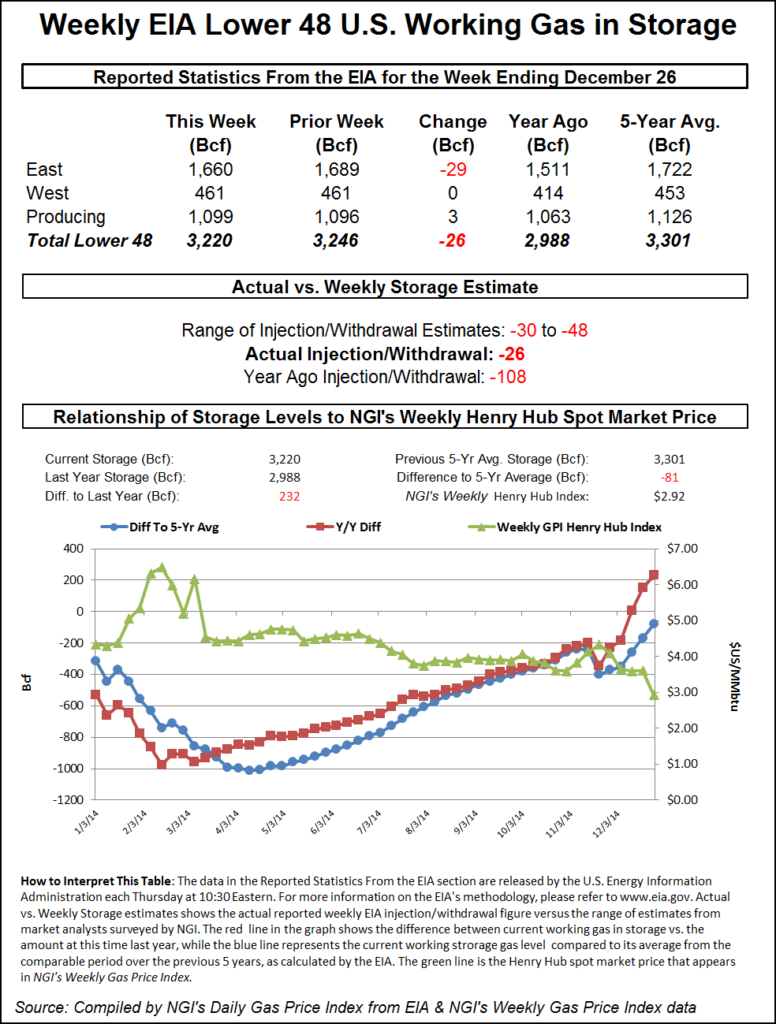

For the week ended Dec. 26, the Energy Information Administration (EIA) reported a decrease of 26 Bcf in its 12:00 p.m. EST release Wednesday, about 14 Bcf less than estimates. As a result, February broke beneath $3 to a low of $2.987 after the number was released and by 12:15 a.m., February was trading at $3.032, down 6.2 cents from Tuesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease of about 40 Bcf. IAF Advisors analysts calculated a 30 Bcf decline, and Citi Futures Perspective analysts figured on a 43 Bcf pull. Ritterbusch and Associates was looking for a 48 Bcf withdrawal.

The price tumble was expected, but “a close below $3 is going to be necessary for a new price regime to stick,” a New York floor trader said.

Tim Evans of Citi Futures Perspective said the report “suggest[ed] either a further increase in production or a larger-than-anticipated drop in demand related to the Christmas holiday. It certainly reinforces the dominant bearish sentiment.”

Inventories now stand at 3,220 Bcf and are 232 Bcf greater than last year and 81 Bcf below the five-year average. In the East Region 29 Bcf was withdrawn, and the West Region saw inventories stay flat. Stocks in the Producing Region rose by 3 Bcf.

The Producing region salt cavern storage figure added 3 Bcf from the previous week to 330 Bcf, while the non-salt cavern figure fell by 1 Bcf to 768 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |