NGI Archives | NGI All News Access

Idaho PUC OKs Avista Plans for Flat NatGas Demand

Idaho regulators last Friday approved plans for Spokane, WA-based Avista Utilities that will guide the company’s response to natural gas demand in the state’s northern panhandle for the next 20 years. The Idaho Public Utilities Commission (PUC) accepted Avista’s integrated resource plan (IRP), which is updated every two years.

Avista’s latest plan continues to forecast very low gas demand growth among its Idaho customers as an offshoot of continued economic slowdown and increased energy efficiency (see Daily GPI, Nov. 26).

Avista told the PUC it has a diversified portfolio of gas supply resources, including contracts to buy gas from several supply basins, stored gas and firm capacity rights on six interstate pipelines.

Avista does not anticipate a need to acquire additional natural gas resources beyond what it already provides, a PUC spokesperson said. “Demand is down due partly to the recession, while the availability of natural gas increases because of the abundant supply of shale gas. The company anticipates growth in customer demand of only 0.7% annually.”

Nevertheless, Avista’s plan outlines several scenarios and how it would respond to each one. Avista’s IRP outlines uncertainties that could impact demand for natural gas, including:

Existing and new LNG facilities are looking to export low-cost North American gas to higher-priced Asian and European markets, according to the Avista plan, which noted that in Canada, 16 LNG export projects are in various stages of permitting, along with two proposed terminals in Oregon.

“LNG exporting has the potential to alter the price, constrain existing pipeline networks, stimulate development of new pipeline resources and change flows of natural gas across North America,” the IRP said.

As part of its review, the PUC said that neither Avista’s IRP nor its 2015 business plan attempted to predict when it might be cost-effective again for the combination utility to resume offering incentives to customers to reduce their gas consumption. Avista suspended its demand-side management (DSM) programs for natural gas customers in 2012 after gas prices dropped to the point that the DSM programs were no longer cost-effective.

The latest IRP, however, indicates a conservation potential assessment (CPA) for 228,000 therms of gas savings in 2015, increasing to 3.6 million therms by 2034, the PUC spokesperson said.

Avista maintains its CPA uses “high-level assumptions” that may be overly optimistic and that the issue should be further explored in the company’s 2015 business plan rather than in the context of its IRP. Avista was directed to file an addendum to its business plan within 60 days that analyzes the CPA results and addresses whether it might be cost-effective to resume DSM programs.

Demand is down due partly to the recession, while the availability of natural gas increases because of the abundant supply of shale gas. The company anticipates growth in customer demand of only 0.7% annually.

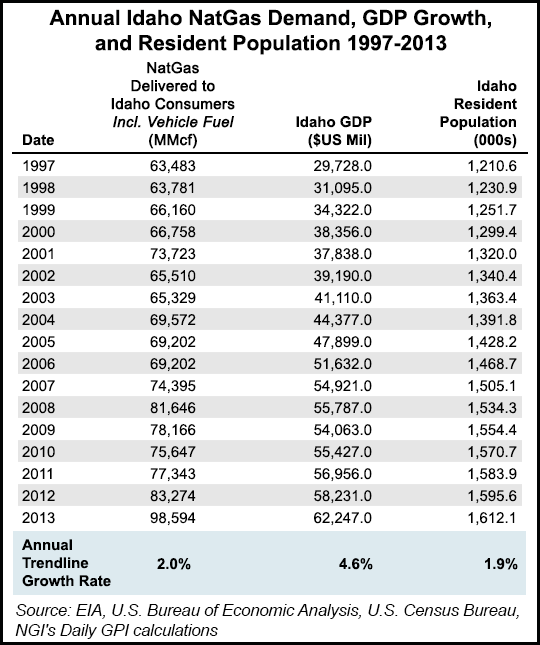

That 0.7% annual growth forecast is a marked reduction from the 2.0% annual natural gas demand growth Idaho turned in between 1997-2013.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |