NGI Archives | NGI All News Access

Mild Weather Pattern Influences Natural Gas Price Outlook Through Mid-December

Natural gas forwards markets were generally lower for the first week of December as relatively mild weather blanketed much of the country, and forecasts offered little hope of more sustained cold in the next couple of weeks.

“Overall, we see nothing but mild patterns to come and this will clearly lead to strong bearish weather sentiment, with temperatures simply too warm to expect anything but smaller-than-normal draws on supplies at a time when heating demand is supposed to be quite strong,” said forecasters with NatGasWeather.

Furthermore, several weather outlooks are calling for El Nino to strongly influence this winter season in the US, likely bringing mild temperatures across the US. And, forecasters with NatGasWeather believe it is El Nino that has assisted the mild weather pattern currently on tap through mid-December.

“We do caution there is a strong typhoon over the western Pacific which could cause the weather models to do some strange things over the weekend, but we still like a milder pattern through mid-December,” NatGasWeather forecasters said. “Although, again, it will be very important to watch what happens during the last week of December, as this will likely be the next area of focus to see if a surge of colder Canadian air will be able to advance toward the northern US. If colder weather patterns fail to gain traction, it will likely continue to drive strong bearish weather sentiment.”

Even as temperatures in the Northeastern US are expected to dip below freezing early next week, natural gas markets in the region followed the general downtrend and put up the largest declines across North America.

At the Algonquin Gas Transmission city-gates, January basis plunged $1.861 between Monday and Thursday to land at plus $11.438/MMBtu, and February basis tumbled $1.918 to $11.15/MMBtu.

Algonquin’s February-March package dropped $1.396 during that time to $8.692/MMBtu, while the winter 2015-2016 plummeted 40 cents to $7.76/MMBtu and the winter 2016-2017 fell 25 cents to plus $5.43/MMBtu. By comparison, Algonquin’s summer 2015 strip slipped just 2 cents to minus 11 cents/MMBtu.

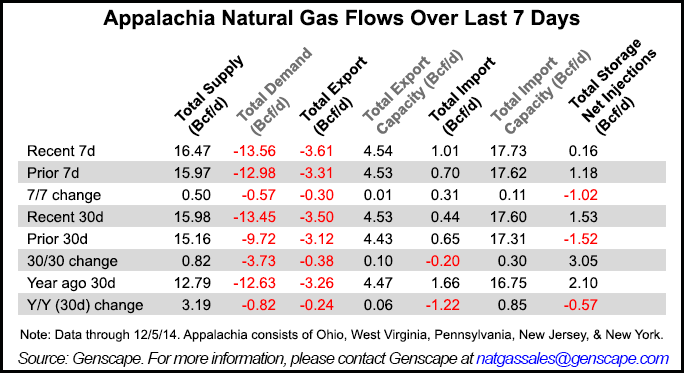

Stout decreases were seen throughout the Northeast as regional production hit a fresh high of more than 19 Bcf/d this week, aided by the in-service of several pipeline projects, including REX’s Seneca Lateral and TETCO’s TEAM 2014 expansion, both of which have seen an increase in volumes this month.

At Transco zone 6-New York, January basis fell about 60 cents to plus $7.555/MMBtu, February dropped 79 cents to plus $6.561/MMBtu, and the balance of winter lost 48 cents to hit plus $3.332/MMBtu. The winter 2015-2016 and winter 2016-2017 strips were down more than 20 cents apiece.

TETCO-M3 saw its biggest declines at the front of the curve, with January shedding 55.7 cents to reach plus $2.543/MMBtu, February sliding 51 cents to plus $1.782/MMBtu and the balance of winter dropping 32.4 cents to plus 60.7 cents/MMBtu. The rest of the curve shifted about 10 cents or less.

But one market hub moved against the pack in response to the sharp drop in basis at the benchmark Henry Hub, a Northeast trader said, noting the net price of Dominion didn’t change much.

Dominion South point January basis jumped 24 cents to minus 98.9 cents/MMBtu, representing a full value price of $2.66/MMBtu, a drop of about 10 cents from the start of the week. The balance of winter priced similarly.

The Nymex January contract fell some 35.8 cents during that time.

Even winter strips further out the curve picked up about 10 cents amid word of Williams’ Constitution Pipeline’s approval by the Federal Energy Regulatory Commission.

The 30-inch, approximately 124-mile Constitution Pipeline has been designed with a capacity to transport 650,000 Dth/d and will extend from Susquehanna County, Pennsylvania., to the Iroquois Gas Transmission and Tennessee Gas Pipeline systems in Schoharie County, New York. It has an expected in-service date of late 2015 or early 2016.

“DSP will compete less with Northeast PA Marcellus as more of that gas can get out,” the trader said. “Plus, producers likely have more new capacity than net new production long term. That’s why I’m bullish DSP in general.”

Over in the Midwest, where temperatures are expected to hover within 5 degrees of seasonal norms during the next couple of weeks, prices were lower.

At the Chicago city-gates, January basis fell 16.7 cents to plus 35.3 cents/MMBtu, February dropped 15 cents to plus 36 cents/MMBtu and the balance of winter slid 10 cents to plus 27.4 cents/MMBtu.

Michigan Consolidated Gas saw January basis slide 11.2 cents to plus 29.3 cents/MMBtu, while the rest of the curve fell less than 10 cents.

Across the border in Canada, AECO-Alberta found some relative strength as storage inventories in the region are tracking well below normal for this time of year. Current supply stocks are hovering around 300 Bcf, a level typically not reached until February.

As such, prices along the AECO forward curve failed to budge from Monday to Thursday, with January and the balance of winter holding at minus 57 cents/MMBtu.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |