British Columbia Advances $24B of LNG Projects

The British Columbia government let C$24 billion (US$22 billion) worth of liquefied natural gas (LNG) projects advance a regulatory step, but whether they are still moving forward commercially remained an open question.

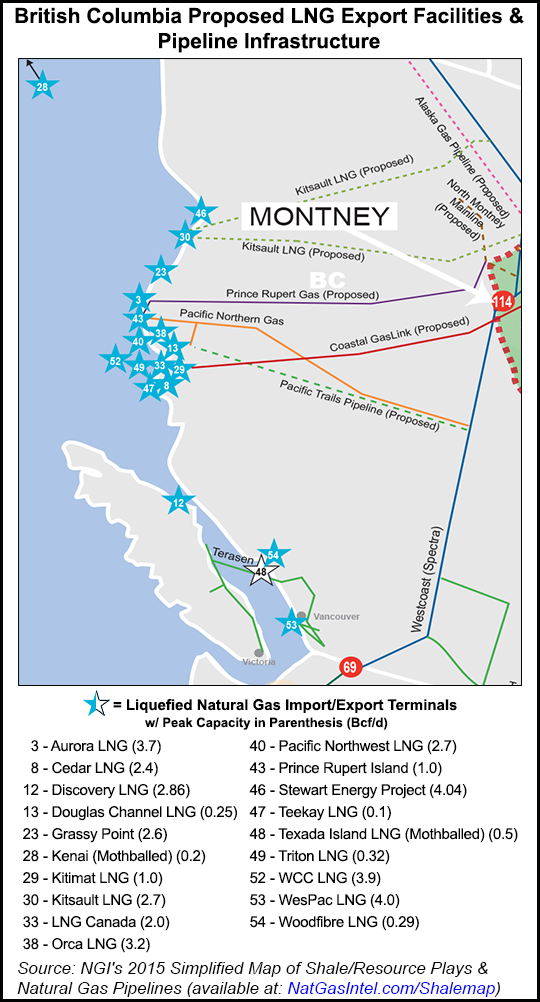

The provincial environment and natural gas ministries granted assessment certificates this week to the proposed C$11.4 billion (US$10.3 billion) Pacific NorthWest LNG export terminal, C$7.5-billion (US$6.8 billion) Westcoast Connector pipeline and C$5-billion (US$4.5 billion) Prince Rupert Gas Transmission conduit.

In announcing the permits, neither Environment Minister Mary Polak nor Natural Gas Development Minister Rich Coleman predicted when or even whether any of the projects will proceed into construction.

The rulings — and especially the steep price tags on the proposals — highlighted a BC difference that underlies consensus among industry analysts and participants alike: Canadian LNG projects are struggling on a long, uphill path to become competitive on international markets.

Unlike rivals for overseas LNG sales in the United States, Australia, the Caribbean and the Middle East, the BC projects are attempting to start from scratch in remote locations on an entirely new industry from wells to tanker docks.

The pipelines, sponsored by Westcoast Energy (Spectra) and TransCanada Corp., each aim to cross nearly 900 kilometers (560 miles) of forests, muskeg swamps, foothills and mountains from northeastern BC shale drilling regions to proposed Pacific Coast LNG terminal sites.

Despite the astronomical size of the cost forecasts, the project price tags fall well short of revealing the full scale of capital commitments required to launch the BC industry. Northern shale drilling remains in field trial stages. Pipeline connections linking the gas deposits to inlets of the proposed provincial crossings are likewise still in early development and regulatory phases with costs forecast in the C$1 billion (US$900 million) range.

In announcing the provincial permits, the BC ministers also acknowledged that the projects still have a long way to go before completing the complicated Canadian regulatory process: “Each project will require various federal, provincial and local government permits to proceed,” said the statement by Polak and Coleman.

Pacific NorthWest LNG — sponsored by Malaysian state conglomerate Petronas and its Alberta-based subsidiary, Progress Energy — warned even before oil and linked overseas LNG prices fell this fall that staying on its initial schedule of making a construction decision before Christmas was becoming increasingly difficult.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |