NGI Archives | NGI All News Access

Eclipse to Fund Large Share of 2015 Spending With Private Placement

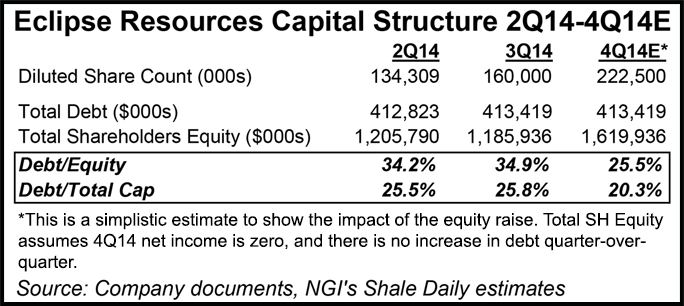

Eclipse Resources Corp. said Monday that it will sell 62.5 million shares in a private placement that will help fund a large portion of its 2015 capital budget of $640 million in a move aimed at preserving its balance sheet during the commodities downturn.

The shares will be sold at $7.04 each to affiliates of private equity firm EnCap Investments LP and are expected to net Eclipse $434 million after expenses related to the sale.

Established in 2011, Eclipse went public in June and has grown production significantly from its days as a private operator (see Shale Daily, Oct. 30; Aug. 14; June 23).

While it will reduce 2015 spending by 20% from this year’s budget of about $800 million, the company expects to use more cash and efficiencies in its drilling program to grow production 240-290% from this year’s anticipated exit rate of 73-75 MMcfe/d.

“This incremental capital funds our capital program and should allow us to come out of this current commodity price downturn poised to take advantage of an outstanding asset base, a strong balance sheet and an experienced and efficient operating team,” said CEO Benjamin Hulburt in a statement.

Eclipse’s 2015 program will look similar to this year’s. It plans to place 58 net wells into sales in its operated and non-operated areas in Ohio, where it has nearly 130,000 acres in the Utica and Marcellus shales.

The company also said that it could adjust spending plans depending on what happens with commodity prices next year.

“We believe it is imperative in this environment to closely monitor and manage the company’s liquidity and balance sheet,” Hulbert said. “We intend to make further adjustments to our capital spending plan as the commodity price situation dictates in order to preserve this liquidity.”

Eclipse said it has more than half of 2015 natural gas production hedged at $3.75/Mcf. It also announced Monday that it had entered a 10-year firm transportation and marketing agreement with Blue Racer Midstream LLC to send propane and butane volumes through Blue Racer’s firm capacity on Sunoco Logistics Partners LP’s planned Mariner East 2 project (see Shale Daily, Dec. 5, 2013). Mariner East 2 will deliver natural gas liquids from the Marcellus and Utica to the Marcus Hook terminal near Philadelphia for export overseas.

Expected to be in service in late 2016, Eclipse will have firm transportation on Mariner East 2 that grows from 7,500 barrels to 14,000 barrels over the 10-year period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |