Markets | NGI All News Access | NGI Data

California Up, But Overall Market Falters; Futures Can’t Hold After Storage Report Gains

Next-day gas fell in Thursday’s trading as buyers and sellers elected to get deals done prior to the release of often market-moving storage figures from the Energy Information Administration (EIA).

Gains in California were unable to offset double- and even triple-digit declines in the Northeast, Mid-Atlantic and Marcellus region. Losses of a nickel to a dime were seen in the Great Lakes, and Permian/San Juan gas traded about a penny lower. The overall market retreated 12 cents. Futures got off to a strong start following the report of a supportive 51 Bcf storage draw, but faded at the close. January settled 7.2 cents lower at $3.634, and February fell 7.3 cents to $3.663. January crude oil skidded 99 cents to $59.95/bbl, the lowest in more than five years.

The market seemed to be taking much of its price cues from weather forecasts for the Great Lakes and the nation’s mid-section. AccuWeather.com forecast that Chicago’s high of 33 Thursday would rise to 38 Friday and 41 Saturday. The normal high in Chicago is 36 this time of year. The high in Kansas City Thursday of 41 was seen reaching 54 Friday and a balmy 60 by Saturday. The seasonal high in Kansas City is 42. Denver’s 63 high Thursday was expected to hold Friday and ease to 58 on Saturday. The normal high in Denver is 42.

Gas for Friday delivery on Alliance tumbled 13 cents to $3.63, and deliveries to the ANR Joliet Hub shed 11 cents to $3.64. Gas at the Chicago Citygates traded 3 cents lower at $3.61. Next-day deliveries on Consumers dropped 10 cents to $3.80, and gas on Michcon came in 3 cents lower at $3.82. At Demarcation, gas changed hands for Friday delivery at $3.48, down 9 cents.

AccuWeather.com forecast temperate conditions for Chicago. “Dry weather and milder conditions are in store for most of the weekend in the Chicago area, [and] temperatures will linger in the 30s through Friday,” the company said in a report. “It will be cold for a few days, but this is definitely not the coldest air Chicago has seen,” said AccuWeather.com meteorologist Maggie Samuhel.

“Temperatures will steadily climb after Friday and just in time for those headed out for holiday shopping trips. Saturday and Sunday’s temperatures will require a jacket, but they will be considerably higher than recent days. It’s not out of the question that Sunday will flirt with the 50-degree mark. Despite the blast of warmer air, mostly cloudy skies will linger throughout the weekend. By next week, rain and snow showers will return.”

Northeast and Mid-Atlantic points took the day’s greatest hits, dropping more than $2 at some points. Deliveries to the Algonquin Citygates plunged $1.77 to $8.20, and gas at Iroquois Waddington fell 28 cents to $4.12. Deliveries on Tennessee Zone 6 200 L sank $2.13 to $7.43.

Gas on its way to New York City via Transco Zone 6 fell 75 cents to $3.75, and packages on Tetco M-3 were seen 28 cents lower at $3.30.

Marcellus and Appalachia fell about a dime. Gas on Millennium fell 22 cents to $2.32, and deliveries on Transco Leidy shed 8 cents to $1.96. Parcels on Tennessee Zone 4 Marcellus were off 13 cents to $1.92 and gas on Dominion South shed 12 cents to $2.86.

Permian and San Juan gas was seen about a penny lower. Friday deliveries on El Paso Permian were flat at $3.43, and gas on Transwestern came in flat as well at $3.42. At Waha, next-day gas was quoted at $3.39, down two cents. Parcels on Transwestern San Juan fell a penny to $3.44, and gas at El Paso Bondad changed hands at $3.43, unchanged.

California quotes managed to make it to the positive side of the trading ledger. Gas at Malin was flat at $3.48, but deliveries to PG&E Citygates added 9 cents to $3.98. At the SoCal Citygates, next-day packages were seen 3 cents higher at $3.92. At the SoCal Border, next-day gas added 5 cents to $3.74, and gas on El Paso S Mainline rose 2 cents to $3.73.

Analysts are thinking that with the warm patterns in play for the next two weeks, storage balances could shift dramatically, with the year-on-year storage deficit getting completely wiped out. The Thursday morning release of storage data, however, had the weather bulls temporarily in control, but that soon faded.

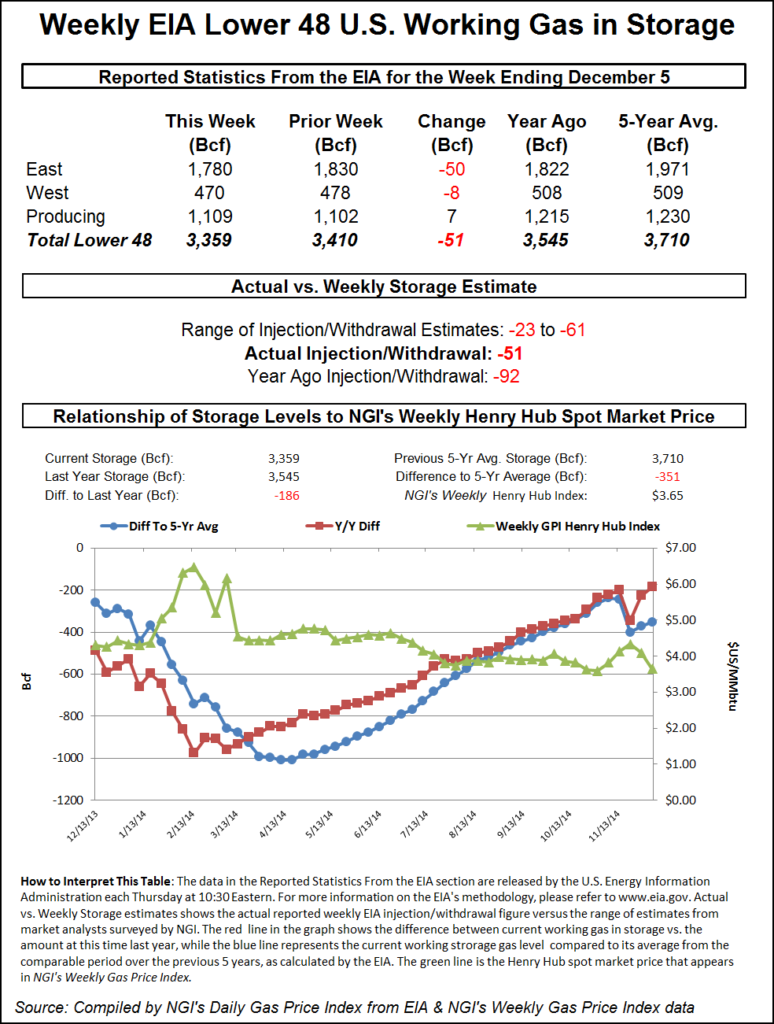

For the week ended Dec. 5, EIA reported a decrease of 51 Bcf in its morning report. January futures rose to a high of $3.778 after the number was released and by 10:45 a.m. EST January was trading at $3.758, up 5.2 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for a decrease of about 40 Bcf. An analysis by industry consultant Genscape revealed a pull of 42 Bcf, and IAF Advisors analysts calculated a 40 Bcf decline. Bentek Energy’s flow model anticipated a withdrawal of 41 Bcf.

“This move looks like profit-taking by the shorts,” said a New York floor trader. “It’s an excuse to get out of the market if you are a nervous short.” The trader added that he didn’t think this was new buying. “I think it would be a little brave for anyone to get long on this report, but there is likely money being pulled off the table.”

Inventories now stand at 3,359 Bcf and are 186 Bcf less than last year and 351 Bcf below the 5-year average. In the East Region 50 Bcf was withdrawn and the West Region saw inventories fall 8 Bcf. Stocks in the Producing Region rose by 7 Bcf.

Analysts see a shifting supply-demand landscape. “Despite rising Northeast production, deliverability constraints require the industry to maintain large Production Region stockpiles to avoid potential seasonal price spikes,” said Teri Viswanath, director of natural gas trading strategy at BNP Paribas. “What’s more, winter-peaking demand will continue to rise next year with the early retirement of peak-shaving coal units and the start of LNG exports, increasing the supply reliance from this region.

“The compression of the seasonal spreads has reduced the profitability of storing gas, making ‘merchant’ leases particularly unattractive. However, the significant rise in seasonal demand should reverse this trend. So while current mild conditions continue to pressure storage economics this winter, the swing in seasonal balances next year suggests a very different scenario will unfold.”

Forecasters studying their weather models see signs that cold air may be on the way, but it won’t be for at least another two weeks. “The modeling overnight maintained relative consistency on both the warm-dominated pattern for most of the next two weeks and the attempt to switch back to a colder pattern at the end of the 11-15 day,” said Matt Rogers, president of Commodity Weather Group, in the firm’s Thursday morning outlook. “All model guidance this morning [Thursday] has some sort of ridging building, either from the gatekeeper position along the U.S. West Coast toward the Yukon (European) or right up into Alaska, too (American/Canadian) by the Christmas holiday.

“These trends started [Wednesday] during the 12z cycle except for the Canadian, which has been developing this new pattern for a number of runs now. Because the change is still at the very end of the 11-15 on most guidance (Canadian faster), we must remain somewhat cautious yet. It will take a little time to reconnect the cold air and replenish the supply, so the initial cooling advances in this change may be on the weaker side at first and may focus more toward the Rockies and Plains at the start.”

Until then, significant storage draws may be unlikely.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |