Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

PDC Cuts 2015 Spending, to Focus on Wattenberg

PDC Energy Inc. will cut spending next year and switch its focus almost entirely to Colorado’s Wattenberg field, where it said increasing efficiencies should help to drive down costs and increase production by 50% from 2014.

The Denver-based company announced a 2015 capital expenditure (capex) budget of $557 million, down 14% from this year’s budget of $647 million. Nearly all of next year’s budget, or $516 million, is to go to the Wattenberg, where PDC has plans to keep running five rigs and complete 110 gross-operated Niobrara and Codell horizontal wells. What little it has left over would go toward completing a four-well pad in Guernsey County, OH.

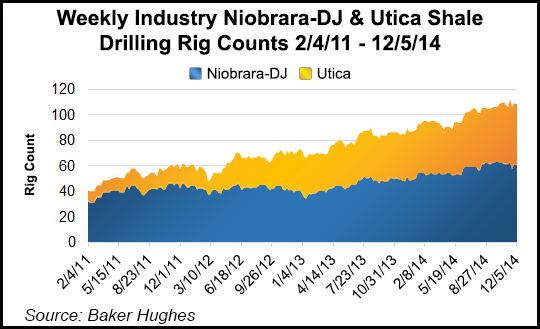

Citing weak oil and bearish natural gas prices, along with widening gas differentials in the Appalachian Basin, PDC plans to idle its sole drilling rig in the Utica Shale.

“We will continue to monitor crude oil and natural gas pricing and have the operational flexibility to adjust capital spending in Wattenberg or Utica should commodity prices change materially,” incoming CEO Bart Brookman said.

The bulk of its operations in recent years have centered in the Wattenberg, where it has 97,000 net acres. When it announced its 2014 capital budget, the company suspended its drilling program in the Marcellus Shale and later sold those assets (see Shale Daily, Dec. 12, 2013).

Topeka Capital Markets analyst Gabriele Sorbara said next year’s budget was “significantly better” than some of the market had expected. While some estimates forecast PDC to budget as much as $700 million or more, with less production to show for it, it instead came in with lower spending and a production forecast at 13.8-14.5 million boe.The company also said it would hit its 2014 exit rate of 9.3-9.5 million boe when it announced guidance after market close on Monday.

“The better than expected production growth per dollar of capital is due to the greater efficiencies from its focus on the core Wattenberg acreage, longer laterals and upsized completions,” Sorbara said. “With a solid balance sheet, strong hedge book and plenty of liquidity, PDCE is set up nicely to withstand the commodity price down-cycle.”

PDC said it anticipates a commodity mix of 45% crude oil, 20% natural gas liquids and 35% natural gas next year. PDC’s 2015 budget is based on a full-year New York Mercantile Exchange price of $67/bbl for oil and $3.80/Mcf for natural gas.

PDC said it has 80% of its 2015 crude volumes hedged at $89/bbl, while 75% of its natural gas production is hedged at $4/Mcf.

“Even prior to Thanksgiving, U.S. producers were already pulling back. With OPEC failing to agree to a production cut, significant spending reductions are materializing,” Wunderlich Securities analyst Irene Haas said. “Early yesterday, ConocoPhillips set 2015 spending at $13.5 billion, a 20% decrease from 2014…This is just the tip of the iceberg; we expect U.S. producers to retreat to their best return projects and to cut spending aggressively to protect their balance sheets while riding out the downturn.”

Haas also said PDC’s hedges will help insulate it from stagnant commodity prices, while BMO Capital Markets analyst Phillip Jungwirth said the Utica was a “drag on overall capital efficiencies and returns” for PDC.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |