Markets | NGI All News Access | NGI Data

Nervous Shorts Cover Following Supportive Storage Figures

Natural gas futures gained ground following the release of government storage figures showing a higher withdrawal than traders had anticipated.

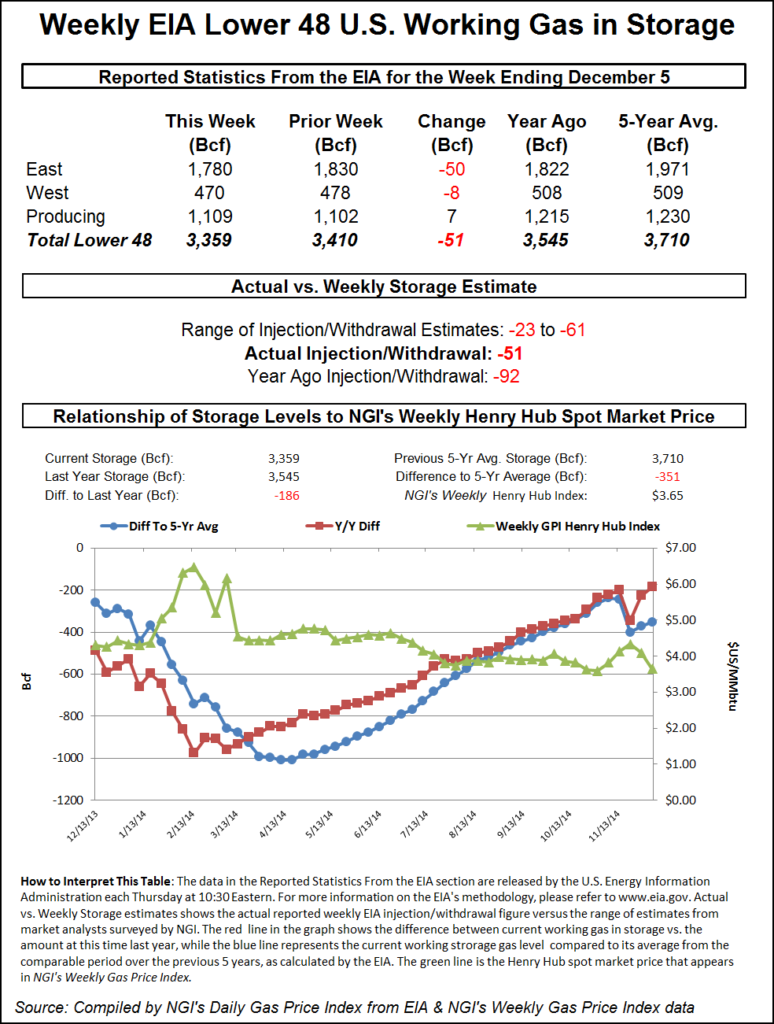

The Energy Information Administration in its 10:30 a.m. release reported a withdrawal of 51 Bcf for the week ended Dec. 5, about 11 Bcf more than market expectations. January futures rose to a high of $3.778 after the number was released, and by 10:45 a.m. January was trading at $3.758, up 5.2 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease of about 40 Bcf. An analysis by industry consultant Genscape revealed a pull of 42 Bcf, and IAF Advisors analysts calculated a 40 Bcf decline. Bentek Energy’s flow model anticipated a withdrawal of 41 Bcf.

“This move looks like profit-taking by the shorts,” said a New York floor trader. “It’s an excuse to get out of the market if you are a nervous short.” The trader added that he didn’t think this was new buying. “I think it would be a little brave for anyone to get long on this report, but there is likely money being pulled off the table.”

Inventories now stand at 3,359 Bcf and are 186 Bcf less than last year and 351 Bcf below the five-year average. In the East Region 50 Bcf was withdrawn, and the West Region saw inventories fall 8 Bcf. Stocks in the Producing Region rose by 7 Bcf.

The Producing region salt cavern storage figure added 9 Bcf from the previous week to 323 Bcf, while the non-salt cavern figure fell by 1 Bcf to 787 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |