Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Utica’s Long-Term Potential Still Hard to Gauge, Analyst Says

Although the Utica Shale land-grab is largely over and most Ohio acreage has been delineated, there remains a flurry of activity on the play’s fringes that makes it difficult to say with certainty what the formation’s ultimate resource potential is and where its producing boundaries will be drawn, according to Wunderlich Securities Inc. analyst Irene Haas.

“This whole play is still unfolding and what we are expecting to see now is that dry gas trend moving eastward into Pennsylvania,” Haas told a crowd during a presentation in Cleveland on Wednesday. “What we need to figure out is at what depth is it uneconomical, because as you keep going east, the rock gets deeper.”

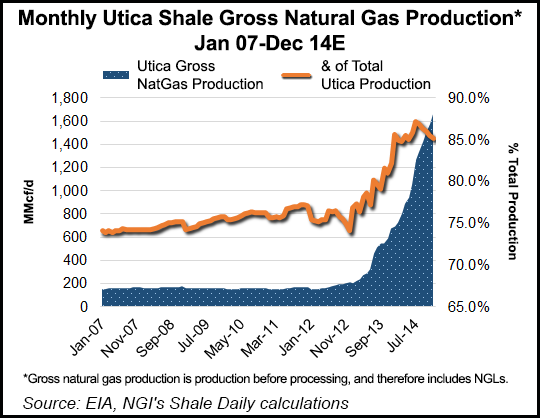

In August, when the U.S. Energy Information Administration announced that it would include the Utica in its monthly Drilling Productivity Report, it cited increasing production from the formation that couldn’t be ignored (see Shale Daily, Aug. 1). The EIA said the Utica’s per-rig production is significantly higher than in other fields at the beginning of their development, such as the Eagle Ford and Haynesville shales. The EIA’s latest projections show that the Utica should surpass 1.6 Bcf/d this month.

Pennsylvania is just the latest frontier in the unconventional industry’s push to test the Utica’s boundaries and replicate some of eastern Ohio’s production success. In February, Range Resources Corp. became the first company to announce that it would drill a Utica well in southwest Pennsylvania’s Washington County (see Shale Daily, June 5; Feb. 26). EQT Corp. followed suit over the summer in nearby Greene County (see Shale Daily, July 24).

Haas said EQT is expected to report its Utica results by the end of the quarter. She also expects Rice Energy Inc. to announce results in the second half of 2015 from a well it has planned in Greene County.

The latest series of tests expected on wells in Pennsylvania comes after a handful of operators announced successful Utica wells in West Virginia earlier this year, where more are being planned (see Shale Daily, Sept. 25; Sept. 8; March 26). More surprisingly, two Utica wells announced in September by Royal Dutch Shell plc in north-central Pennsylvania’s Tioga County tested at peak rates of 26.5 MMcf/d and 11.2 MMcf/d, which have renewed interest in the area’s potential (see Shale Daily, Nov. 24; Sept. 3

Haas called the Shell wells a “head scratcher” because the laterals, drilled to 4,200 and 3,100 feet, were short compared to those that have been completed in Ohio. “Shell might have landed themselves in a nice little pocket there. The big question is, is the whole trend connected? I’m hoping not, because if that’s the case, we wouldn’t know what to do with all the gas.”

To demonstrate how wide the Utica’s parameters have grown in the last year or so, Haas said Wunderlich compiled data from the play’s top 12 producers, which hold a collective 2.5 million net acres in the play. She said only three companies provided an assessment of the play’s areal extent. One operator provided a resource base estimate.

Based on the data collected, and using simple math based on the acreage currently under leasehold, Wunderlich estimated that the Utica holds 190 Tcfe of resource potential. Haas said that’s enough to keep operators busy for the next 50 years.

She added that little is known about the play’s volatile and black oil windows, which could eventually be prospective to the north and west of the play’s core in Ohio. Farther south, in Washington County, OH, Haas said development looks encouraging, but more data will be needed to prove the acreage there.

Haas also addressed the recent slide in oil prices and how unrest in the financial markets could affect Appalachian operators. Wunderlich analysts expect that by January, a significant round of capital spending reductions will be made to preserve balance sheets, despite hedging.

The gas-rich Appalachian Basin, Haas said, won’t be immune. If gas prices were to remain stable, Utica production would likely be maintained or even increased. Wet gas, however, is partially correlated to crude oil prices, which could mean that some parts of the basin could be impacted.

In any event, Haas said if the commodity price environment remains weak, Appalachian production would also likely be curtailed late next year. Companies with more exposure to oil-producing basins elsewhere in the country, she said, will likely feel the squeeze more than gas-weighted operators.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |