Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Futures and Cash Glide Lower; January Pummeled 16 Cents

Physical gas for Friday delivery managed to trade in similar fashion to futures Thursday in spite of the fact that most traders elected to get their deals done prior to the release of often market-jolting government inventory figures.

Thursday’s trading resembled less of a jolt than the sound of air escaping from a tire. Both physical and futures fell by double digits, with New England and the East dropping the most, but Midwest market centers were close behind. Only one Marcellus point made it into the plus column, and the market on average shed 19 cents. Producing regions with pricing tied to the Henry Hub also fell.

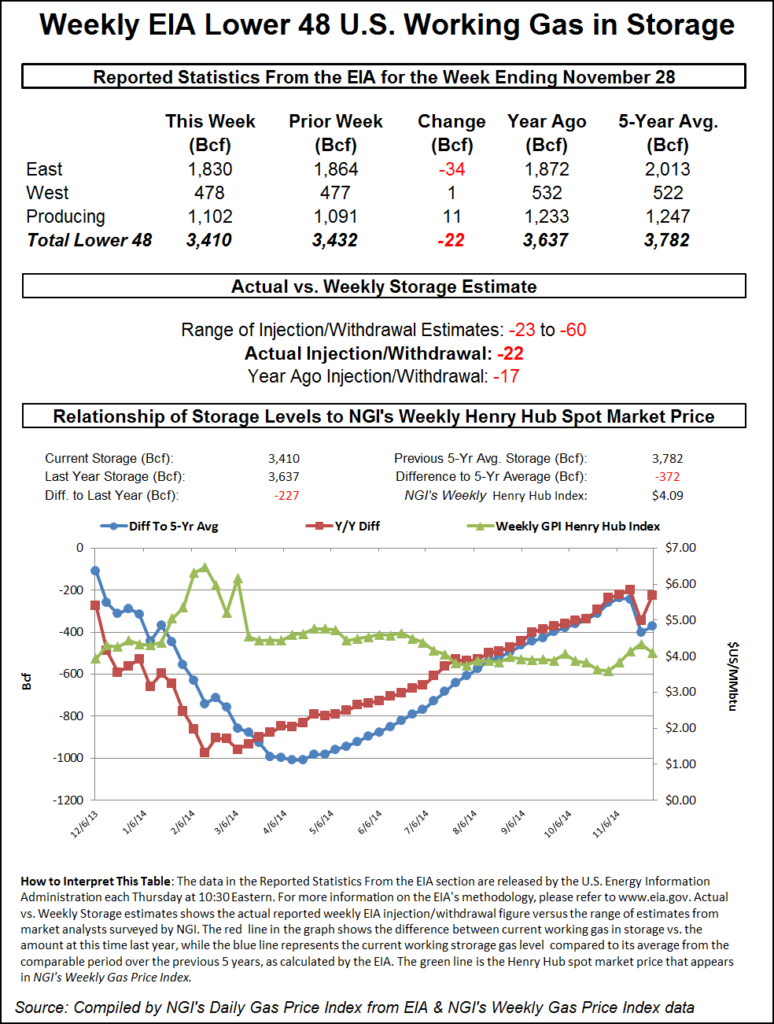

The Energy Information Administration (EIA) in its morning release of inventory figures reported a withdrawal of just 22 Bcf, far short of market expectations as high as a 60 Bcf pull. At the close, January futures had dropped 15.6 cents to $3.649 and February was lower by 14.7 cents to $3.661. January crude oil fell 57 cents to $66.81/bbl.

In Northeast trading the prospects of just seasonal temperatures coupled with a weak power demand environment and a weak screen were enough to send prices tumbling. ISO New England forecast peak power Thursday of 18,200 MW would slide to 17,880 MW Friday and reach only 16.050 MW Saturday. Similar load forecasts prevailed in New York, with the New York ISO predicting peak load Thursday of 21,242 MW falling to 21,129 MW Friday and softening to 19,259 MW Saturday.

Next-day gas at the Algonquin Citygates shed $1.36 to $4.56, and gas at Iroquois Waddington fell 8 cents to $3.92. Gas on Tennessee Zone 6 200 L dropped $1.10 to $4.71.

Gas on its way to New York City on Transco Zone 6 fell 21 cents to $3.53, and packages on Tetco M-3 were seen 13 cents lower at $3.12.

IntercontinentalExchange reported that Friday peak power at the ISO New England’s Massachusetts Hub fell $8.03 to $45.68/MWh, and next-day peak power at the PJM West terminal rose $1.07 to $42.59/MWh.

Temperature forecasts for New England were seasonal for Friday, but by Saturday some modest warming was expected to set in. Wunderground.com predicted that Providence, RI’s Thursday high of 43 would reach 44 Friday and 54 by Saturday. The normal high in Providence is 46. New Haven, CT’s Thursday high of 44 was forecast to hold Friday before rising to 51 Saturday, 8 degrees above the seasonal norm. Boston’s 43 high on Thursday was seen sliding to 39 Friday but rebounding to 50 by Saturday, well above its seasonal high of 45.

Weather throughout the East was expected to be active, but the temperature outlook was seen favoring rain rather than snow. The National Weather Service in New York City said, “high pressure centered to our north shifts east tonight and reaches the Canadian Maritimes on Friday. Low pressure then approaches Friday night…bringing rain to the region through Saturday night. High pressure builds in behind the low on Sunday. A coastal low meandering offshore may impact the region during the first part of next week.”

Gas on Columbia TCO shed 10 cents to $3.50, and deliveries on Dominion South were seen 11 cents lower at $2.74. Gas at Transco Leidy fell 12 cents to $2.28, and gas on Tennessee Zone 4 Marcellus recorded the only gain for Friday adding 1 cent to $2.14.

Midwest market centers also fell but not quite at the rate of New England points. Gas on Alliance was seen down 10 cents to $3.65, and gas at the ANR Joliet Hub shed 10 cents to $3.65. At the Chicago Citygates, Friday packages retreated 12 cents to $3.60, and on Michcon next-day gas came in 8 cents lower at $3.73. Gas on Consumers lost 7 cents to $3.73.

Producing zone quotes also weakened. Gas on Transco Zone 3 gave up 14 cents to $3.45, and deliveries to the Henry Hub dropped 8 cents to $3.55. Parcels on Columbia Gulf Mainline were seen a dime lower at $3.44, and gas on Tennessee 500 L dropped 8 cents to $3.48. At Katy, next-day gas came in at $3.40, down 18 cents.

Once the 10:30 am EST release of government inventory figures hit the market, futures prices lost no time cascading lower. January fell to a low of $3.671 after the number was released and by 10:45 EST January was trading at $3.695, down 11.0 cents from Wednesday’s settlement.

For the week ended Nov. 21 the EIA reported a titanic withdrawal of 162 Bcf, but recent mild weather conditions had estimates circulating about 75% less for the week ended Nov. 28. Last year, 141 Bcf was pulled from storage, and the five-year pace is for 50 Bcf. For the week ended Nov. 28, IAF Advisors predicted just 23 Bcf being withdrawn, and ICAP Energy saw a pull of 30 Bcf. A Reuters poll of 23 traders and analysts resulted in an average 41 Bcf with a range of 23-60 Bcf.

The falling prices had traders resetting their trading parameters. “I think we are now looking at $3.50 support and $3.75 resistance although there probably won’t be much resistance at $3.75,” said a New York floor trader; “$4 is a better resistance number.”

“The 22 Bcf net withdrawal for last week was at the bottom of the range of market expectations, implying both a larger than expected drop in demand as temperatures warmed back up and possibly some step up in supply,” said Tim Evans of Citi Futures Perspective. “It implies an even weaker flow of storage withdrawals in the weeks ahead.”

Inventories now stand at 3,410 Bcf and are 227 Bcf less than last year and 372 Bcf below the 5-year average. In the East Region 34 Bcf was withdrawn and the West Region saw inventories increase 1 Bcf. Stocks in the Producing Region rose by 11 Bcf.

Weather forecasters continued with their theme of temperature moderation and are tinkering with developments on the East Coast for next week. “Modeling continues in fairly good agreement this morning on a warm-dominated pattern with focus of strongest warm anomalies in the West to Central U.S. for the six-10 day shifting eastward for the 11-15 day,” said Matt Rogers, president of Commodity Weather Group.

“The models continue to fluctuate around a transient cool to cold trough into the East next week that delivers a brief bout of modestly colder temperatures.”

Despite the protracted fall in natural gas futures, market technicians see a buying opportunity. “Can the bulls salvage any hope of a seasonal advance into the start of 2015?” queried analyst Brian LaRose of United ICAP. “The upper bounds of our old falling wedge cuts at $3.763 Thursday, very near to the 0.7862 and 0.852 [retracements] at $3.757-3.689.

“At this time, we stand by our previous recommendation: continue to scale down buy with a protective sell stop beneath $3.541. Would only shift to short positions on a close beneath this level,” he said in closing comments Wednesday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |