NGI Archives | NGI All News Access

Avista Forecasting Soft Gas Demand Growth in 20-Year Idaho Plan

Avista Utilities anticipates little demand growth over the next 20 years in its northern Idaho natural gas service territory, the Spokane, WA-based company said in an updated integrated resource plan (IRP).

The draft update indicated that Avista does not envision the need to acquire additional resources beyond what it already is providing.

“Demand is down due partly to the recession, while the availability of natural gas increases because of abundant shale gas supplies,” said a spokesperson for the Idaho Public Utilities Commission (PUC), which is taking comments on the IRP until Dec. 16.

Avista has estimated annual growth in gas customer demand to be 0.7% annually, the spokesperson said. That is a drop from the annual growth projections just two years ago, which were more than 1% annually.

“There are enough uncertainties regarding future natural gas supply and price that the company’s plan outlines a number of scenarios,” the spokesperson said.

In spite of the softness in projected demand, the IRP includes several scenarios to determine how the combination utility plans to respond should one of them become a reality. Avista identified at least three potential impacts depending on the amount of U.S. liquefied natural gas (LNG) exports, the number of natural gas vehicles on the road, and the added volumes of gas that will be needed for power generation .

Avista’s IRP outlines the existing and new facilities that will be looking to export LNG into the relatively higher-priced Asian and European markets.

“LNG exporting has the potential to alter the price, constrain existing pipeline networks, stimulate development of new pipeline resources, and change flows of natural gas across North America,” the IRP said.

The utility has a diversified portfolio of gas supply resources, including contracts to buy gas from several supply basins, stored gas, and firm capacity rights on six pipelines. But it also includes an action plan in the updated IRP to cover contingencies in case growth accelerates or plunges, monitoring supply side demand, and periodic briefing updates with state regulatory staff.

Avista told the PUC it will take steps to prepare for changes, such as:

Two years ago, Idaho’s PUC accepted Avista’ s IRP in which shale gas-driven low prices and abundant supplies were predicted to dominate the next 20 years (see Daily GPI, Jan. 2, 2013). At that time, customer demand was projected to grow at slightly more than 1% during the period.

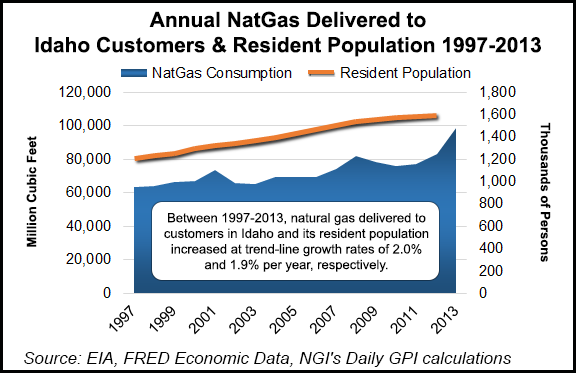

Avista’s projected Idaho natural gas demand might be a bit conservative, at least when compared to historical growth rates for the entire state. Between 1997 and 2013, natural gas delivered to customers in Idaho and Idaho’s residential population increased at trend-line growth rates of 2.0% and 1.9% per year, respectively, according to Energy Information Administration and FRED Economic Data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |